We have seen some big headlines this past weekend regarding the novel coronavirus, with Italy, South Korea and Iran all noting increases in confirmed cases.

I wanted to reach out and provide you with an update on our thoughts. We continue to manage your investments with a high level of care and attention, as summarized here:

- We Hold Cash - We took advantage of market strength to raise cash before news broke about the coronavirus

- We are Watching for Opportunities - We are monitoring markets closely to take advantage of buying opportunities as they materialize

- Quality is Key - Quality remains our top priority as we focus on profitable companies that are managed by qualified, capable management teams, and do not hold too much debt on their balance sheets. We find that these high-quality companies are better capable of adjusting to changing times, and better able to increase their value over the long-term

- Disciplined in our Approach - Our focus on diversification & regular portfolio rebalancing ensures we regularly take profits and hold an appropriate asset mix of cash, fixed income, and equity in line with your long term investment objectives and risk tolerance

To provide you with a deeper dive into our approach, we have summarized a few key points here:

We have steered well clear of names that we believe will be most negatively affected by the coronavirus such as airlines and commodity companies. We have instead focused on names with defensive qualities. These companies should not see earnings materially affected by further deterioration of the current coronavirus situation. For example, utility, waste management, and real estate companies are not expected to bear much of the pain coming from the novel coronavirus spreading (we feel reasonably assured that people will still take out their garbage, pay for electricity, and pay rent)

Indeed, some of the consumer discretionary names held are seeing some negative impact today, as fears of supply disruption weigh down on these companies. Still, we do think that these declines in value are more temporary than permanent.

Current Facts regarding Corona Virus & Markets

As of Feb. 24th, 2020, 79,757 cases have been confirmed (with 2,412 confirmed outside of China).

- There have been 2,629 deaths (of which 36 have occurred outside of China), which translates to a fatality rate of about 3%.

- 25,272 cases are confirmed to have recovered.

Figure 1 Source: https://www.worldometers.info/coronavirus/

To compare, the 2009 swine flu, aka H1N1, infected 1.6 million and killed 284,500 for a fatality rate of 17%.

As I type this (Feb. 24th), the S&P 500 index is down 2.7%, surrendering all of its gains this year-to-date. Not all sectors are equally hit with airlines and healthcare names being the most negative, while gold, real estate, and utilities showing flat or positive results. (Side note: Healthcare names appear to be more affected by Bernie Sander's recent win in Nevada for the Democratic nomination than the novel coronavirus.)

The novel coronavirus may well be on the trajectory of reaching pandemic status, but epidemiologists, doctors and scientists are hard at work as we speak

- Australian researchers have already replicated the virus in a lab, helping accelerate the search for a vaccine.

- The World Health Organization announced that clinical trials of an existing drug, Remdsivir, are getting fast-tracked in China, and we could see results within a few weeks.

Short Term Market Volatility often provides a Long Term Opportunity to buy Quality Businesses at Discount Prices

Although situations like the novel coronavirus are cause for concern, from a market perspective, we have confidence that this too will eventually pass. Along the way, it may well result in the market weakness we have been watching for as an opportunity to put more cash to work in the existing long term innovative businesses you own.

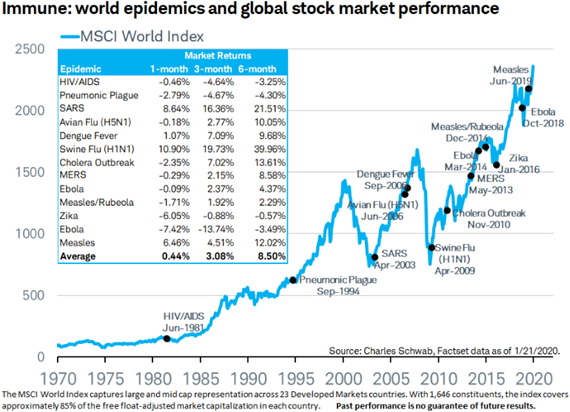

Staying the course is often a hard thing to do when the markets are down, but I do believe looking back in history often provides some helpful context. Here is a quick snapshot of some historical data:

Past results do not guarantee a future outcome, and it is hard to say whether this coronavirus outbreak will get worse before it gets better. Still, I do believe in holding a well-diversified basket of high-quality companies and maintaining a carefully managed portfolio of businesses over the long-term.

I trust this provides a helpful summary. We will keep you updated as market updates are available. Please also feel free to contact myself, Darren, Kuan or Rossi should you have any questions.

"Find a purpose in life, so big it will challenge every capacity to be at your best."