As the end of 2022 nears, I thought I’d share a few final thoughts and take a peak into 2023 to ponder where we might be headed.

I’m including HERE Jim Allworth’s (RBC Chief Investment Strategist) latest outlook. He writes about what a U.S. recession could look like, and points out that while they haven’t reached that stage yet, it is now all but certain there will be one.

If you’re a regular reader of mine, you’ll know how valuable I think Jim Alworth’s perspective is. In the event you’ve found yourself falling prey to this latest news cycle rhetoric and don’t feel like reading one more thing about the stock market, then I encourage you to just skip to the last section entitled, “How much does the arrival of a recession and accompanying equity bear market matter to the investment outlook?”. It alone should help to put your mind at ease.

Most global stock market performances for 2022 (as of this writing), have been negative. That being said, I will always direct clients to take the glass-half-full approach and examine a longer period of time to ascertain calendar returns and how they translate to continued positive growth, with the high quality companies we own. We experienced unprecedented gains to the upside in 2021, and strong returns for 2019 + 2020 (despite the pandemic sell-off). Just looking at this 4-year dataset will illustrate we (my clients) are indeed still well ahead of the curve.

During conversations with a number of clients this fall, I’ve talked about the potential for the first half of 2023 to be rocky. Much of this will play out in reaction to rising interest rates, inflation data, unemployment figures, along with consumer sentiment (perhaps the largest driver). This does not mean however that I’m nervous or wanting anyone to make any “big” moves. That being said, I am content to sit on a bit more cash (money market) than usual. This puts us in a good position to be ready for some buying, when the opportunity arises.

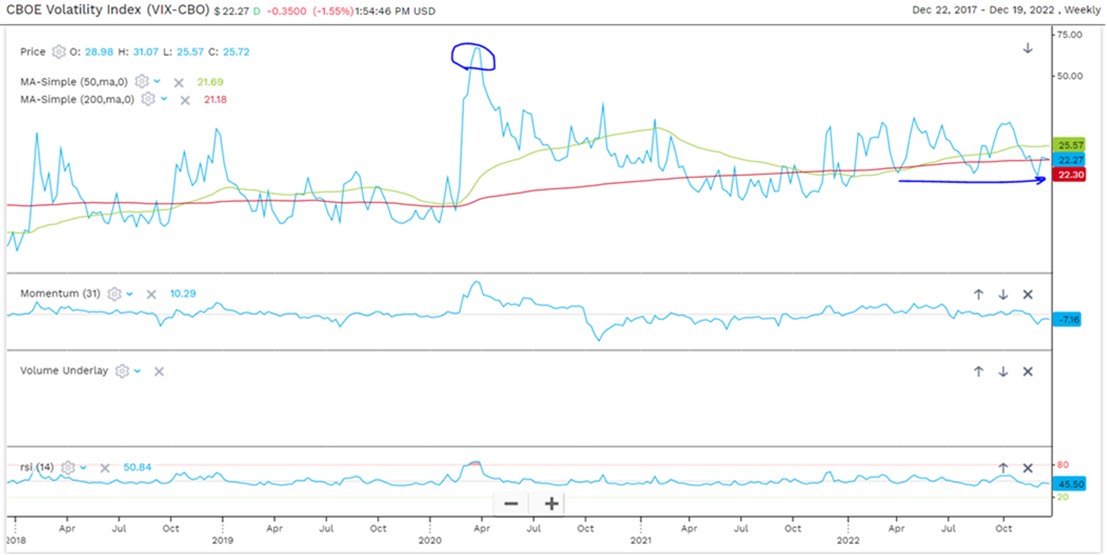

Below I’m including a 5-year chart, measuring the volatility index. Despite headlines to the contrary, you might be surprised to learn that October/November saw volatility indicators dropping. A happy outcome of this is that the vast majority of portfolios under my care experienced strong returns for both months. I’ve also circled the peak (volatility over this 5-year period) from the February to April 2020 time frame. Obviously this is extreme, and we’ve not seen these levels since then.

I’d like to conclude by saying that I am very confident we will navigate our way through 2023 in fine form. Certainly there will be some highs and lows ahead of us, but I will be here to guide you through all of it.

Happy Holidays to all!

Libby

Source: FactSet

Source: FactSet

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc.* nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2004. All rights reserved.

* All rates, yields and prices are subject to change