The spousal loan strategy is a method of income splitting that may enable couples to lower their overall family tax bill by entering into a prescribed rate loan arrangement. This arrangement is typically beneficial for couples where one spouse has significantly more taxable income than the other. This article outlines the basics of the spousal loan strategy.

Any reference to a spouse in this article also includes a common-law partner.

The strategy at a glance

The spousal loan strategy aims to shift future investment income from a higher-income spouse to a lower income spouse to take advantage of the lower-income spouse’s lower marginal tax rate. Let’s assume you’re the higher-income spouse. This strategy involves you loaning funds to your spouse at the Canada Revenue Agency’s (CRA) prescribed interest rate in effect at the time the loan is made. Your spouse will then invest the borrowed funds for the purpose of generating investment income. This investment income will be taxable to your spouse at their lower marginal tax rate, which effectively reduces your family’s overall tax bill.

You might be wondering why you can’t simply gift money to your spouse, have them invest the funds, and have the income generated on those funds taxed in your spouse’s hands. The reason is that there are attribution rules designed to prevent certain types of income splitting between you and your spouse.

These attribution rules do not apply where you loan money to your spouse at the CRA’s prescribed interest rate in effect at the time the loan was made. Your spouse must pay you annual interest on the loan by January 30 of the following year (and by January 30 of every subsequent year the loan is in place). It’s crucial to meet this deadline, because if the interest payment is late by even one day, the attribution rules will apply for that taxation year, and all subsequent years.

The prescribed interest rate in effect at the time the loan is made will be locked in for as long as the loan is outstanding, regardless of subsequent changes to the CRA’s prescribed interest rate. The lower the interest rate, the greater the tax saving opportunities for you and your family.

The components of the strategy

The following are the main components of the spousal loan strategy.

Identify potential non-registered assets

You may want to start by identifying assets you own that generate investment income and are currently exposed to your higher marginal tax rate. These may be assets that have accumulated over time in a taxable non-registered account; funds from a sudden cash windfall, such as an inheritance; or proceeds from selling a business. You should also determine the amount you wish to lend to your spouse.

One method of lending these assets is converting these non-registered assets into cash if the assets are not already in cash form. Consider the tax cost of disposing of your investments since the disposition may trigger capital gains or losses. You could also review your Notice of Assessment to determine if you have capital losses carried forward that could be used to offset any capital gains realized.

Loan to your spouse

You can make a demand loan to your lower-income spouse. The loan is backed by a promissory note and a loan agreement which sets out the terms of the loan. It’s essential that you consult with a qualified legal advisor in drafting these documents. The loan is an arrangement between you and your spouse, and any legal documentation should be filed away safely.

It’s generally recommended that you lend money from an account solely in your name to an account solely in your spouse’s name, rather than using joint accounts. You should speak with a qualified tax advisor if you’re considering the use of joint accounts when implementing a spousal loan strategy.

Your spouse builds a portfolio

Your lower-income spouse can take the borrowed funds and invest in a portfolio in their own name. Generally, the spousal loan strategy will only be effective if the annual income generated from the portfolio is greater than the interest rate on the loan.

If you disposed of your securities at a loss before loaning the cash to your spouse, and your spouse intends to repurchase the same securities, you should be aware of the superficial loss rules. The superficial loss rules may deny your immediate use of the loss where your spouse repurchases the identical security and owns it on the 30th day after the settlement date of the disposition. To prevent the superficial loss rules from applying, your spouse can consider waiting 30 days before repurchasing the security or purchasing a different security with similar exposure to the markets.

Your spouse makes annual interest payments

Your lower-income spouse must pay you the annual interest, as set out in the loan agreement, no later than January 30 of the following year. If the interest payment is not made, the income earned by your spouse on the borrowed funds may be attributed back to you and taxable in your hands.

Your spouse should make the interest payments using their own funds. The use of joint accounts may be problematic, as it may be more difficult to demonstrate that the interest payment was made from your spouse’s own funds. Your spouse should also document that the payment is for interest owed on the loan for the relevant tax year.

Calculate your annual tax savings

Ensure that the strategy remains effective by reviewing your family’s financial situation and tax savings with a qualified tax advisor every year. The end goal of the spousal loan strategy is to shift investment income earned on non-registered assets to your spouse with a lower marginal tax rate to achieve family tax savings. The required interest payment on the loan must be accounted for when determining your spouse’s investment return. You should also factor in the taxes owing on the interest payments you receive from your spouse.

