“Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us suppose further that everyone is convinced that this is a unique event which will never be repeated…”

- Economist Milton Friedman, “The Optimum Quantity of Money" (1969)

I’ve had this topic on my mind to write about for some time now. I’ve stayed away from the topic of, call it what you will, Universal Basic Income (UBI), Subsidized Income (SI), or Modern Monetary Theory (MMT) debates because they are overly ideological and nonproductive, plus I tend to remain optimistic regardless of what is going on, and MMT would only have applied in an ugly economic scenario. Note the last word is “Theory”. But MMT is not so theoretical anymore. We are now living it, so thought I’d pass on some thoughts on of it so people can have an educated debate going forward on what exactly MMT is. It’s obviously been on people’s mind lately:

MMT is officially described as:

“A macroeconomic theory and practice that describes the practical uses of fiat currency in a public monopoly from the issuing authority, normally the government's central bank. Effects on employment are used as evidence that a currency monopolist is overly restricting the supply of the financial assets needed to pay taxes and satisfy savings desires” (Source:Wikipedia).

MMT's main tenets are that a government that issues its own fiat money:

- Can pay for goods, services, and financial assets without a need to collect money in the form of taxes or debt issuance in advance of such purchases.

- Cannot be forced to default on debt denominated in its own currency;

- Is only limited in its money creation and purchases by inflation, which accelerates once the real resources (labour, capital and natural resources) of the economy are utilized at full employment;

- Can control demand-pull inflation by taxation and bond issuance, which remove excess money from circulation (although the political will to do so may not always exist);

- Does not need to compete with the private sector for scarce savings by issuing bonds.

What does all that mean?

MMT starts with the basic premise that the US dollar is a simple public monopoly, and therefore, the US government can never run out of money. It never has to worry about funding the money in order to be able to spend it. Unlike our personal finances (or a corporation), where our ability to spend is limited by our ability to earn, under MMT government spending would never be constrained by the need to raise taxes or borrow money, and the printing presses just crank up and simply spend the money in the economy. The money created is the government’s creation, not from a society’s efforts or productivity.

MMT’s roots actually go back over 100 years, and is in fact, an old Marxist idea. The very basis of the theory, the idea that governments can finance their expenditures themselves and therefore deficits don’t matter, actually goes back to the Polish Marxist economist Michael Kalecki (1899-1970). But he wrote before central banks existed. So take the same thoughts, package them up and throw the word “Modern” in front of I and …..“voila”…. “MMT”

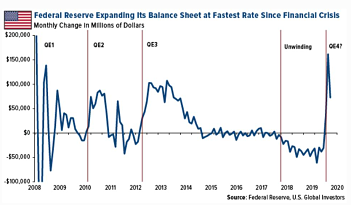

Breaking it down to current day reality, the US Federal Reserve is doing MMT as I write. But rather than giving printed dollars away to the Treasury, it’s using the bond market as a conduit. The Fed balance sheet is now reportedly over $6 trillion. I repeat, six……. Trillion.

Having been around a few years, it seems to me since the advent of cheap money, the downturns are getting worse. 2000 was bad, 2008 was worse, and now 2020 is appearing to be worse than 2008. This is not a case of the trend is your friend. The trend would suggest ever cheaper money, ever more debt, and ever more intervention only lead to ever more severe consequences.

While it may provide some short-term pain relief, MMT won’t cure what ails the economy’s current underlying distress, outside of Covid-19, which revolves around the high levels of debt…everywhere. But odds are it will act as a catalyst for longer term disruption. Debt is a drag on future economic growth. Slower growth means less jobs. Less jobs means more people on government programs. That makes scapegoats popular. Many will blame free markets and capitalism, but right now, we have neither “free” markets nor true capitalism. In order for capitalism to work, we must allow corporations to fail. Ex astronaut Frank Borman, when he was the CEO of Eastern Air Lines (1975 to 1986) had one of best quotes I always remember: “Capitalism without bankruptcy is like Christianity without hell”. If you believe in one, then have to believe in the other side. The bankruptcy process works just fine. Sure, some shareholders and creditors would experience losses, but that would teach them to be more careful the next time. That’s pure risk vs. reward capitalism.

