“Reality is merely an illusion, albeit a very persistent one.”

Genius Physicist, Albert Einstein

As we moved into the fall, there was a lot on investor’s minds.

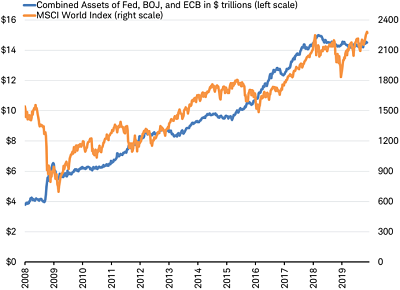

Many markets pundits have claimed that the entire stock markets gains of the past ten years have been largely attributable to the central bank stimulus and purchases. “Maybe” is what I’d say, but then one would logically argue the recent return to stimulus and growth of their balance sheets by the most important central banks on earth would be a strong positive signal for equities.

As we head into 2020, there is already a lot on investor’s minds, notably:

- The outcome of US/China trade negotiations

- Impeachment proceedings

- A US Presidential election

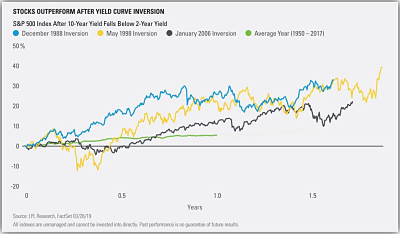

- Inverted yield curves

Among a myriad of other concerns.

There seems to be a widely held view that Quantitative Easing (QE), more specifically, central bank bond purchases, helped lift equity prices. That opinion is simply derived from the fact that when QE was present, markets seemed to rise, and anytime the central banks tried to remove it in recent years, the market threw “temper tantrums” and went down.

(Source: Charles Schwab, Bloomberg data as of 11/22/2019)

Yet, the relationship is not that simplistic as some would lead to believe. There have been periods over the past 10 years when central banks slowed their buying or even trimmed their balance sheets and shrank for most of 2019’s global stock market rally.

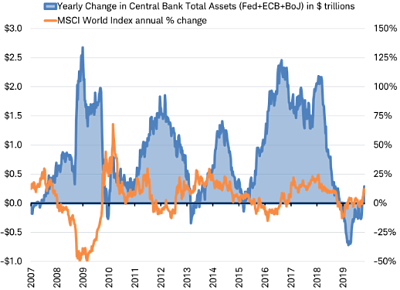

Here’s the relationship between central bank balance sheets and the markets in 2019.

The bears will argue that in each passing round of QE, the upside benefit has weakened, so now the benefit of any QE is negligible, the central banks are “pushing on a string” as is often said.

In recent months the “noise” focused around the inverted yield curve. Each of the past 9 recessions back to the 1950’s saw the 1-year /10-year yield curve spread invert approximately 14 months on average before a recession. However, I will add that although an inverted yield curve preceded all 9 prior recessions, not all yield inversions lead to a recession. Examples occurred in 1966, 1978, and even 1998, where a yield inversion in these cycles did not lead to an immediate recession. Inversions also occurred in 1988 and 2006, but an economic downturn didn’t happen until further out.

So while an inversion of the yield curve may suggest trouble ahead for the economy, economic growth and market gains can continue for years after the initial inversion.

The European Central Bank (ECB) restarted QE on November 1st. The US Federal Reserve has been cutting interest rates all of 2019. If readers recall when the year started, consensus estimates were for the Fed Reserve to raise rates 3-4x in 2019. That was the main stimulus for the decline in markets in Q4 2018. In reality, the Fed has cut interest rates 3x in 2019.

As we head into 2020, and about to be bombarded with a slew of economic forecasts for the upcoming year, investors should take any with a grain of salt, and be best served focusing on what is actually occurring.

Stay tuned,

Vito Finucci, B.COMM, CIM, FCSI

Vice President and Director, Portfolio Manager

Our story

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®Registered trademarks of Royal Bank of Canada. Used under license. © 2019 RBC Dominion Securities Inc. All rights reserved.