As I sit at my desk on this Friday afternoon heading into the long weekend, I can’t help but smile when I look at the graphic below. What you see there is the 1-year chart comparison between the S&P/TSX60 (Canada - upper blue line); and the red line - representing the S&P500 (US).

The sharp drop we saw in both indexes in early April can be directly attributed to intensified tariff threats coming out of the US. Since then, we’ve had quite the surge back up - to new highs. Throughout the spring and summer, I’ve been actively taking profit, in order to rebalance and protect capital, for all clients. This means we now have approximately 10% cash at our disposal, for possible near-term buying opportunities.

For the few months leading up to February, Canada was performing pretty much in lock-step with the US. However, since April, our market has been steadily outperforming our neighbours to the south, thanks to a whole host of reasons I won’t go into right now (stay tuned for that in September).

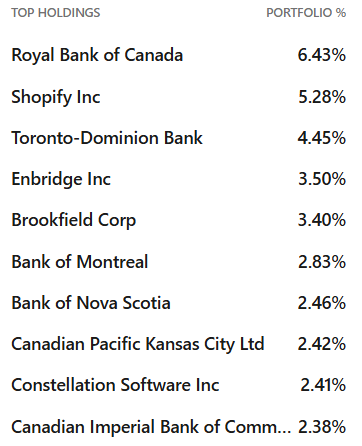

Below the chart, I’ve included a list of today’s top 10 Canadian companies on the S&P/TSX. Royal Bank and Shopify have been vying for the top position all of August, which has been interesting to watch.

The fall should prove to be interesting, so put on your seatbelts!

P.S. If you’re reading this and you’re not already a client – why not consider getting in touch with me, for a complimentary portfolio review?

Libby

*Source: FactSet

*Source: FactSet

*Source: iShares

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® /™ Trademark(s) of Royal Bank of Canada. Used under license. © Royal Bank of Canada 2024. All rights reserved.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc.* nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. *Member CIPF. ®Registered trademark of Royal Bank of Canada. Used under licence. ©Copyright 2004. All rights reserved.

* All rates, yields and prices are subject to change