With uncertainty about the U.S. economy’s fate hanging in the air, market participants are paying close attention to Q4 2022 earnings reports and the prospects for earnings and revenue growth in 2023.

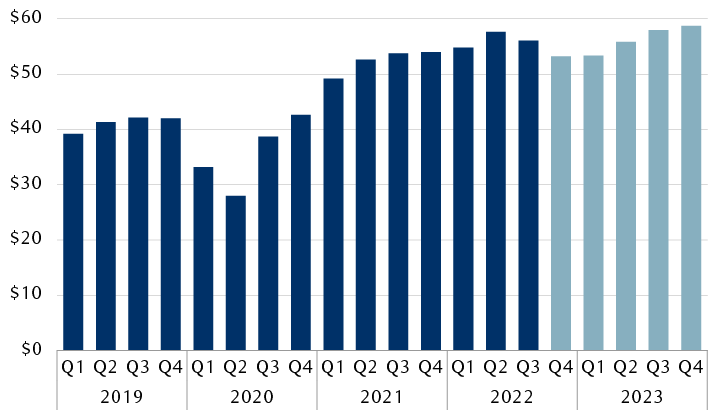

The consensus forecast is for quarterly earnings to ebb moderately in Q4 2022 and hold steady in Q1 2023, with growth picking up thereafter, as the chart illustrates. If the U.S. economy does indeed succumb to recession, we think this forecast would be too optimistic.

U.S. profits seem set to ebb over the near term

S&P 500 quarterly earnings per share: actual in dark blue, consensus estimates in light blue

Column chart showing quarterly S&P 500 earnings per share since 2019. The actual results are from Q1 2019 through Q3 2022, and the consensus estimates are from Q4 2022 through Q4 2023. Earnings rose slightly until Q4 2019 to almost $42 per share. Then they plunged in Q1 and Q2 2020 due to COVID-19, falling to a low point of roughly $28 per share. Then they steadily gained, rising to almost $58 per share in Q2 2022. They pulled back slightly in Q3 2022, and the consensus forecast estimates that earnings will retreat further in Q4 2022 and Q1 2023 to about $53 for each period. Then the consensus forecast estimates earnings will bounce toward year end, reaching almost $59 per share in Q4 2023. There is some uncertainty about this estimates given the economic risks, as the report explains.

Source - RBC Wealth Management, Refinitiv I/B/E/S; data as of 1/25/23

The main question for investors is to what degree any additional earnings retrenchment has already been factored into the market.

Underwhelming, but could be worse

The U.S. Q4 earnings season is off to a decent start given the challenging economic conditions.

With 25 percent of companies having reported thus far, S&P 500 earnings are on pace to decline 2.7 percent year over year. That would represent the lowest growth rate since Q3 2020, the tail end of the most acute phase of the COVID-19 crisis.

The biggest driver of the decline in overall earnings is pressure on technology-oriented companies within various sectors (a.k.a. Tech+). Excluding this segment, Q4 results are much more favorable, with earnings growth pacing 4.7 percent year over year.

Relative to consensus expectations, the magnitude of earnings and revenue beats are uninspiring at 2.0 percent and 0.5 percent, respectively. But at least these rates are not negative, as they would likely be if results across a broad range of sectors were hitting a wall.

If the earnings beat rate holds steady for the remainder of the reporting season, our national research correspondent estimates the final tally for Q4 S&P 500 earnings growth would be only slightly negative at -0.7 percent year over year instead of the current -2.7 percent consensus estimate.

Additional Q4 takeaways:

- Growth stocks are exceeding value stocks in earnings and revenue growth, and the growth category has stronger earnings beats.

- Domestically focused companies are delivering higher earnings growth than more globally oriented firms.

- Profit margins are weak overall, pacing around -8.9 percent year over year—not surprising, given that margins peaked at record levels previously and the economy is soft. Weak margins could usher in another round of corporate cost cutting.

- Margin retrenchment is not just a Tech+ story; it is also impacting Materials, Financials, Health Care, and Consumer Staples.

- Some companies are still facing challenges with supply chain disruptions and/or labor shortages, but the proportion is lower than in previous quarters.

- More companies have announced layoffs, mostly in the Tech+ group.

- Some of the largest companies in the Consumer Staples and Industrials sectors are signaling they still have pricing power; they continue to benefit from inflation.