MMT is by definition a centralizing tool and would create a massive shift of power from the private sector towards more government control over…well…a lot more things. The debate can go for some time about how much we want the government to control in our lives, but let’s just say I prefer the private sector’s ability to allocate capital more efficiently.

MMT would pretty well eliminate the need for the current central banking system. A good argument can be made for either side of that debate. If implemented, one can ask if MMT will also end the US dollar’s reserve currency status?

If the Fed’s liabilities are made legal tender, the fractional reserve banking system would have to end to permit the Fed’s liabilities to act as such. It was exactly what was done in 60 cases of hyperinflation including after the Weimar Republic in Germany after WWI, China in the 1930’s and 1940’s, and in Yugoslavia (early 1990’s) and Bolivia (mid 1980’s) with their bouts of super-inflation.

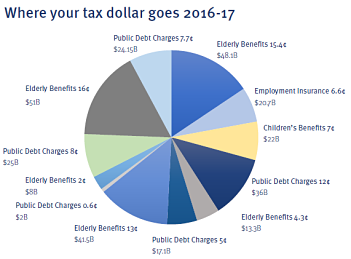

I also believe MMT would also greatly acerbate the class distinctions: You would have a growing chasm between those who pay taxes, and those who live off them. Promises of free income, free education, free healthcare…well free everything will appeal to many. That is why I think in the coming decade, politics and the leaders chosen will be more important to financial markets than ever before. Remember, every government policy has its own winners and losers, and usually a whole lot of unintended consequences that go along with it.

To many who argue for UBI, they believe it is going to cure poverty, eliminate stress, reduce crime, unleash entrepreneurial spirits, emancipate more women, save us from Artificial Intelligence and even fight climate change. I am not sure I agree with all that, but we will see arguments made in the media that claims such.

While no country on the planet will admit they are in a fully- fledged MMT policy, there are some who arguably are close. Some will say Japan, with 2.5X the level of debt the USA has, has been in some form of MMT for almost three decades now. Universal Basic income (UBI) is an offshoot of MMT, and Denmark has had a UBI scenario for some time. Denmark always ranks high when the polls come out of the “happiest” places on the planet. As a Danish client told me, Danish taxes are over 60% all in, and “when’s the last time you heard of any innovation out of Denmark?”. The nation of Finland recently had an experiment where 2000 unemployed people aged 25-28 were paid a tax free 560 Euros per month, independent of any other income they had, and not conditional on looking for work. The results were obvious: 1) people were happier and 2) Not a single new job was created. Finland abandoned the experiment not long after. In 2017, Swiss voters overwhelmingly rejected a proposed UBI in a referendum vote.

As legendary investor Warren Buffet has often said, “you never know who's swimming naked until the tide goes out.” Well folks, it seems as if the tide has indeed gone out for now, and low tide might stick around for a bit. The three engines of growth that have driven the global economies the past 20+ years – soaring debt, financialization, and globalization – all seem to be wobbling from a “punch to the face” created by the global shut down due to the coronavirus pandemic. But I’m not sure turning on the printing presses from central banks is the only solution.

But that doesn’t mean giving away as much money as is humanly printable is the solution.

Modern Monetary Theory – is neither a “modern” idea nor does it seem to be just “theory” any longer.

For those old enough to have studied the classics in school you may recall: As Ernest Hemingway wrote in the classic “The Sun Also Rises”, to the question, “How did you go bankrupt?" Two ways. Gradually, then suddenly.” Let’s hope the debate on the topic is a good one, smarter minds prevail, and we don’t go down a road which will put those that come behind us in a negative situation that they are forced to deal with from a bad hand we dealt to them.

Stay Tuned,

Vito and Eric

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®Registered trademarks of Royal Bank of Canada. Used under license. © 2020 RBC Dominion Securities Inc. All rights reserved.