Keep in mind that this strategy should be implemented as part of a long-term financial plan. It’s possible that over the lifetime of the loan, because of market fluctuations, you may not achieve the expected tax savings at certain points in time. However, in general, the longer the loan remains in place, the more potential there is for greater savings.

Ensure your loan is enforceable

You should ensure that the demand loan remains legally enforceable. Some legal advisors believe that making the annual interest payments on the prescribed rate loan is sufficient action to avoid the loan from becoming unenforceable. Making the interest payment annually is an acknowledgement by your spouse that the loan is still outstanding and enforceable. An alternative is to renew the promissory note on an annual basis or to have your spouse acknowledge in writing that the promissory note is still valid. You should consult with a qualified legal advisor to determine what’s required to keep the loan enforceable in your jurisdiction.

Benefits of the strategy

The main benefit of the spousal loan strategy is the ability to maximize your family’s after-tax investment income by lowering your family’s overall tax liability.

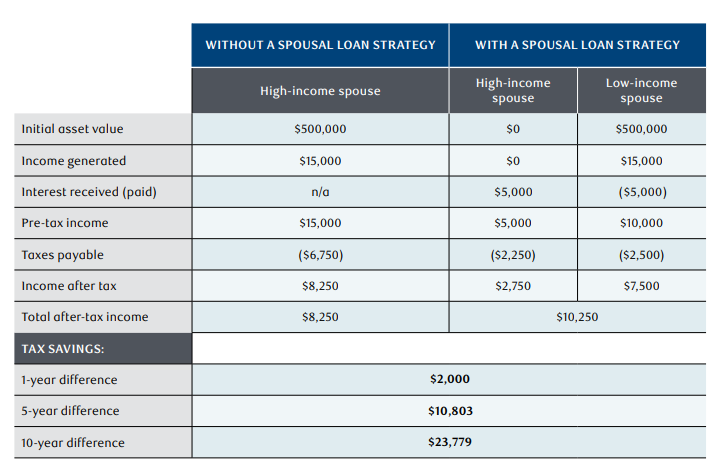

The following is an example, using an assumed prescribed interest rate of 1%. However, the prescribed interest rate is subject to change on a quarterly basis, please ask your RBC advisor for the up-to-date prescribed interest rate table for the current prescribed rate. This illustration shows how loaning your lower income spouse $500,000 at a 1% prescribed interest rate can generate tax savings of approximately $10,000 over five years and approximately $23,000 over 10 years. The illustration assumes you have a marginal tax rate of 45% while your spouse has a marginal tax rate of 25%. The illustration also assumes your spouse is invested in a portfolio that earns annual interest of 3% and all savings are reinvested.

The tax savings are the result of the investment income being taxed in your lower-income spouse’s hands, as opposed to your own. Your family’s net tax benefit of having a prescribed rate loan at 1% is $2,000 in one year alone. If this loan remains in place for 10 years with similar returns, the savings become significantly greater. These savings can be further compounded if the return on the investment increases.

Tax considerations of the strategy

Interest deductibility

The interest paid by your spouse on the spousal loan is generally tax-deductible where the proceeds from the loan are used to purchase income-producing assets, such as a bond that pays interest or a stock that pays dividends.

If your spouse decides to not reinvest the income earned on the portfolio and instead withdraws the income for non-income producing purposes, such as travel or personal spending, the interest on the loan should remain deductible, as long as the original borrowings remain invested in income-producing assets.

Where your spouse disposes of all or a portion of the investments, they will need to identify the current use of borrowed money to determine the extent to which interest remains deductible. In such a case, your spouse should speak with a qualified tax advisor to determine the amount of interest that remains deductible.

If your spouse requires funds for personal purposes, such as travel or purchasing joint assets like a cottage or boat, instead of using the borrowed funds, it may make sense from a tax perspective for your spouse to repay a portion of the loan. You can then use the repaid funds to pay for the personal expenses or purchase the non-income producing assets. This way, the interest your spouse is required to pay you (and the amount you’re required to include in income) is reduced. However, it’s important to note that when repaying the loan or repaying a portion of the loan, your spouse may need to sell some of their investments to fund the repayment which may result in taxable capital gains or losses.

Alternative minimum tax (AMT)

It is important to be aware of the AMT rules so that you or your spouse does not end up with an unexpected tax bill. AMT is the government’s way of ensuring you pay at least a minimum amount of tax. You’re required to compute your tax liability by calculating your regular tax and AMT. The AMT calculation allows fewer deductions, exemptions, and tax credits than the regular income tax rules. You pay either the regular tax or the AMT, whichever is highest.

