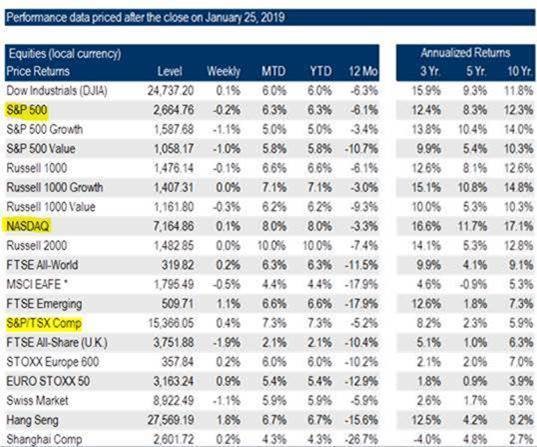

After a punishing 4th quarter (not just in Canada but globally), it has been a refreshing and much needed relief to witness the substantial market rebound in January. As of Friday Jan 25th, the S&P/TSX is back up +7.3% & the S&P500 is up +6.3%. If you take a look at the table below, you’ll note all major indices continue to have healthy annualized returns over the past 5 & 10 years.

2018 housed the perfect storm of fears of future unknowns which included (but was not limited to) political uncertainty and turmoil (China-US-Russia); muted global growth expectations; Brexit and European economic weakness in general; the interest rate (US Fed/B of C) guessing game and so on... Doom and gloom gripped the imaginations of the industrialized world and hence contributed to what we experienced, most significantly in December. Add in the fact that it was tax-loss selling season and you had the perfect storm.

Another significant occurrence that somehow managed to slip under the radar of most – in early December over 500 hedge funds gave notice to their investors that they would be liquidating (closing) at the end of the month. This was the culmination of 10 years of poor performance (note: we’ve never owned a hedge fund). These announcements were then followed by an en-masse exit from these thousands of positions, sending the stock prices plummeting. Had this been done in an orderly fashion over a period of months, perhaps the “sell-at-any-price” situation would not have occurred. This sell-down effect snowballed into exchanged-traded funds (ETFs) and mutual fund redemptions that we hadn’t seen since early 2009.

Now it’s time for some positive and uplifting news! If we go back and look at the S&P500 (most commonly cited US index) starting in 1925, we find that the average return after a negative year has been +12.5%. Only twice have we seen a divergence from this stat and that was during a world war and global recession, of which neither are likely to happen this year. Another interesting fact is that the S&P500 averaged a +34% return in the 12-months after a correction bottom and an astonishing +47% after a bear market ended. Now to 2018, wherein December 24th was the low and because this correction ended far later in the year than any other on record, we can make a deduction that the outlook for 2019 is more than robust!

I noted with great interest the Fundstrat 2019 Technical Strategy report that came across my desk last week. We (RBC DS) subscribe to it and therefore I’m able to share the attached with you. It’s a fascinating account that shows we are still in the midst of a bull market that is expected to take us into the early 2030’s (you read that right – it’s not a typo). I encourage you to look through this report as there is a lot of compelling information there.

As we move into February (and one step closer to Spring and warm weather), it is my hope that you’ve taken away from my comments that there is indeed an upbeat outlook. Most importantly, we’ve laid the foundation with the holdings in your portfolio, for great long-term success!

It’s my great privilege to work with you and I am most grateful for your continued trust and loyalty. As always, I encourage you to reach out at any time if you have any questions.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc.* nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2004. All rights reserved.