Below is a list of companies in Canada and the United States that have increased their dividends in the month of February.

The companies we list are not the complete list of companies that have increased their dividends in Canada and the United States or the rest of the world however, they are companies we follow or own.

Canadian Companies

| Company | Previous ($) | New ($) | Change (%) |

| BCE | 0.92 | 0.9675 | 5.20 |

| Enbridge | 0.86 | 0.8875 | 3.20 |

| TC Energy | 0.90 | 0.93 | 3.33 |

| Toromont Industries | 0.39 | 0.43 | 10.30 |

US Companies

| Company | Previous ($) | New ($) | Change (%) |

| 3M | 1.49 | 1.50 | 0.70 |

| Deere & Co. | 1.20 | 1.25 | 4.20 |

| Coca-Cola | 0.44 | 0.46 | 4.50 |

| Home Depot | 1.90 | 2.09 | 10.0 |

| PepsiCo | 4.60 | 5.06 | 10.0 |

| Sherwin-Williams | 0.60 | 0.605 | 0.80 |

| Walmart | 0.56 | 0.57 | 1.79 |

| YUM! Brands | 0.57 | 0.605 | 6.10 |

The dollar value listed per share represents a quarterly dividend payment.

Information was obtained from the companies directly.

History of Coca-Cola Company

Coca-Cola Company recently increased their quarterly dividend by 4.5% from $0.44 to $0.46. With this dividend increase, the company now pays an annual dividend of $1.84 per share to their shareholders. Coca-Cola has increased their dividend for 61 consecutive years.

In the 2022 Berkshire Hathaway Chairman’s letter, Warren Buffett highlighted the significance of holding onto strong dividend paying companies for the long term. In 1994, Berkshire Hathaway completed its seven-year purchase of 400 million shares of Coca-Cola that the conglomerate still owns to this day. Their total cost was $1.3 billion and in the year the purchase was complete, Berkshire Hathaway received a cash dividend of $75 million.

Fast forward to 2022, the annual dividend Berkshire Hathaway received from Coca-Cola had increased to $704 million. Growth occurred consistently every year and it was “just as certain as birthdays” as Warren stated. You can see by this example, by buying a strong dividend paying stock and holding onto it for the long term, you can be rewarded with growing cash flow. In addition to the growing dividends, the stock also brought gains in stock prices. At year-end of 2022, Berkshire’s Coke investment was valued at $25 billion. That is an unrealized capital gain of $23.7 billion. All that was required of Warren and Charlie was to hold onto the growing stock and cash the dividend cheques when they came in.

