Happy Friday. We are all happy to see sunshine and looking forward to warmer days ahead, and felt it was a great time for a refresh. We are excited to announce that we have updated our team name to Hymers Private Wealth. Stay tuned for our updated website, to be launched very soon.

With summer around the corner and as the economy gradually reopens, we are pleased to share some of Hymers Private Wealth favorite summer appetizers, along with a market update:

Hymers Private Wealth Appetizer Favorites

Watermelon And Feta Appetizer Bites

Watermelon And Feta Appetizer Bites - the perfect bite sized summer appetizer, easy to make and great for a party

Ingredients:

-

10 oz feta cheese — (240 grams), cut into 1x1 inch squares, 1/2 inch thick

-

10 oz watermelon — (240 grams), cut into 1x1 inch squares, 1/2 inch thick

-

mint leaves — Optional, for garnishing

-

balsamic vinegar (balsamic glaze) — Optional, for garnishing

Instructions:

-

Skewer feta and watermelon pieces onto appetizer picks.

-

Garnish with fresh mint and balsamic vinegar (optional). Serve immediately.

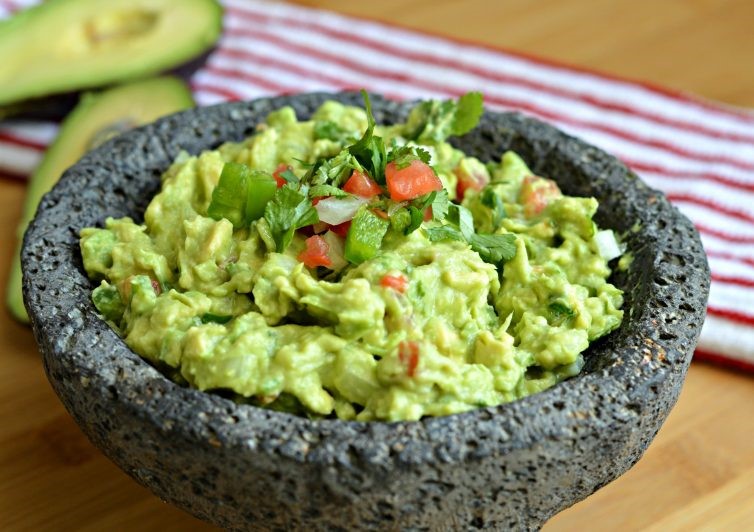

Guacamole

Ingredients:

-

2 ripe Avocados (peeled and pitted)

-

Chop up a little red onion (to your taste)

-

1 Roma tomato (or your choice)

-

Juice from 1 Lime (or more depending on your taste and juiciness of the lime)

-

Pinch of Cilantro leaves (optional)

-

½ clove of Garlic (or more depending on your taste)

-

Salt to taste

-

Pinch of Pepper to taste

Instructions:

-

Mash it all together to the texture you desire. You can adjust salt, garlic, lime, & pepper at this point.

-

Grab a bag of your favorite chips and enjoy!

Shop Local Team Challenge – we’ve all enjoyed taking the opportunity to support our local businesses by sharing gift cards in the office. This has been a fun way to explore all of the great locally owned businesses in the Okanagan. The warm weather has us thinking about being poolside/lakeside, and ready for fresh new swimwear and lounge wear!

Rhonda at 1000 Palms The District Kelowna

Market Update

There were some welcome developments this week; specifically the Canadian banks reporting results that allowed investors to breathe a collective sigh of relief. Beyond the banks, equity markets rallied further, but it was the inner workings of the move that was particularly noteworthy. We explain more below.

Big week for Canadian banks

Sentiment with respect to the Canadian banks had been very poor heading into the week. Investors struggled to understand the degree to which the sector would have to prepare, or provision as it is often called in investment terms, for future loan losses. Fortunately, the results reported by the banks were generally fine. To be clear, profits were down substantially. And provisions did increase exponentially with banks setting aside billions of dollars to prepare for bankruptcies and defaults. But the amounts set aside were generally lower than what some investors had expected, which provided some reassurance that perhaps the environment may not yet be as bad as some had feared. This may help explain why the sector was one of the strongest performers this week. Nevertheless, it is important to remain vigilant. The risk remains that the banks may have to increase their provisions even more than expected in the future should the economic damage be longer lasting. It is impossible to know. But, we remain comforted by their generally strong balance sheets and ability to pay sustainable dividends.

A rally with more participants

It feels comforting when markets are moving higher. But, not all market rallies are the same. Beneath the surface, there can be some that are driven by just a handful of the largest stocks and others that are driven by many smaller ones. One concern about this recovery has been that a good portion of it has been led by large technology and other so called “growth” stocks, who increasingly make up a large part of many regional stock markets. Within the past few weeks, that trend has been changing as we see other segments of the market driving a bigger part of the overall stock market gains. We view this as a healthy sign that reflects growing confidence in the economic recovery that is now underway.

Investors and policymakers will undoubtedly be watching the economic progress very closely over the next month. The significant income support programs implemented by the Canadian and U.S. governments more than a month ago are set to begin expiring in July. The hope is that enough workers will have been rehired by then to alleviate pressure on governments provide further stimulus. The degree and sustainability of the recovery, the geopolitical tensions between China and the U.S., and the pandemic, remain risks that we will continue to monitor with great interest.

| ||||||

|

| ||||

| When the Fed goes low, we go high – The Fed is dusting off an obscure policy tool—yield curve control—as it ramps up efforts to keep Treasury yields low. So, we look to go where yields remain high—that is, high-yield corporates—and explore our shift to a positive outlook on the sector. (pg 1 and below) |

"When we give cheerfully and accept gratefully, everyone is blessed.” ~ Maya Angelou

Global Insight Weekly - May 28

Global Insight Weekly - May 28