Plan - don't predict

In this week's letter:

- Why the BoC might be ready to cut rates while the Fed still isn't

- Why people put off completing their Wills and ideas for how to get started quickly and painlessly

- Business owners seeking advice on an exit: which sources of advice provide the most confidence in a succession plan?

Why the BoC might be ready to cut rates while the Fed still isn't

With rates at 5%, Canada has clear evidence on a number of fronts that the economy is slowing and continues to slow while inflation appears to be heading towards target. A divergence in rate cutting will benefit borrowers of Canadian dollars but the expected weakening of the Canadian dollar vs the US would naturally cause inflation on US imports. Bring back 2010 when it was cheaper to go out for dinner in NYC than in Toronto!

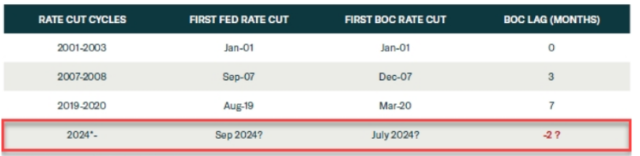

Canada vs US Rate Cut Cycles - Canada often lags

Source: complied by BCA research

While in the past, the BoC has typically tracked or slightly lagged US rate cutting cycles, there seems to be enough evidence at this stage that Canada will dance to the beat of it's own drum. Here are some of the factors that could lead to easing in Canada sooner rather than later, regardless of what the Fed does:

1) As covered last week, PMIs, both manufacturing (and services), are at contracting levels - i.e. under 50. and Inflation is on track to hit target.

2) The Canadian debt burden is substantial

3) The popularity of variable rate mortgages which worked great in an interest-rate loosening period after the great financial crisis has come back around to bite borrowers in the a$$. However, those hurt the most will feel the most relief this time around.

Canadian Debt/GDP is near the top of the Global List

Source: BIS

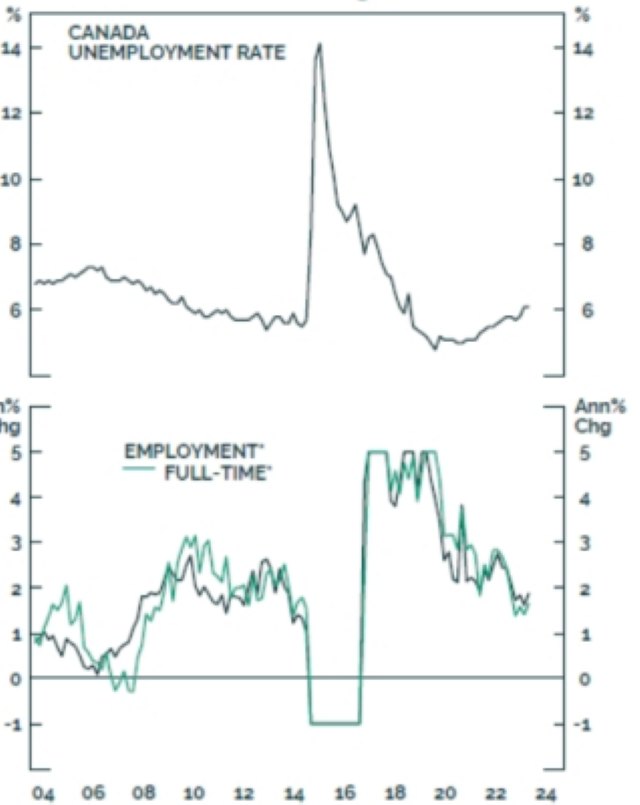

4) The labour market is weakening with unemployment at 2 year highs.

Canadian unemployment is the weakest since 2021

Source: BCA, truncated

The lag

Keep in mind that much of the tightening impact of higher rates is yet to be felt by mortgage holders whose borrowing terms are ending in the next year.

Why people put off completing their Wills and ideas for how to get started quickly and painlessly

If there's one thing that continues to strongly drive our ability to help families is their need for planning. A large number of Canadians either have no Wills in place or ones that are in need of updating. Those without Wills on their passing will die intestate and that can mean:

- a loss of control of one's estate. If you die intestate in Ontario, the Succession Law Reform Act of 1990 will be the source of law that determines the distribution of your assets instead of you making those decisions yourself

- additional stress for surviving family members

- with a lack of tax planning, there very well might be less left to your survivors

So, with an understanding of all the negatives of not planning, why do people still put things off? Here's one simple answer: no one wants to think about their own mortality and, therefore, by not reviewing Wills, people might feel more comfortable avoiding facing your own inevitable end. Add to that the cost of having a Will prepared professionally and you have a perfect recipe for avoidance.

