It's been a little more than 20-years since I moved to Ottawa from the Toronto. I've made great strides to become an Ottawa Senators fan, but, I still find myself getting pulled back into the Toronto Maple Leaf web, especially when the NHL playoffs come along. I guess there are some things that I'll never be able to shake.

Playoff hockey, or playoff anything, is high stakes. The whole season boiled down to a series or a game. You win you keep going, you lose, well, you're out. It isn't rocket science. Everyone gets it.

In these high-stake environments, all eyes turn to a team’s best players to step up and lead them to victory. More often than not, they don't disappoint. As the fans will say at the celebration party, or after they renew their $100MM contract, "(Insert player name) is worth every penny".

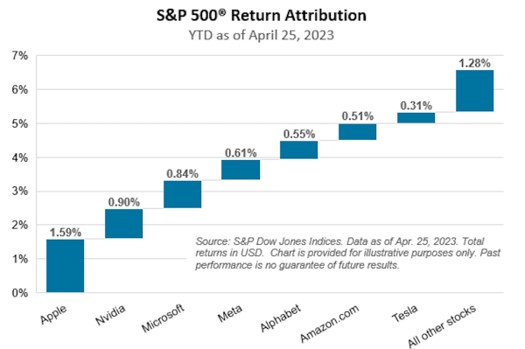

I recently came across some analysis from Sam Ro of Tker's substack on the S&P500. Sam highlighted how YTD, the S&P500 is being propped up by seven companies!!! Have a look for yourself below.

Is this a bad thing?

After a dismal 2022, investors were looking for something to get them out of the rout and right the ship. Another year of negative returns (which is possible, but not probable), would be devastating. Given investor sentiment at the beginning of the year (and even now), we needed the market MVP's to step up and guide us in the right direction. When you look at those seven names, I feel this is happening now, or am I missing something here? As the analysis goes, many see the current market as being overly concentrated; I see it as playoff hockey. The stakes are high right now and the starts are stepping up.

In sport, I have witnessed time and time again the top players get tired, opening the door for new leaders to emerge (look at the youngster Matthew Knies). Without fail, this will happen in the markets as well. Until then, let the leaders lead.