Seems October tempts the hobgoblins of stock market angst.

That’s certainly and suddenly true here in 2018. The feeling seems justified given that more than 50% of 10% corrections either end or occur in October.

But despite annual forewarnings, Canadian stock weakness in Sep/Oct has not been the case since 2014. In the US, indices did show some relatively modest weakness in those particular months during each of 2014, ‘15, and ‘16. Though stocks subsequently moved higher in each case.

You may recall that 2018 began with a shake as February delivered a very short-lived downward move of approximately 8% for stocks. That pullback began over inflation fears and most everything was shellacked for a couple weeks. This selloff is much narrower – rising bond yields and the threat of inflation continue to play a role, since those will have a later effect on profit margins – but this situation has been more limited to high-fliers like tech stocks. Defensive sectors like utilities and consumer staples are dropping too, but less so.

While the move higher in interest rates this year is notable, the aggregate Canadian bond market is down only < 1% year-to-date. Higher rates are also generally a good thing for retirees and fixed income investors.

Stock investors may be spooked for the moment but this is far from a crisis. Economic conditions in the world’s largest economy remain buoyant. Upcoming corporate profit expectations are likely to help. Already announced corporate stock buybacks have much more runway for supportive action (that is, plans are likely to accelerate). Bond ETF inflows have been twice that of stock inflows this year. All of this argues for a relatively shallow stock selloff and a resumption of the uptrend this winter.

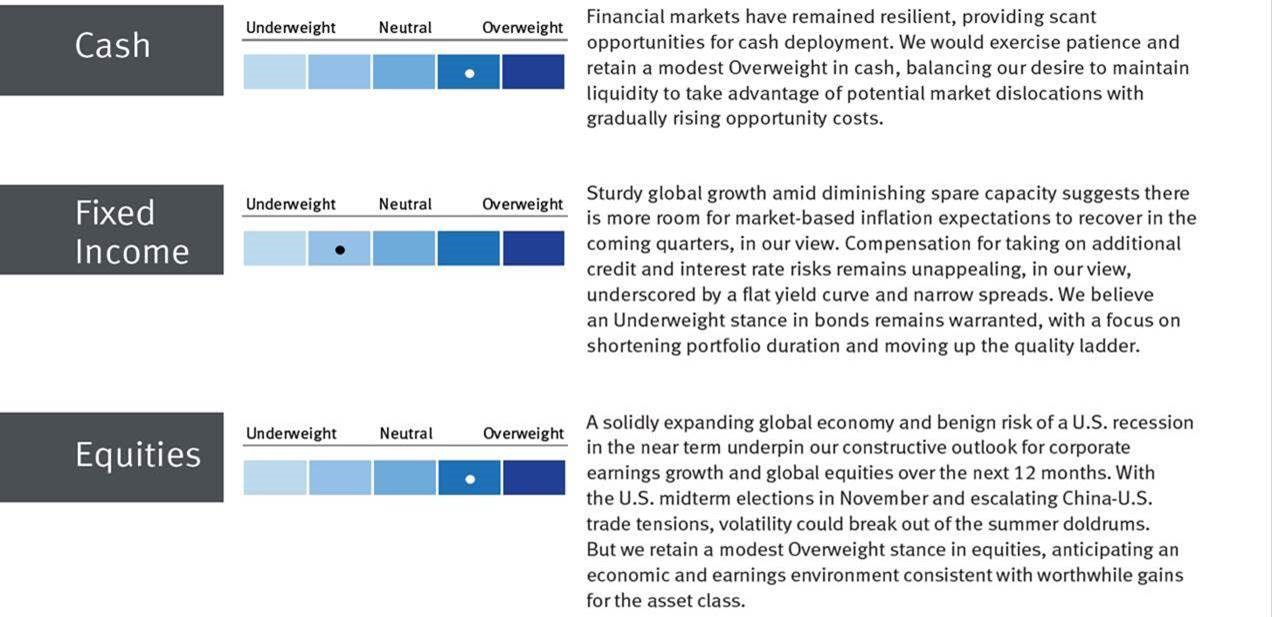

The bottom line RBC Global Asset Management forecast for 2018 and 2019 global growth remains the best since 2011. In their view, stocks will again move higher and, as such, they’re maintaining a mild overweight in stocks and an underweight in bonds. However, the business cycle is aging and total-return expectations have been cut slightly. Globally, markets in Europe and Asia are viewed as cheaper relative to fair value and more appealing areas for new money investment.

RBC Dominion Securities’ direction looks very similar, as the Asset Allocation Guide below indicates:

The average investor should certainly stay the course through what is highly likely a run-of-the-mill correction. The US stock market’s track record following mid-term elections has also been tremendously positive. So with a reasonable outlook for stocks well into next year, any further meaningful corrective action should allow investors with above average cash weights to work some of those dollars into promising ideas. Our own portfolio positions are on average more defensive, slightly higher income-paying, and considered 'more value, less growth'. That basic prescription seems ready for outperformance.

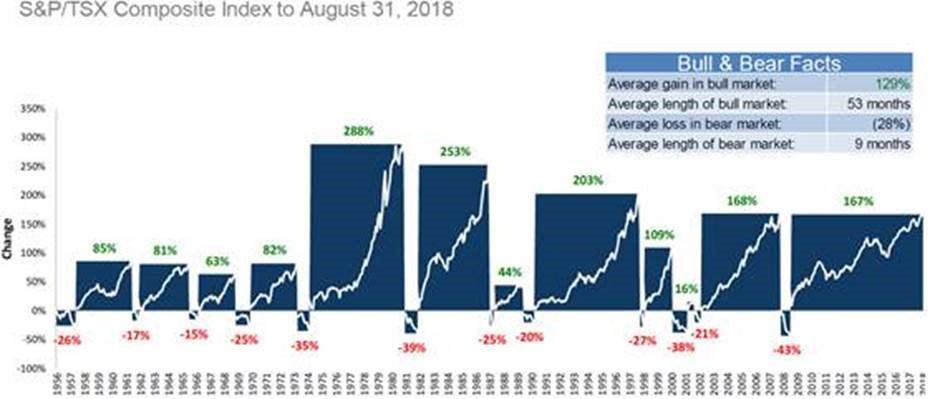

For those unconvinced and expecting a full-on bear market, the long-term perspective offered by the charts below might at least reduce your concern. These two charts represent the TSX Composite and the S&P 500 since 1956. All bars above the line are bull markets; all bars below are bear markets. For the purposes of these charts, a bull (bear) market is defined as a positive (negative) move greater than 15% that lasts at least 3 months.

Key takeaways for investors: 1) markets spend far more time in positive territory (bull) than negative (bear); 2) bull markets are on average much longer, providing a more substantial percentage change; and 3) on average bear markets are more brief, and yet engender widespread and intense fear.

Source: Mackenzie, Bloomberg

October is almost over and with it Halloween. While the hobgoblins may move on, stock market volatility is likely to persist, at least for a number of weeks. As they say, “the bond market trades like adults and the stock market trades like kids.” As usual, the adults have it right. This scare won’t be over in just a few days. But more encouraging times are around the corner.

Boo.

Best regards,

Craig Maguire, CIM

VP, Portfolio Manager