Our recommendations on how to get started

1. Start at least with a basic Will so you have something in place. Sometimes dipping your toe in the water is the best way to get in a pool.

There are some excellent resources to build a Will in 20 minutes. This approach will avoid many of the pitfalls of dying intestate. Try doing it just before you go and leave the kids at home, if that applies. This could create some motivation. Once you have that completed, you can go the next step and have your Will reviewed and updated by a professional.

2. For families with more complex needs, it's important to appoint Powers of Attorney and Executors. In the case of the latter, people often don't realize the extensive responsibilities and the time required to fulfill this important and paid role. Our recommendation is to hire a professional or seek at least partial support through an agent for executor solution within which you select an executor but have the continued support of a professional, arms length team.

The Executor Selection Dial

Whatever the case, keep in mind that whatever you do, there is no zero cost solution to having an Executor. The selection of a Trust company is sometimes ideal because your Will is distributed by an arms-length party that can follow your wishes exactly as described in your Will. To learn more, get in touch.

Business owners seeking advice on an exit: which sources of advice provide the most confidence in a succession plan?

Let's start with some background. According to surveys carried out by the Canadian Federation of Independent Business, a number of which are shared below, there will be $2T of businesses that will go through a succession process.

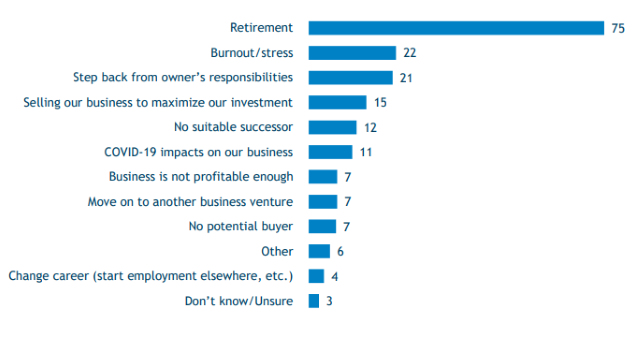

It's estimated that under 10% of business owners don't yet have a written succession plan in place, possibly risking the maximization in value of their primary source of wealth. Let's start with reasons for an exit of which the main impetus is retirement.

Reasons for exiting (% response)

Source: CFIB

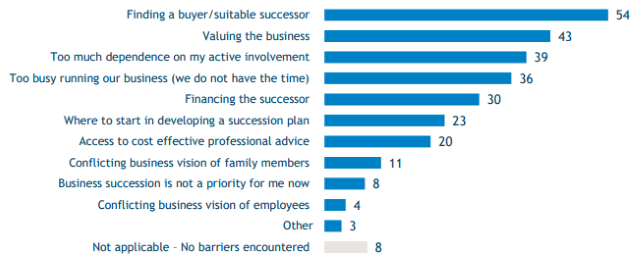

Top Challenges for those looking to sell their business

And when it comes to preparing an exit, there are many challenges with the largest issue is actually finding a buyer.

Challenges when working on succession planning

source: CFIB

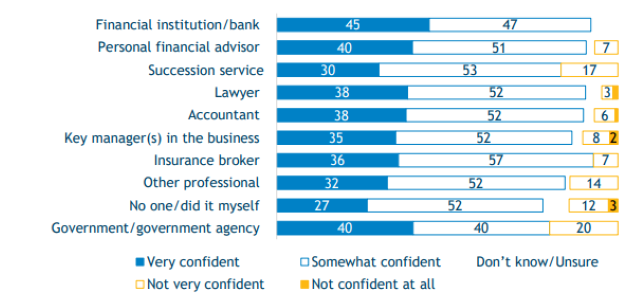

Circling back to the original question: which sources of advice are providing business owners with the most confidence in their plans.

Business owner’s level of confidence in having a successful business exit, based on advisors consulted while developing a succession plan (% response)

Source: CFIB

Although lawyers and accountants rank relatively highly in the survey, financial institutions and personal financial advisors, the latter typically working alongside the former, provide the highest level of confidence to business owners about their exit plans.

We've been working successfully with business owners for a number of years now, helping them both with their succession planning and the associated life transitions. If you'd like to learn more about our services and how we help our clients through this crucial process, please get in touch.

And with that, we'll wind up as always with this week's global insight. Enjoy.

In this week’s issue:

State of play: More-demanding valuations across financial assets appear to signal investors have become more confident that a “soft landing” is the most probable outcome over the next 12 months. We provide an update on the macro environment and its implications for portfolios.

Regional developments: Bank of Canada expected to cut rates next week; U.S. homebuying sentiment at lowest level in nearly half a century; Stage seems set for the European Central Bank’s first interest rate cut; New support for Chinese real estate sector and more likely to come

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.