There has been a great deal of discussion recently about artificial intelligence and the technology infrastructure that supports it. With so much rapid change in this space, I wanted to share some key information and perspectives, supported by recent data and charts to help provide a clearer picture of where different countries stand today, how global leaders are positioning themselves, and what this might mean for innovation and investment opportunities in the years ahead.

Massive AI Infrastructure Investment

Alphabet’s Google, Microsoft, Amazon, and Meta Platforms are projected to spend $364–$400 billion in 2025 on capital expenditures, the majority dedicated to building AI infrastructure.

To put this in perspective:

- Canada’s total defence budget (2024): $33–36 billion USD

- European Union total defence spend (2024): ≈$353 billion USD

- Canada’s new federal AI funding (2024–2025): $1.5–2.4 billion USD

- Canada’s GDP (2024): ≈$2.2 trillion USD — Big Tech’s 2025 AI capex equals about one-sixth of the entire Canadian economy.

Bottom line: In one year, just four companies are investing in AI infrastructure at a scale that exceeds Canada’s entire defence budget, dwarfs public AI spending, and surpasses the EU’s total defence expenditures.

U.S. Technology Leadership

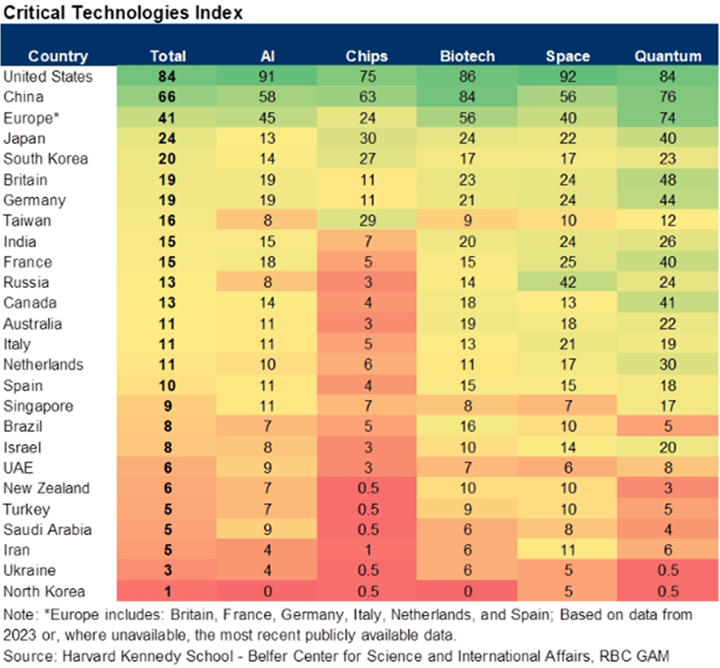

Despite global competition and trade headwinds, the United States remains the global leader in key transformative technologies:

- Artificial intelligence

- Semiconductors

- Biotechnology

- Space technology

- Quantum computing

The U.S. holds a particularly strong lead in AI and space, a significant advantage in semiconductors and quantum computing, and a competitive position in biotechnology.

While China has made rapid progress, especially in AI applications and large-scale implementation, the U.S. continues to lead in research depth, innovation ecosystems, and corporate investment scale.

Canada’s Position in AI

Canada has been a pioneer in AI research, but its global competitive standing has slipped (see the chart below). Private-sector investment is limited, commercialization lags, and global market share remains small compared to peers such as the U.S., U.K., Germany, and South Korea.

To close the gap, Canada will need to scale up funding, incentivize innovation, and better connect research breakthroughs to market applications.

Europe’s Innovation Gap and Opportunity

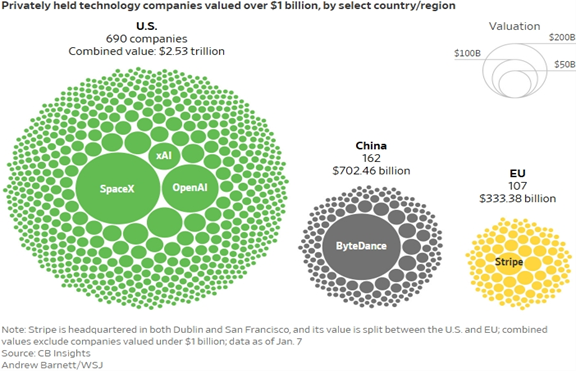

Europe’s strong education systems and skilled workforce have not translated into the same level of global tech leadership as seen in the U.S. or China.

Key challenges include:

- Risk-averse business culture

- Complex regulatory environments

- Venture capital funding at only ~20% of U.S. levels

As the chart below illustrates, over the past 50 years, the U.S. has created 241 companies from scratch with a market capitalization above $10 billion, while Europe has produced just 14.

Key Takeaways

- The U.S. is still the global leader in AI and other critical technologies.

- China is advancing quickly but still trails the U.S. in several innovation drivers.

- Canada risks falling further behind without strategic investment in AI commercialization.

- Europe’s innovation lag may create attractive long-term investment opportunities.

As always, if you have any questions or would like to discuss how these trends might relate to your portfolio or broader strategy, please feel welcome to reach out to me.