Equity markets experienced a lull over the past two weeks, ahead of two catalytic events: President Xi and Trump’s meeting at the G20 this weekend (now complete) and Q2 reporting that begins mid-month. While markets overall are up fractionally, performance under-the-hood felt incongruent: for example economic and trade sensitives like Deere, Maersk and Caterpillar rose a sharp 5% - 10% even as safe haven assets like Treasuries and gold equities also rallied. Performance of the latter as trade tensions have escalated is notable.

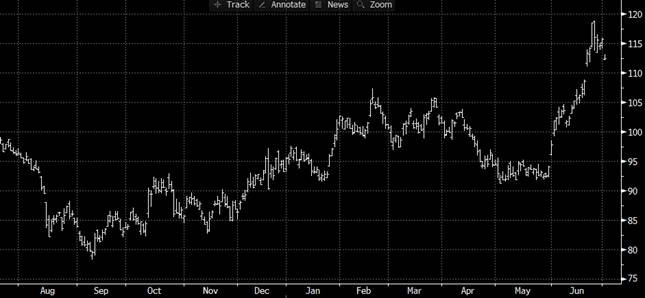

VanEck Vectors Gold Miners ETF (GDX US): 1-year price return, normalized

This weekend’s agreement between China and America to resume trade negotiations is of course being interpreted a market-positive event. At the same time, agreeing to talk again and “unsuspending” Huawei is easy progress from recently lowered expectations. Evidently the difficult part is actually agreeing to anything else, particularly when the entire effort is perennially one tweet away from being derailed. The situation feels quite representative of the overall context for financial markets as we arrive at the half-way point for 2019: the easy part is behind us and considerable uncertainty lies ahead.

Highlighting uncertainty in financial markets is typically a low-value-add comment – that is their whole reason for existence, after all. We are also acutely aware of the risks of confirmation bias. Nevertheless, there are enough tangible risks packed into the second-half of 2019 that the uncertainty appears worth continuing to flag, particularly in the face of new all-time highs for the S&P. Specifically:

- Progress (or lack thereof) in trade negotiations with both China and the EU;

- Clearly deteriorating business confidence and economic leading indicators;

- Fed cuts that are priced to disappoint, with three in six months already assumed by rate markets;

- Brinksmanship between Congress and the White House on the debt ceiling and spending cap deals that are required by year-end, particularly leading into an election year; and,

- Increasing odds of a hard-Brexit.

As noted previously, an equity market decline in the range 15% - 25% peak-to-trough would be consistent with a garden-variety recession and would provide a welcome buying opportunity as the list of secular positives remains powerful.