Plan - don't predict

In this week's letter:

-

Investing with a Canadian Home Bias - Does it make sense to hold so much Canadian Exposure?

-

Is the timing right to invest in Canada?

-

Financial Literacy - teach your children well - how we're doing it

While we believe strongly in the value of diversification, many Canadian investors have a large portion of Canadian stocks in their portfolio as compared to the percentage of Canada's contribution to world GDP. That value is roughly 1.2% as of 2024, according to World Economics. A typical global balanced portfolio might have a total of 30-40% invested in Canada and that would be more than 30X the weighting if the rest of the world was considered proportionately.

Dividing up portfolio to allocate to every country in the world isn't a solution as GDP doesn't reflect the true risk/reward of investing in a country. Canada, having a stable economy, secure borders, rule of law and other stabilizing factors, also offers Canadians tax advantages to investing locally including a more favourable tax treatment of dividends than one would receive for any other international dividend payouts which are treated as basic income.

So, yes, in many ways, the Canadian Home Bias makes sense while in others, this is less the case. We build institutional quality portfolios for our clients, and, speaking of institutions, Canada Pension Plan which manages about $600B has a Canadian exposure of less than 15% at the current time while simultaneously having a much larger focus on alternatives such as infrastructure, private credit and private equity. We agree on the latter and reflect the same in our portfolios.

How's Canada Looking Anyways?

Given our typically heavy weighting for Canada, how are we doing economically and what are the investing prospects? We are still climbing out of the inflation-riddled COVID aftermath so we'll share some insights into the economy and indicate the bullishness and bearishness of some elements of the economy.

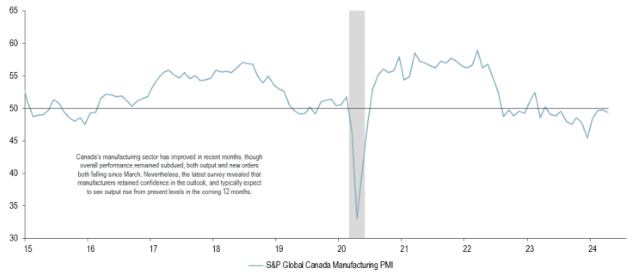

Manufacturing:

With interest rates hiked up to 20 year peaks, manufacturing, as measured by the purchasing managers index, is in on the side of contraction - that is, under 50. Above 50 indicates expansion. That's bearish on the economic front but might be considered bullish in the sense that interest rates are more likely to be eased if manufacturing weakens.

Canada manufacturing purchasing managers’ index (PMI)

Source: RBC Wealth Management, Bloomberg; shaded regions are U.S. recessions; data through 5/17/24

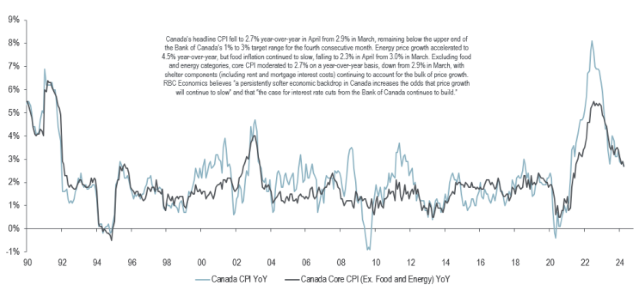

Inflation:

Although we're not out of the woods yet, the spike and drop of inflation has been dramatic and appears to continue to head in the right direction. In the 1970s, inflation was allowed to run hot for nearly a decade and the rate hikes imposed to cool it did not stop the fire all at once. It actually took a second round of hikes to finally nip it in the bud. It seems central banks are wary of making the same error this time and that is likely influencing their decision to watch the data and lower rates carefully. Higher rates for longer would be bearish for markets but doesn't necessarily mean the stock market will sell off. It's more that higher rates are not ideal for a rally but the two aren't mutually exclusive.

Canada inflation: Consumer price index (CPI) and core CPI

Source: RBC Wealth Management, Bloomberg, Statistics Canada; data through 5/21/24

Looking at our market - cheap or expensive?

And, as measured by forward historical forward earnings, the Canadian market is neither cheap nor expensive as it hovers around the 20 year average. Ideally purchases are made when things are cheaper but markets can perform well off the averages as well.

S&P/TSX Composite Price/Earnings

Source: RBC Wealth Management, Bloomberg; data through 5/17/24

Regardless of what he market is doing, personal financial decisions are more about one's needs and objectives. If you're depending on a very strong market to achieve your financial goals over the next couple of years, you might be misallocating your nest egg and should consider ideas to back off on risk. Get in touch to discuss ideas.

Financial Literacy - What we're sharing with the next generation

And speaking of financial advice, we are strong supporters both in word and in deed of continuing to bolster our clients' and their families knowledge in the space.

As parents, we recognize that information and ideas, nagging aside, that we share with our own children are often rejected simply because it's coming from us. However, somehow young people are more receptive to third parties. And so we are very big supporters of financial education and make it a integral part of how we help our clients. That is, we bring in the young folk and work at rounding out their own financial knowledge for their own futures. And even though what we share with them might be new, the guidance we share is actually well applied to all stages in life.

Look, old guy doing a selfie with the next gen at our latest financial literacy event

RBC Dominion Securities

Here are some of the key lessons we share here as well as with the next group of leaders working in engineering, technology, retail, education and neurobiology.

Determine the appropriate asset allocation

Despite all of the talk and value in analyzing individual securities, the primary driver of returns in a portfolio is asset allocation which is the proportion of stocks vs bonds. The "balanced" portfolio is typically 60/40 stocks vs bonds but that ratio is often updated during the market cycle.

Use prudent diversification

Modern portfolio theory, despite its shortcomings, is the right approach for most investors. Diversification can enhance portfolio returns while simultaneously reducing risk. Have your cake and eat it too!

Expect investment fads to come and go - unicorns vs donkeys

We have a good friend who runs a successful home-delivered automotive service and laughs at the goal of being the next unicorn and instead focuses on being a donkey. Slow and steady wins the race. Chasing performance ties into the idea of fear of missing out, a feeling we all suffer from when tempted to "keep up with the Jones". We recommend reading the classic "Tales of a stock market operator" as well as the latest from Howard Marks in his excellent book "The Most Important Thing".

Resist timing the market

Timing the market is, as we've said, nigh on impossible. Attempts to time the market means trying to pick highs and lows. As we all know, at the lows, we are much more likely to step to the sidelines in fear and at the highs we are more likely to chase returns as our recency bias has us feeling like the market will continue until it reaches the moon.

If you're interested in learning more about how we incorporate financial literacy into our family wealth planning, we'd be happy to share some strategies to help your own young adult children learn the ropes. Feel free to reach out.

As always, we'll wrap with this week's global insight. Enjoy and have a great May 24 weekend.

By Portfolio Advisory Group

In this week’s issue:

A return to normalcy? The ongoing yield curve inversion, a potential recession indicator, looks out of line with record equity markets and robust commodity pricing. We look at some reasons investors are accepting lower yields on longer-maturity bonds.

Regional developments: Strong Canadian equity performance; Fed policymakers assess inflation and current interest rates; UK general elections scheduled for July, services inflation remains stubborn; China announced major policies to support the housing market

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under licence. © 2023 RBC Dominion Securities Inc. All rights reserved.