OUR NEW COMMITMENT TO YOU

I am so pleased to announce our new commitment to you:

We know wealth management. We know you even better.

This commitment is one important outcome of a branding exercise we recently went through. Our goal was to better understand the unique value we deliver to you, our clients - so we can better communicate that value to you, and in turn, you can take best possible advantage of our offering. And yes, so you can, if you wish, better explain it to people in your life whom you think could benefit from our approach.

As part of the branding exercise, we interviewed some of our clients. What stood out to us in some of their responses is this duality: they recognize us as knowing wealth management very well, and they also appreciate how much we care about knowing them on personal level.

Our commitment of We know wealth management. We know you even better. is one element of six in our new brand foundation, which also consists of a core purpose, vision, mission, values and character. We will be introducing each of these elements to you in the coming months. For today, in addition to our commitment, I want to unveil our mission:

Our mission – what we do every day

With every interaction, we strive to increase our clients’ confidence in their financial future.

This element really speaks to me because the process of increasing our clients’ confidence in their financial future depends on me getting to know you on what can be a very personal level. It is all about building trust - and earning your trust is a feeling that is very satisfying. I do it by asking questions and listening to understand your situation. What motivates you? What are your hopes? What are your fears?

In the realm of estate planning for example, these kinds of questions are especially pivotal in determining what is most important to you - and then crafting customized solutions accordingly. In the process of talking about things like wills and powers of attorney, clients often confide in us information they share with a very small circle only. In moments like those, your trust is a privilege we take very seriously indeed. It is this trust that allows us to know you better, serve you better, and thus ensure you are increasingly more confident in your financial future.

I look forward to talking about our other brand foundation elements in upcoming issues of the Journal.

UPDATED WEBSITE AND LINKEDIN!

As part of our brand update, we have refreshed the visual side of our brand with new website photography against a stunning RBC blue background. More important on the site is the new brand-foundation-related content, new bios for Colleen and I, and new video, which we will introduce in the coming months. For the moment, if you wish to have a peek at the upgrades, please have a look around.

We have also updated our LinkedIn pages with the fresh look and message. Are you connected with us on LinkedIn? If you aren’t, please send us a connection request, so you can follow the content that we post exclusively on that platform:

Send Jason a connection request by clicking here.

Send Colleen a connection request by clicking here.

MORE WAR IN OUR WORLD

There are now two major military conflicts underway: one in Russia-Ukraine and one in the Middle East. This creates volatility in the markets that, on the one hand, we are observing very closely, and on the other, is a completely normal part of market behaviour.

Oil prices are going up, as we would expect. Supply is under threat. War is inherently unpredictable, so there is indeed the possibility that an escalation in either war could occur, driving oil prices up even further and creating even more volatility in the markets overall.

The most important thing we can do from an investment perspective is to stick with the financial plan we have created with you. We have a plan for your financial future that takes into account that there will always be volatility. We are sticking with that plan, and your retirement plans, as a result, remain firmly on track.

A NEW NUMBER ONE WORRY

What is Canadians’ top concern? Climate change, perhaps?

It was. But not anymore. According to a recent survey by the Angus Reid Institute, housing affordability is the new #1 in our list of worries.

