Canada’s recently unveiled 2024 federal budget proposes to increase the capital gains inclusion rate to 66.67% from 50%. Knowing tax efficiency plays a key role in building wealth and you may be wondering how this change may affect you.

We outline planning strategies you may want to consider before the proposed June 25, 2024, effective date and going forward.

The effect on individuals

Any capital gains realized prior to June 25, 2024, will have an inclusion rate of 50%. Any capital gains realized on or after June 25th 2024, will have an inclusion rate of 50% on the portion up to $250,000 and an inclusion rate of 66.67% on any portion above $250,000.

The proposed higher inclusion rate on capital gains would increase the average tax rate on capital gains above $250,000 at the top marginal tax rate to 33.8% from 25.3%.

The effects on corporations

The budget proposes that all capital gains realized in a corporation on or after June 25, 2024, will have an inclusion rate of 66.67%, regardless of whether the corporation is an operating, holding or professional corporation. There is no 50% inclusion rate available to corporations for the first $250,000 of capital gains.

Investment income earned within a corporation is taxed at 2 levels - once at the corporate level and also at the personal level when the income is distributed to shareholders. A portion of the corporate tax paid is refundable to the corporation when taxable dividends are paid out to the shareholders. The purpose of this prepayment and refund of tax is to achieve integration. When a tax system is perfectly integrated and individual being different to earning investment income in a corporation versus earning it personally.

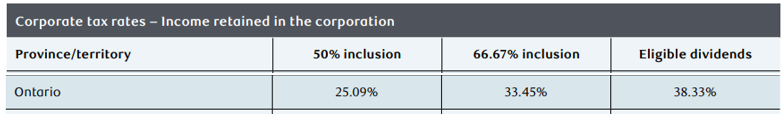

With the increase in tax on the first dollar of capital gains realized in the corporation, when looking at the passive investment income tax rates in a corporation, there is now an almost equality when earning eligible dividends and capital gains.

We highlight the current and proposed corporate tax rates for capital gains earned in the corporation and distributed as dividends compared to capital gains earned personally, assuming the shareholder is in the top marginal tax rate.

When comparing the combined corporate and personal tax rates on capital gains that are earned in the corporation and then distributed at the top marginal tax rate on capital gains earned personally, there's a significant tax cost to earning and the capital gains inside the corporation, especially with individual is subject to the 50% inclusion rate.

Considerations for a sale of securities prior to June 25

It's important to consider the power of tax deferral as one of the fundamental tools of tax planning. With the tax deferred investment strategy, the money that might go to pay current taxes remains invested for greater long term growth potential I benefit from the power of compounding. Selling now will result in a prepayment of tax and a smaller after-tax amount to reinvest.

It has a higher probability that the inclusion rate for the future capital gain is likely to be 50%, because of your ability to take advantage of the $250,000 threshold for individuals, it's not recommended to realize an early capital gain.

For securities you have not previously considered selling this year or next, the decision should be analyzed to determine your ‘break-even holding period’.

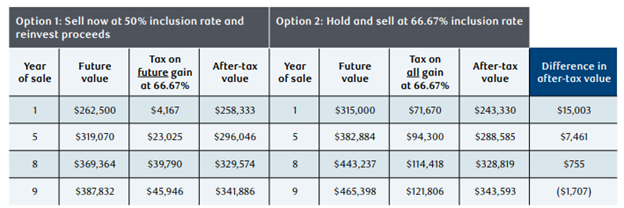

Break-even analysis example: Individuals

Here's an example of an individual selling securities before June 25 at the 50% inclusion rate, versus holding the security until the future date and selling on the inclusion rate is 66.67%. This example assumes the individuals already realized capital gains this year, and the additional sale of securities results in capital gains entirely in excess of the $250,000 threshold.

Let’s assume:

- The FMV of securities is $300,000

- The ACB of the securities is $100,000

- Their marginal tax rate today and in the future is 50%

- The expected future rate of return is 5% (100% deferred capital gains, no interest, no dividends)

If the individual were to sell today, they would be subject to capital gains tax of $50,000 leaving them with only $250,000 of after-tax proceeds for reinvestment. Alternatively, the individual could hold/not sell and keep the full $300,000 invested.

