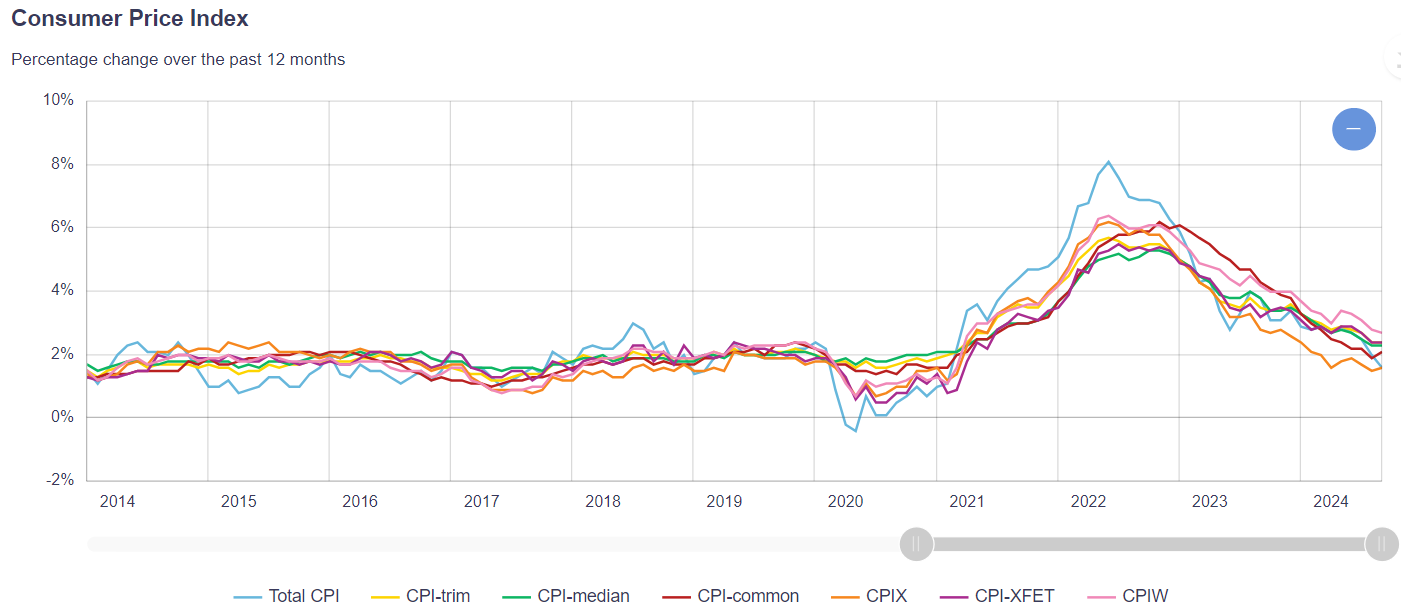

As I sift through the mountain of data and forecasting that has been published as of late (employment figures, GDP growth, Consumer Price Index (CPI), upcoming Bank of Canada meeting, and so on…), what stands out the most is that the Canadian inflation rate has fallen to 1.6% year-over-year in September. I’ve included below, the 10-year CPI chart which clearly illustrates the downward trajectory to the end of last month. This is the first time since February 2021 that inflation has been below the central bank’s target of 2%.

*Chart source: Bank of Canada

As we look to next week’s BOC meeting (23rd), those in the “betting game” (aka traders) are now projecting they may opt for a larger rate cut, with a 50 basis point reduction. Since inflation is back under control, policymakers can better concentrate on preserving economic growth, which is vital to the overall health of our country.

While it’s true that the September employment data was stronger than expected, Q3 GDP growth is projected to be around 1.8% which is well below the BOC’s 2.8% forecast. And, although gasoline prices are meaningfully lower, rent and food costs remain elevated.

As of now - mid-way through October, markets here in Canada and the US, continue to soar, further solidifying the remarkable year we’re all experiencing, as far as investment returns are concerned. As I have been saying for much of this year, volatility will likely increase dramatically as we approach the US election and as such, it’s still my desire to have a healthy allocation to cash (money market) to take advantage of buying opportunities (bargains) as they come along.

No matter what the future holds, my clients have banked some remarkable gains with longer-term annualized returns that are well above average. Thanks to this, I strongly believe we will be able to weather whatever is on the horizon.

As always, if you have any questions or concerns, please do not hesitate to contact me.

Libby

The strategies and advice in this communication are provided for general guidance. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2022 RBC Dominion Securities Inc. All rights reserved.