Have you ever wondered whether real estate or the stock market is the better long-term investment? With house prices rising higher and higher in the Canadian residential real estate market this has understandably inspired debate.

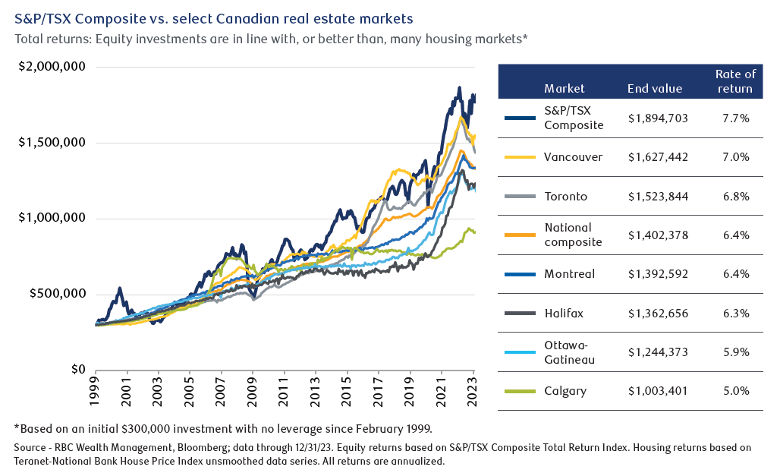

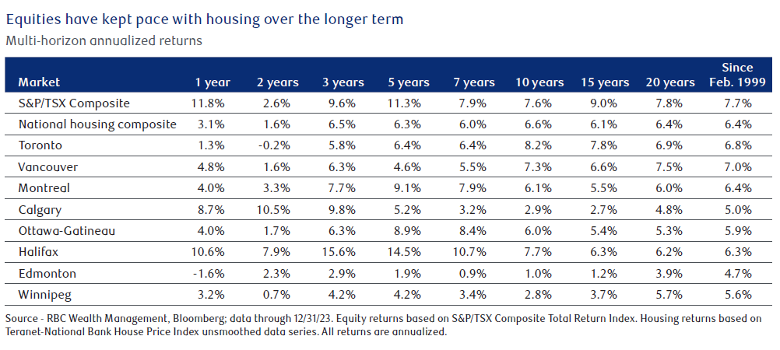

In our latest newsletter, we take a deep dive into the long-term performance of the S&P/ TSX composite index compared to real estate markets across major Canadian cities.

While the strength of the Canadian housing market has been touted as the ultimate investment by investors, it turns out that Canadian equities have generated annualized total returns since early 1999 that are in line with, or better than, various Canadian real estate markets dash including Toronto and Vancouver.

Sure, it's fun to chat about how much your house has gone up in value at dinner parties. But let's not forget why most people buy homes in the first place-to live in them. However, investing in the stock market is typically done with the goal of having capital appreciation over the long term to reach your financial goals.

Comparing houses to stocks isn't exactly apples to apples, there are several factors that make the direct comparison difficult. Real estate comes with its own set of challenges, such as lack of liquidity. Real estate can seldom be quickly liquidated for cash.

Also, real estate comes with onerous barriers to entry, including down payments, access to financing, insurance costs and other fees such as agent commissions legal fees on land transfer tax. Another consideration of home ownership is the long-term costs including property taxes, repairs and maintenance expenses.

In contrast, investing in the stock market is easier and doesn't require the same initial capital requirements.

It is worth noting the investments in real estate and stocks are not mutually exclusive and property can play a role in once overall investment portfolio. Whether you choose stocks or real estate-or a mix of each depends on your financial goals, time horizon, and risk tolerance.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2023 RBC Dominion Securities Inc. All rights reserved.