For AMT purposes, you can only deduct 50% of certain interest expense and carrying charges instead of 100% for regular tax purposes. This rule may have a significant impact on a borrowing spouse who is deducting the interest paid on the prescribed rate loan. The impact will be more pronounced for those who have entered or are considering entering into prescribed rate loan arrangements at higher interest rates.

Speak to a qualified tax advisor to determine if you will be affected by AMT.

Debt forgiveness

In certain circumstances, the funds loaned to your spouse may be invested in a portfolio that declines in value. Where there’s insufficient capital for your spouse to repay the loan and you decide to forgive the loan, or part of the loan, the debt forgiveness rules may apply.

The debt forgiveness rules are complex, but in general, the amount not repaid will be deemed to be forgiven and first used to reduce certain tax attributes as they relate to your spouse, if available. The tax attributes that will be reduced include non-capital losses, farm losses, restricted farm losses, allowable business investment losses, and net capital losses carried forward, in that order.

If your spouse’s losses are insufficient to absorb the forgiven amount, they can reduce other specified tax attributes, such as the adjusted cost base of certain capital property held by your spouse. If there is still a forgiven amount remaining, a portion of the amount will be included in income and taxable to your spouse in the year the unpaid amount is forgiven.

The debt forgiveness rules can result in unintended consequences; for this reason, it’s essential that you consult with a qualified tax and legal advisor if you intend to forgive a spousal loan.

Upon death

If your spouse passes away while the spousal loan is still in existence, the executor of your spouse’s estate would have the obligation to repay the outstanding loan, as it would be considered a debt of the estate. The outstanding loan balance, if held in a sole account, would be included in your spouse’s estate and would likely be subject to probate fees.

Normally, assets transferred to a spouse on death would be rolled over at cost. However, that only applies to gifts from the estate and a gift from the estate cannot satisfy the requirements to repay the loan. If the assets in the estate are used to repay the spousal loan, the assets are subject to a deemed disposition on death and any accrued capital gain (or loss) on the assets in your spouse’s account would be taxable on your spouse’s final tax return. The ACB of the assets in the estate will then be equal to the FMV of the assets as of the date of death. Further, the estate could realize another capital gain (or loss) depending on the value of the assets on the date of the liquidation relative to the date-of-death value.

This is another reason that using joint accounts is not recommended. The right of survivorship would cause the assets to transfer outside of the estate, potentially leaving the estate with insufficient assets to repay the loan. If there are insufficient assets in the estate to repay the loan and the loan must be forgiven by you, the debt forgiveness rules may apply.

If you, the lender, were to pass away and no specific instructions are given to the executor/liquidator of your estate with respect to the loan, your spouse may need to repay the loan to your estate. If your spouse is unable to repay the loan and the loan is considered forgiven, the debt forgiveness rules may apply. Alternatively, if the loan is forgiven in your Will, the debt forgiveness rules would not apply.

Due to these complexities, be sure to address the spousal loan in your estate plans.

Portfolio make-up

The spousal loan strategy may not be tax-effective for your family if you currently invest in a very tax-efficient portfolio (i.e. deferred capital gains, return of capital, etc.). In this case, the taxes payable by you on the loan interest received may exceed any tax savings that result from shifting the investment income to your lower income spouse.

Costs of implementing the strategy

The cost of implementing the spousal loan may include the legal fees associated with drafting the loan agreement and promissory note. You should also consider the resources you’ll need to dedicate to administrative issues such as maintaining documentation with respect to making the annual interest payments and any re-payments of the loan. You may also incur legal fees associated with reviewing your documentation to ensure the loan remains enforceable.

In addition, while maintaining the spousal loan, which includes calculating the required interest payment and reporting or deducting the proper amount of interest on your and your spouse’s personal income tax returns, you may incur additional accounting fees.

You should take these costs and fees into consideration when determining whether the spousal loan strategy makes sense in your circumstances.

Conclusion

Initiating a spousal loan when prescribed interest rates are low may be a useful way to reduce your family’s overall tax bill. Speak to a qualified tax advisor to determine if this strategy makes sense for you and your family.

DOWNLOAD the full article.

This article may contain strategies, not all of which will apply to your particular financial circumstances. The information in this article is not intended to provide legal, tax or insurance advice. To ensure that your own circumstances have been properly considered and that action is taken based on the latest information available, you should obtain professional advice from a qualified tax, legal and/or insurance advisor before acting on any of the information in this article.