The following table shows a difference in after-tax value between selling now at the 50% inclusion rate versus holding and selling the security at a future date at the 66.67% inclusion rate.

To summarize, if the individual expects to keep the securities for at least nine years, they will be better off not selling now and rather holding the investment. In other words, if the individual plans to hold the security for less than nine years, they will be better off to sell before June 25 at the 50% inclusion rate.

The following table shows the break-even holding period for the preceding example using the same assumptions but at various capital growth rates of return.

In conclusion, the lower the future expected rate of return, the longer the break-even holding period will be. Conversely, the higher the future expected rate of return, the shorter the break-even holding. (If you hold a security with a high rate of return and you plan to hold on to the security for the long term, it likely doesn't make sense to sell just to take advantage of the lower inclusion rate).

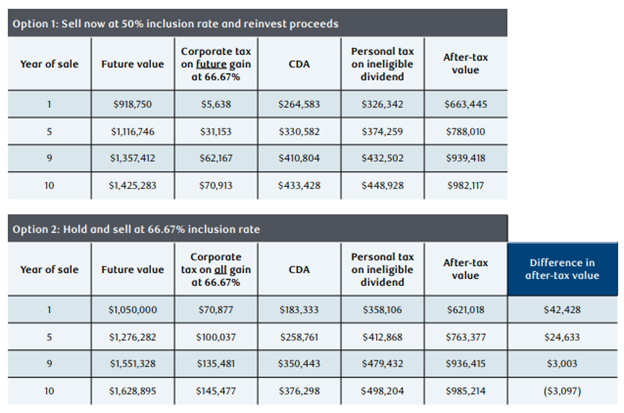

Break even analysis example: Corporations

If you're a business owner, you may be retaining a surplus in the corporation. Where you have no plans to withdraw the surplus from the corporation in the short or medium term, the break-even calculation is similar to the calculation for individuals. However, in the case where the surplus will be withdrawn from the corporation, the calculation differs.

Let's look at an example of a corporation selling securities before June 25 at the 50% inclusion rate and investing the proceeds, versus holding the security until a future date and selling when the inclusion rate is 66.67%.

Let’s assume:

- The FMV of the securities is $1,000,000

- The ACB of the securities is $500,000

- The shareholder’s tax rate is 45% on ineligible dividends

- The corporate tax rate is 50%

- The expected future rate of return is 5%, (100% deferred capital gains, no interest, no dividends)

If the corporation were to sell today, it would be subject to capital gains tax of $125,000, leaving it with only $875,000 of after-tax proceeds for reinvestment. Alternatively, the corporation could hold/not sell and keep the full $1 million invested. It's assumed the shareholder will withdraw the proceeds from the sale of the portfolio after the break even. As a combination of taxable ineligible dividends and tax-free capital dividends.

The following table shows the difference in after-tax value between selling now at the 50% inclusion rate versus holding and selling the security at a future date at the 66.67% inclusion rate.

In the preceding table, the shareholder could expect the difference in after tax value to be the same sometime between the 9th and 10th year. Therefore, if the corporation expects to keep the securities and the shareholder will not extract the funds for at least 10 years, they will be better off not selling now and rather, holding the investment. If the corporation plans to hold the security for less than 10 years and the shareholder will be withdrawing the proceeds, they will be better off to sell before June 25 at the 50% inclusion rate.

The following table shows a break-even holding period for the preceding example.

In conclusion, the lower the future expected rate of return, the longer their break-even holding period will be. Conversely, the higher the future expected rate of return, the shorter the break-even holding period (As such, if you hold a security with a higher rate of return and you plan to hold on to this security for the long term, it likely doesn't make sense to sell just to take advantage of the lower inclusion rate).

The federal budget to increase the capital gains inclusion rate has created questions and concern for many, with this proposed change and continuing to proactively plan for the future, it's important to discuss your situation with your qualified tax advisors, i understand the significance of the potential impacts based on your personal situation and determining if it makes sense to take action prior to June 25, 2024.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved