Equity Strategy

We view the stock market differently.

Over time, the term “diversification” has become a synonym for “risk reduction”. While this holds true in certain contexts, during market-wide drawdown, a well-diversified portfolio may still be impacted. On the other hand, in periods of market-advance, over-diversification may limit the portfolio’s return potential.

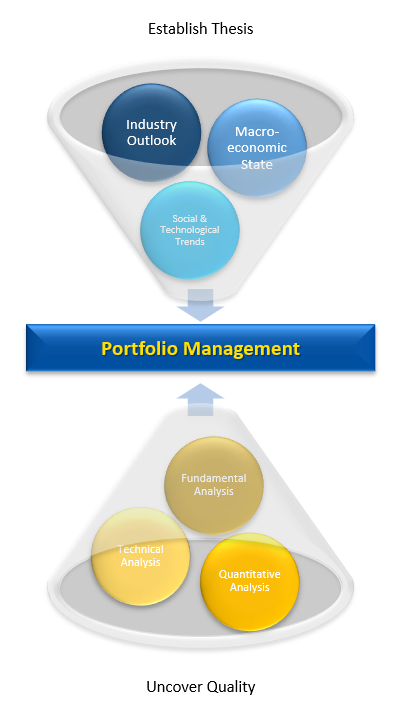

Not all sectors perform the same in times of market volatility. Some sectors outperform during periods of growth and remain resilient during periods of decline. By analyzing the economic and market conditions, we establish an investment thesis that aims to identify these exceptional sectors. As the market evolves and sentiments change, our thesis adapts to stay on top of the trend.

After identifying the sectors of interest, we focus on the companies within each sector. We evaluate a company based on its growth trajectory, fundamental strength, management capabilities, and other factors to uncover quality that will likely outperform its peers in the good times and the bad. While we invest for the long term, we remain vigilant and monitor for any material changes that may impact the company in a fundamental way.