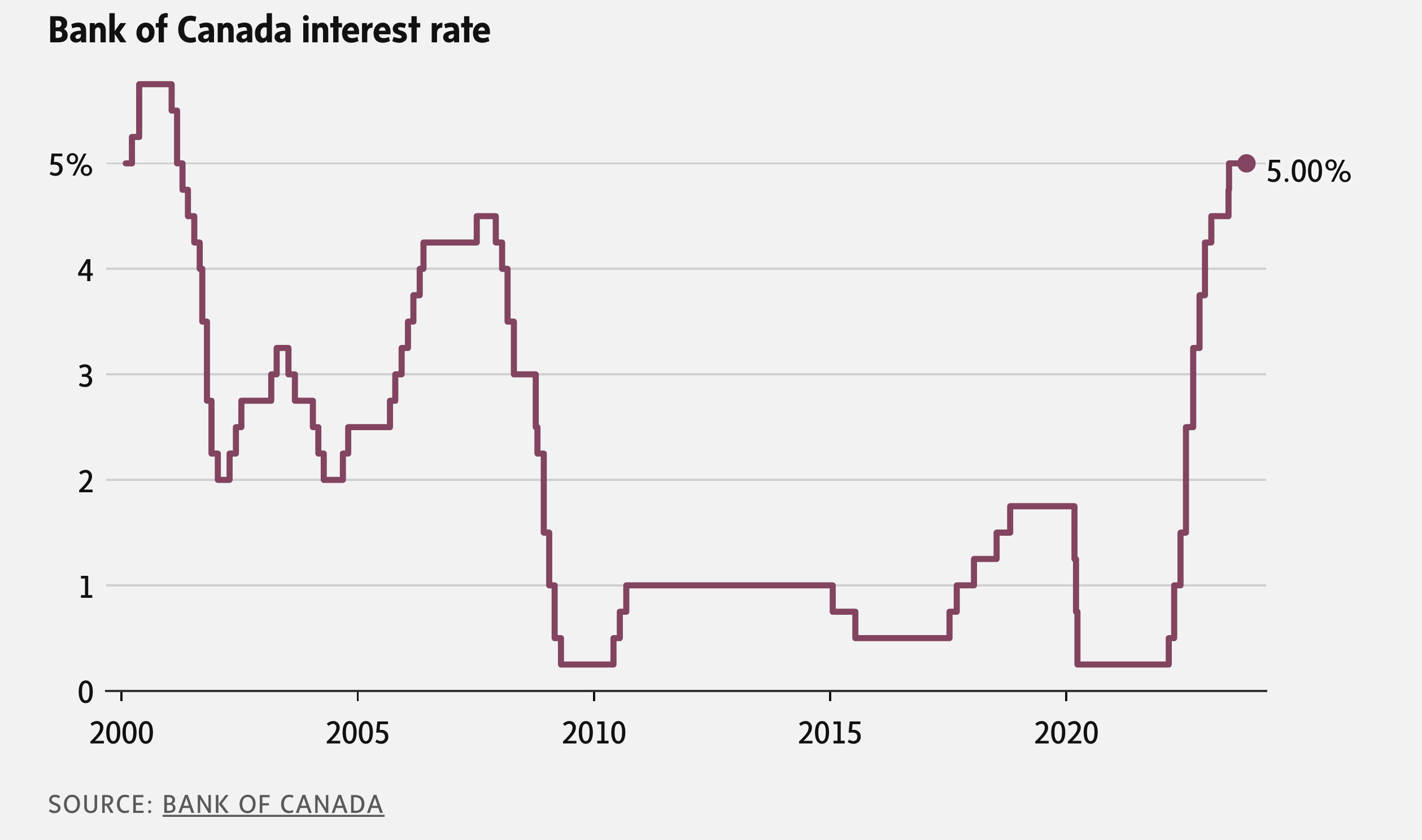

In an attempt to control inflation, the Bank of Canada has hiked interest rates 10 times since March, 2022, taking them from 0.25% to 5%. Last week, the BOC kept them steady at that 5% level. As shown by these rather remarkable figures from the survey, Canadians are feeling the squeeze:

- The number of Canadians who say their mortgage is “very difficult” to pay has almost doubled since March (from 8% to 15%)

- 79% of homeowners with a mortgage say they are either worried or very worried they will face higher payments when it comes time to renew with their bank

- 50% say they are in worse financial position than one year ago

- 35% per cent expect to be in worse shape a year from now

As I said in the August edition of the Journal, it is important to have an emergency fund. To help with housing affordability, yes, and also to support you in case of recession (more on that below), and thus the possibility of becoming suddenly unemployed. If you are retired, it is reassuring to know you have extra funds put away, just in case you need them.

Our standard recommendation is that everyone have enough cash on hand for between three and six months of expenses. In volatile, uncertain times like these, we suggest you think of six months as a minimum.

I also want to remind you about the First Home Savings Account (FHSA) as a strategy to consider in making home ownership more affordable for the people in your lives seeking a first home, including your children and grandchildren. As I shared in the April edition of this blog, we are seeing an increasing number of our clients giving mortgage downpayments as gifts to their children and grandchildren, a decision that in some cases is a deliberate disbursement of their estate now, while they are still around to see and enjoy its effects.

If you are considering any of these options, please do not hesitate to contact me, as I am here to help you work through the pros and cons, and make your wishes happen. To paraphrase our new mission statement, I’m here to increase your confidence in your financial future.

DO WE NEED A RECESSION?

A provocative headline in the Globe and Mail caught my attention: “A mild recession might be just the medicine we need.”

A recession is generally defined as a decline in GDP growth for two or more consecutive quarters. No politician interested in keeping their job would ever suggest that a mild recession can be a good thing, and sure enough, it was not a public servant but the global chief economist at Manulife who suggested that a mild recession, which would be characterized by a drop in spending, “would likely hasten rate cuts. Inflation pressures would dissipate more quickly, clearing the path for an easing of rates.”

That is the idea: that a recession would lead to rate cuts, which would lead to what the economist, Frances Donald, calls “a sizable recovery in growth. The short-term pain of six months or so of recession could potentially, then, deliver a healthier and robust recovery on the other side.”

Whether one thinks we need a recession or not, I continue to believe that a mild one is on the way.

IN PRAISE OF CPP

I have spoken to many retiree clients about CPP, and not one of them wants any changes made to it. They believe it is working just fine.

My view is that the Alberta economy is very cyclical due to the ups and downs of energy prices, and that the steadiness of the CPP, which has a 9.9% rate of return over the past 10 years, is an important counterbalance to that.

THE FAMILY FILES

Have you watched Ted Lasso? It’s a show on Apple+ about an American college football coach who gets hired to coach an English Premier League football (i.e. soccer) club. But he knows nothing about soccer. Comedy ensues.

Fortunately I know more than Ted about soccer, but I am still in for a learning curve, as I am going to be assistant coach on Jake’s team this fall. Jake loves the game. There will be three of them every week.

Cara has been under the weather for a bit. It turns out she had a mild case of chicken pox! Luckily she recovered quickly and only missed two days of school. I am sure she will be recovered in time for Halloween, when she will be dressing up as Barbie Cowboy. Jake will be a soccer player. We will have photos for you in the November edition of this Journal.

--

The greatest compliment we can receive is a referral to someone you care about who would appreciate the same value we take pride in giving you. If you have someone in mind, feel free to contact me at any time. Thank you very sincerely.