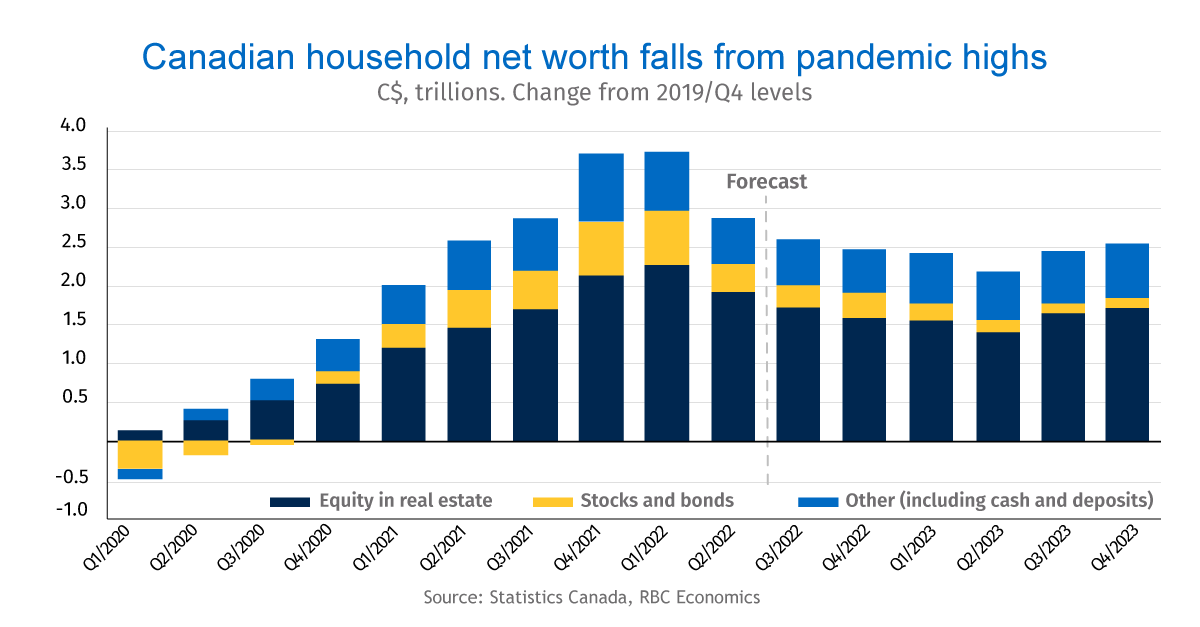

- Canadians amassed $3.9 trillion in net wealth during the pandemic, largely due to a real estate boom that drove home values 52% higher.

- In a sharp reversal, roughly $900 billion of that has been lost as housing markets retrench under the weight of rising interest rates and weakening financial markets.

- And the pain isn’t over. We expect losses to net wealth to total $1.6 trillion in quarters ahead, leaving Canadians feeling less wealthy and less confident about spending.

- The bottom line: The dramatic decline in net wealth, combined with rising prices and higher interest rates, will cut roughly $15 billion from household spending in 2023. This is one of the factors that will drive Canada into a recession early next year.

Canadian net wealth will fall at the fastest pace in decades

Canadians are feeling less wealthy and less confident—and they’re spending a lot less. Though a roaring housing market and surging stock markets created $3.9 trillion in new net wealth during the pandemic, those gains are now reversing. The chill in home prices and weaker financial markets already cratered net wealth by $900 billion (-5.4%) in the second quarter of 2022—the largest drop on record. And with aggressive central bank interest rate hikes continuing to push housing prices lower, more declines are coming. We expect total net worth to fall by more than $1.1 trillion from peak pandemic levels by the end of this year (though this is still well above pre-pandemic levels).