- Banks have generally reported strong loan growth as well as higher net interest income growth and larger net interest margins. But firms with capital markets businesses have seen weakness in that area.

Shifting weather patterns

The stock market is almost always more interested in the future than the past, especially where earnings are concerned.

During the Q4 reporting season, management teams generally have been constructive about future quarters. But some have qualified that stance by noting that economic uncertainties make forecasting difficult, and a small proportion have been downright gloomy about the macro situation.

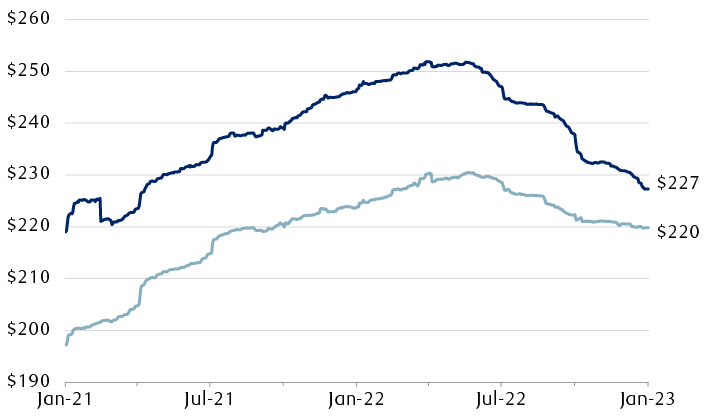

Amid the Fed’s aggressive tightening campaign and related expectations of economic weakness, the S&P 500 full-year 2023 consensus estimate has declined notably from about $252 per share last spring and early summer to $227 currently, as the chart shows. The market has already factored this in; it’s one of the main reasons the S&P 500 retreated markedly in 2022.

The path of S&P 500 annual consensus earnings-per-share estimates through time in U.S. dollars

Line chart showing the change in annual earnings-per-share estimates since January 2021 through January 25, 2023. 2022 estimates began at $197 and rose steadily until the spring and early summer of 2022, peaking at about $230. They subsequently declined to $220 currently. 2023 estimates began at $219 per share, rose to almost $252 in late spring/early summer of 2022, and then declined meaningfully to $227 currently.

Source - RBC Wealth Management, FactSet; daily data through 1/25/23

S&P 500 and sector consensus earnings and revenue growth estimates for 2023

| Sector | Earnings | Revenue |

|---|---|---|

| S&P 500 | 3.2% | 8.4% |

| Communication Services | 6.5% | 9.7% |

| Consumer Discretionary | 25.5% | 11.8% |

| Consumer Staples | 5.7% | 10.1% |

| Energy | -15.5% | -4.0% |

| Financials | 12.1% | 12.2% |

| Health Care | -3.9% | 9.2% |

| Industrials | 11.2% | 9.4% |

| Information Technology | 3.2% | 9.7% |

| Materials | -12.0% | 2.8% |

| Real Estate | -1.0% | 11.7% |

| Utilities | 7.4% | 6.7% |

Source - RBC Wealth Management, Refinitiv I/B/E/S; data as of 1/25/23

We think many institutional investors (managers of mutual funds, pension funds, and hedge funds) are assuming 2023 earnings could be moderately lower than industry analysts’ $227 per share consensus forecast. For example, some institutional investors are factoring in roughly $210 per share for 2023, according to RBC Capital Markets’ U.S. Equity Strategy team. We believe the market is already prepared for the $227 per share estimate to tick down five percent or so in the coming weeks and months.

Despite the vulnerabilities we see in 2023 estimates, the earnings outlook seems “less bad” than in previous periods of economic stress. Even if a recession materializes and prompts deeper cuts to the S&P 500 consensus forecast that take it below the $210 level, household spending and employment should be relatively more resilient than in recent economic contractions. Also, S&P 500 earnings have tended to hold up better during inflationary periods of economic stress than during non-inflationary periods. This is because pricing power associated with inflation helps some industries at least partially offset demand weakness.

Importantly, RBC Capital Markets, LLC Head of U.S. Equity Strategy Lori Calvasina points out that the S&P 500 has historically bottomed three to six months before the earnings clouds lifted. The low point in the market has usually come well before the proportion of companies raising their estimates exceeded the proportion of companies lowering them.

Bottom line: There is further downside risk to the S&P 500’s 2023 estimate, which could bring forth more volatility and/or downside for the index. But we think a lot of bad news has already been absorbed by the market.