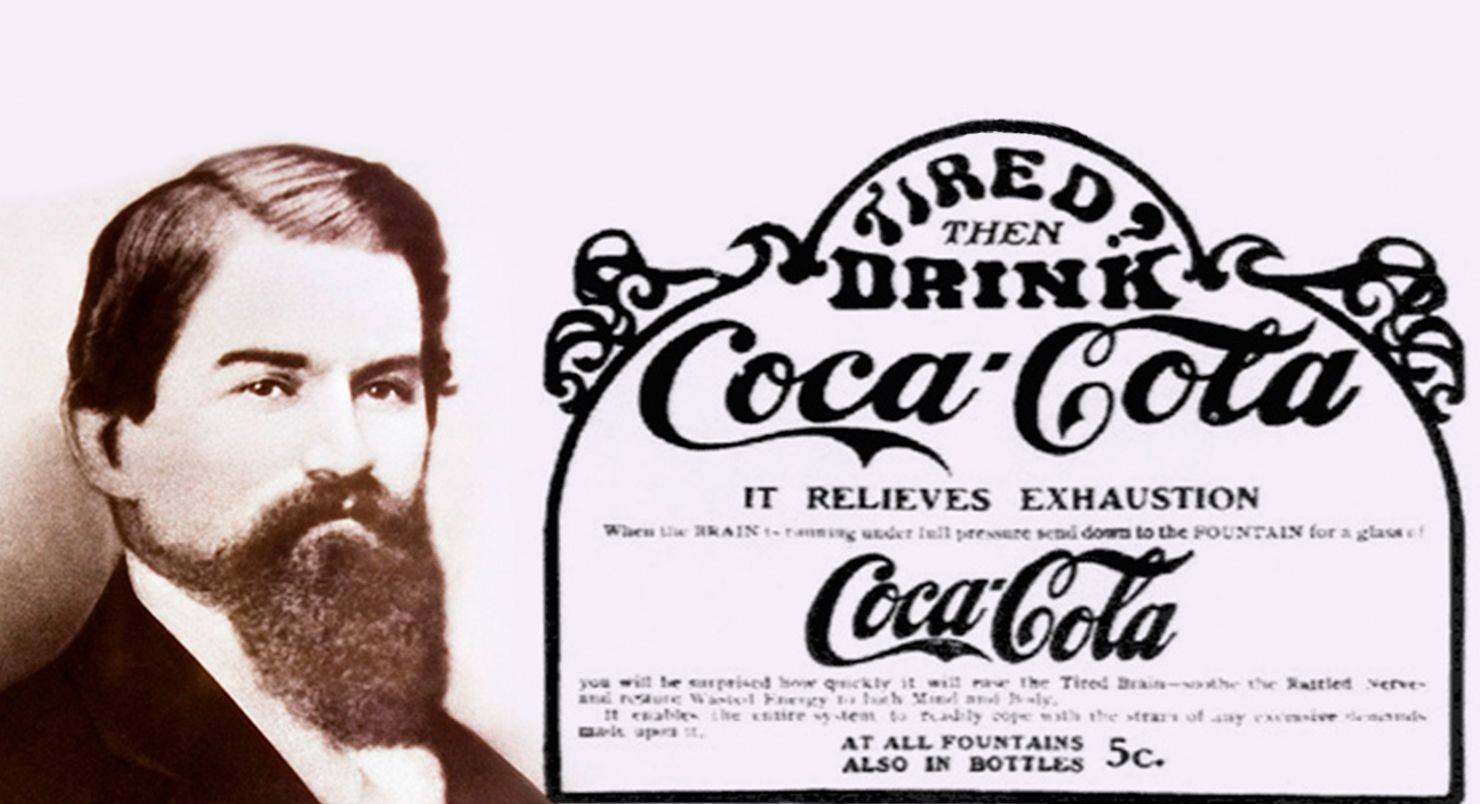

Coca-Cola can reward their shareholders with growing dividends because of their increasing revenue. This profitable company had its beginnings in 1886, in Atlanta, Georgia when nine glasses of Coke were sold for five cents each per day at Jacobs’ Pharmacy. Dr. John Stith Pemberton can be accredited for the original creation of the syrup concoction that was mixed with carbonated water. The drink’s initial purpose was for common ailments and included cocaine and caffeine-rich extracts from kola nuts. It got its name “Coca-Cola” when Dr. Pemberton’s partner and bookkeeper suggested it and wrote it in his unique script. The cocaine was removed from Coca-Cola’s ingredient list in 1903.

Unfortunately, Dr. Pemberton wasn’t aware of the potential behind his creation. He sold his portions of his business to various partners and in 1888, just prior to his death, he sold his remaining interest in Coca-Cola to a man named, Asa G. Candler. Mr. Candler saw the potential behind the “delicious and refreshing” drink and acquired complete control of the company and incorporated Coca-Cola Company in 1889. A few years later in 1893, the trademark “Coca-Cola” was officially registered in the U.S. Patent Office.

Between 1890 and 1900, Coca-Cola’s annual sales increased from approximately 9,000 gallons to 370,877 gallons of syrup. In 1899, the company signed a licensing agreement with an external bottling company which provided them with the ability to buy the syrup and produce, bottle, and distribute the Coca-Cola drink. Most of the American soft-drink industry followed suit and implemented this innovative distribution model.

In 1919, the Coca-Cola Company was sold to a group of investors for $25 million. The investors were led by Ernest Woodruff and his son, Robert Winship Woodruff, who acted as president and chairman from 1923 to 1955. After World War II and beyond, Coca-Cola had a lot of diversification in its iconic packaging, advertising, and products. In 1941, “Coke” was first used in advertising and the trademark was registered a few years later in 1945. The classic contoured glass Coke bottle had its first debut in 1916 and was registered in 1960.

In addition to their marketing techniques and packaging, Coca-Cola introduced additional products. In 1961, the company introduced Sprite and in 1963, the first diet cola drink with no calories was introduced called Tab. Tab stopped being produced in 2020 however, it paved the way for the diet sodas we know of today. Shortly after Tab was introduced, Fresca was added to the product lineup in 1966. It wasn’t until 1982, that Coca-Cola introduced Diet Coke, a low-calorie sugar-free drink.

The Coca-Cola Company also acquired other soft drink brands. In 1946, the company bought the rights to Fanta, which was initially developed in Germany. In 1960, Coca-Cola purchased Minute Maid Corporation, which got the company’s foot in the door in the juice market.

In 1985, Coca-Cola attempted to boost their sales by altering the original Coke recipe. Unfortunately, it was not well received and Coca-Cola reverted to its original flavour and promoted it as a Coca-Cola classic.

Coca-Cola has ensured their product was desirable to all tastes across the globe by altering the Coke recipe and developing new products for different geographic regions. An interesting fact is in 1978, Coca-Cola was the only company allowed to sell cold packaged beverages in the People’s Republic of China.

Since Coca-Cola’s inception, the company has greatly expanded their brands. Some brands you will likely recognize include Powerade, BodyArmor, Dasani, Fairlife, Gold Peak Tea, Simply, Topo-Chico, Vitaminwater, and more. Today, Coca-Cola has over 200 brands worldwide and has claimed the title as the world’s largest nonalcoholic beverage company.

As the company continues to evolve and adapt, Coca-Cola has increased their revenues and profit. In 2021, the Coca-Cola Company had $38.7 billion in net revenues from across the globe. As the company continues to increase their revenue, Coca-Cola is able to reward their shareholders with a growing and consistent dividend. Go celebrate your next dividend payment from Coca-Cola by cracking open a nice cold can of Coke!

If you would like to read more about company history, please take a look at our previous blog post:

References

Britannica, T. Editors of Encyclopaedia. "The Coca-Cola Company." Encyclopedia Britannica, March 3, 2023. https://www.britannica.com/topic/The-Coca-Cola-Company.

“How will you replace your current income in retirement?”™ – Jim Seyers