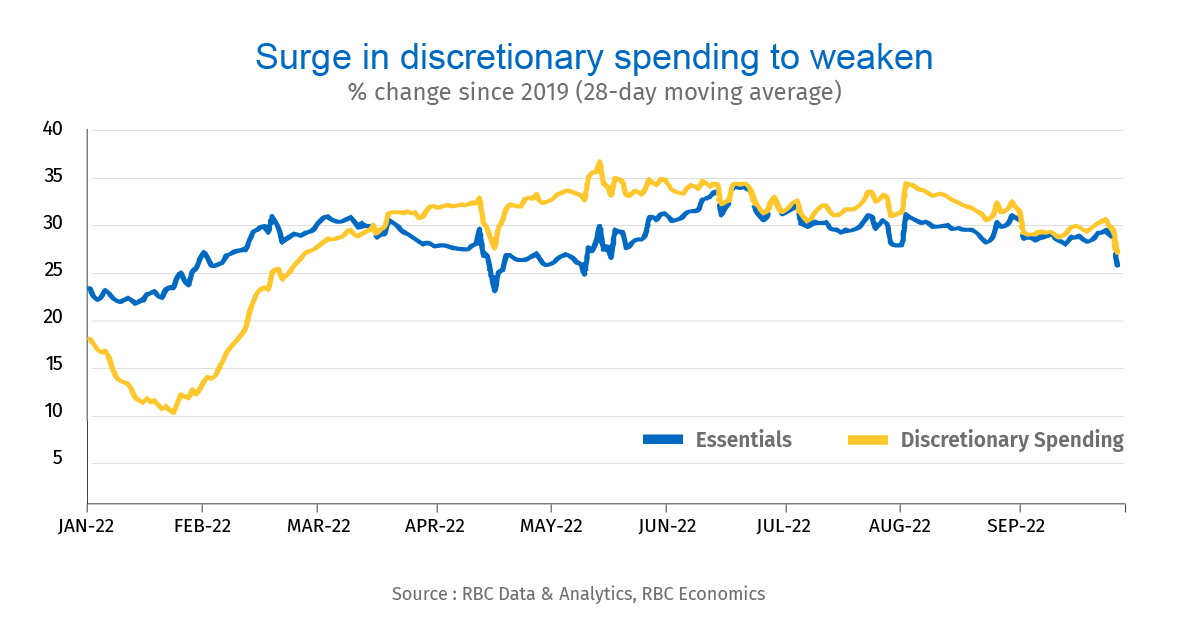

This decline in household wealth will come at a time when Canadians are already feeling the squeeze of higher inflation and rising interest rates. This is particularly the case for Canadians at the lower end of the income scale, who spend a larger share of their earnings on “non-discretionary” or essential purchases like gas, food, and shelter. By contrast, higher-income households—still exercising pent up demand following pandemic lockdowns—have continued to spend on non-essentials like travel and hospitality services. This has kept overall spending strong and added to inflation pressures.

Declining net worth adding to consumer headwinds

Still, for the most part, the sharp decline in net wealth is starting to hit home. Households can finance spending either out of current income or by drawing from their net wealth. As a result, when their net worth declines, so does their confidence about spending. For decades, economists have made various attempts to measure the impact of this “wealth effect”—quantifying how declining net worth feeds through to household spending. Prior to 2000, it was sized at between 3 and 7 cents per dollar. One early Canadian estimate from the Bank of Canada (by current BoC Governor Tiff Macklem) suggested a $1 decline in net wealth would translate to a 5.6 cent decline in household consumption.

Our own estimates suggest a weaker effect. For three decades prior to the pandemic, a $1 decline in home equity appears to have caused a roughly 1.3 cent decline in household consumption (in line with U.S. studies). And the accumulation of wealth from more volatile sources like equity market returns did not translate into higher consumption.

That said, if net worth changes are large, even a small per-dollar wealth effect can take a major toll on consumer demand. And changes to net wealth have been massive during the pandemic, adding 52% to home values alone and over $2 trillion to the value of household equity in real estate. Overall, net worth jumped by $3.8 trillion from Q4 2019 to Q1 2022 and helped drive the initial recovery in consumer spending as pandemic lockdowns eased. For instance, furniture sales surged as buyers outfitted newly-purchased homes.

Now, the decline in home prices and financial markets is turning the tables. We expect a 41% ($1.6 trillion) retracement of those net worth gains from peak-to-trough. While that still won’t retrace all of our pandemic gains, it will nevertheless create a negative ‘wealth effect’ that will drag on consumer spending, even as labour markets soften.

Consumers will curtail spending, putting a damper on the economy

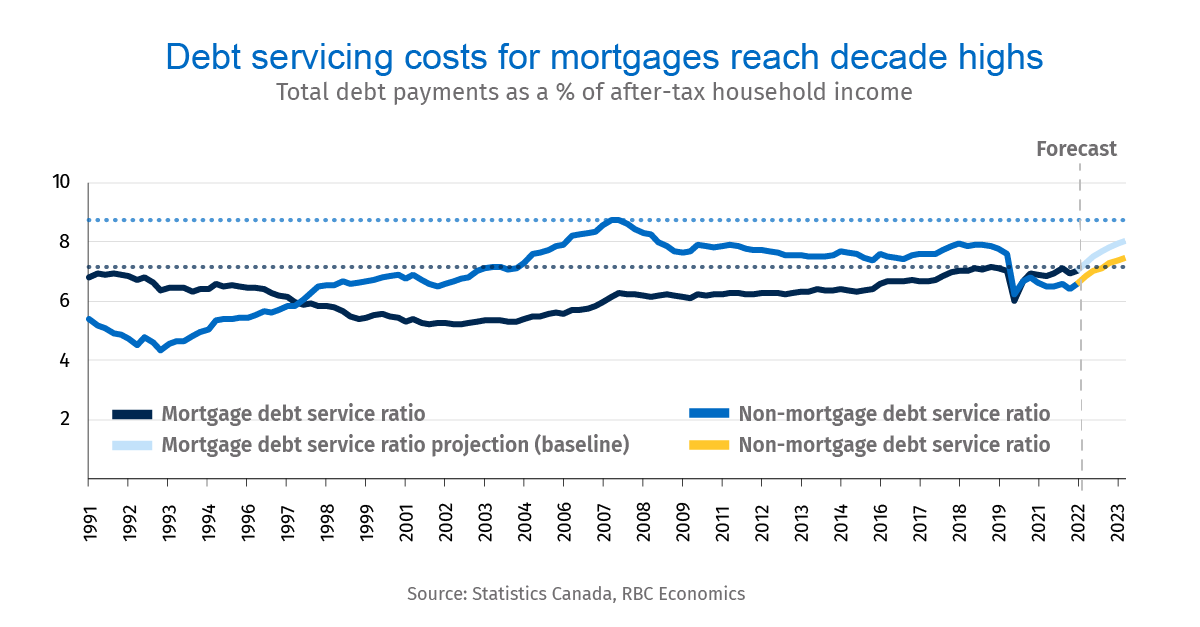

Discretionary or non-essential spending on things like home furnishings and renovations drove the pandemic spending surge. But as interest rates rise and price pressures persist, Canadians will increasingly prioritize necessities like groceries and gas—and debt. We estimate households will soon have to allocate 15% of their take-home pay just to debt servicing, with half of this attributed to mortgage costs.

Spending on travel and leisure services will likely continue in the near-term (though at lower levels) as pent-up demand is released, particularly by higher income households. But our own RBC Cardholder data shows Canadian spending plateaued in the summer months after taking off in the spring following the Omicron-induced lockdowns.

Some purchases of discretionary goods, like furniture, have already started to decline as housing markets retrench. As this decline deepens, it will weigh on businesses, particularly in the manufacturing sector.

Nathan Janzen is an Assistant Chief Economist, leading the macroeconomic analysis group”. His focus is on analysis and forecasting macroeconomic developments in Canada and the United States.

Carrie Freestone is an economist at RBC. She provides labour market analysis, and is a member of the regional analysis group, contributing to the provincial macro outlook.

Naomi Powell is responsible for editing and writing pieces for RBC Economics and Thought Leadership. Prior to joining RBC, she worked as a business journalist in Canada and Europe, most recently reporting on international trade and economics for the Financial Post.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.