A look back at 2023 reveals a market and economic landscape at once uncertain and yet resilient. At the beginning of 2023, the consensus amongst economists was that both the U.S. and Canada would be in a recession (commonly defined as two or more consecutive quarters of negative GDP growth) at some point in the second half of the year. After all, central banks had already aggressively hiked rates to historically high levels to rein in elevated levels of inflation, driving the desired effect of tightening financial conditions. At least a few of the critical economic indicators that have historically demonstrated a solid track record of signaling a recession suggested as much.

And yet, despite all this, robust labour markets persisted, consumer spending chugged along nicely, and North American GDP rates trended at respectable levels for most of the year. Such dynamics, in our view, stem from the lasting impact of incredibly generous fiscal stimulus over the course of the last few years, coupled with an acknowledgement of lower economic sensitivity to rising rates, particularly in the U.S.

Looking forward to 2024

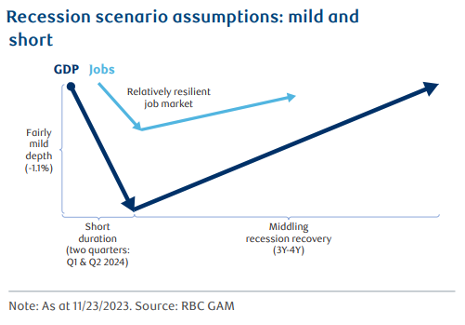

Given this experience in 2023, it is tempting to think that “this time is different” heading into 2024. Yet we maintain that the risk of recession not only remains but has only increased over time concurrent with historically high levels of interest rates. We expect a recession to arrive in the U.S. and Canada, likely in the second or third quarter of 2024, at which point central banks may start cutting rates.

Most recent economic data points to:

- increasing softness in labour markets (though not a precipitous decline)

- stalling wage growth

- fatigued consumer credit

- increasingly somber commentary for the outlook of the economy from the C-suite of major multi-national corporations

We would also note that current consensus expectations for six rate cuts in the U.S. coupled with low-double-digit EPS growth for the S&P 500 index seem somewhat ambitious to us given the aforementioned signs of emerging economic softness coupled with high interest rates.

While central banks are to be credited with driving inflation mercifully lower from the highs established last year, it remains above their targets in both the U.S. and Canada.

Going forward, we do not expect the Bank of Canada or the U.S. Federal Reserve to continue to increase rates – at least not meaningfully. But we expect to see further tightening of financial conditions – typically a precursor to a recession – over the course of the next several months. Partly that’s because rates are as high as they are, and there’s typically a lag of 12-18 months before their effect is fully felt economy-wide. It’s also due to a continuation of quantitative tightening (consider these de facto rate hikes). This is occurring at a time when the tailwinds from generous fiscal stimulus in the years prior are waning.

Quantitative tightening (or “QT”) is a contractionary monetary policy tool applied by central banks to decrease the amount of liquidity or money supply in the economy. It is the opposite of quantitative easing (or “QE”).

Qualifiers & conclusions

A few qualifications.

First, we are not expecting the recession to be particularly severe, given that the labour market broadly continues to operate from a position of strength, while balance sheets for households and corporations remain reasonably healthy (for now). Further, the upside of rates being as high as they are today is that central banks have considerable room and flexibility to react to cushion the economic blow of a recession.

Second, we do not believe that a “soft landing” (see below) is a zero-probability, though central banks’ track record of sticking the landing is unimpressive. Such an outcome will largely be reliant upon inflation continuing its descent to target alongside the overall stability of the labour market.

Time will tell. In light of the continued uncertainty, our bias would be to maintain a healthy level of defensive posturing in portfolios through a modest overweight in fixed income, an upgrading in quality of equity holdings, and proactive redeployment of excess cash in portfolios.

A soft landing is a cyclical slowdown in growth that avoids recession. It is the aim of central banks like the Bank of Canada when it raises interest rates (and, in turn, borrowing rates for consumers and businesses), with their aim being to slow the country’s economy in order to reduce high inflation, while at the same time aiming to avoid causing a severe economic downturn or recession.

Past performance is not indicative of future results. Counsellor Quarterly has been prepared for use by RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC). The information in this document is based on data that we believe is accurate, but we do not represent that it is accurate or complete and it should not be relied upon as such. Persons or publications quoted do not necessarily represent the corporate opinion of RBC PH&N IC. This information is not investment advice and should only be used in conjunction with a discussion with your RBC PH&N IC Investment Counsellor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest information available. Neither RBC PH&N IC, nor any of its affiliates, nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. This document is for information purposes only and should not be construed as offering tax or legal advice. Individuals should consult with qualified tax and legal advisors before taking any action based upon the information contained in this document. Some of the products or services mentioned may not be available from RBC PH&N IC; however, they may be offered through RBC partners. Contact your Investment Counsellor if you would like a referral to one of our RBC partners that offers the products or services discussed. RBC PH&N IC, RBC Global Asset Management Inc., RBC Private Counsel (USA) Inc., Royal Trust Corporation of Canada, The Royal Trust Company, RBC Dominion Securities Inc. and Royal Bank of Canada are all separate corporate entities that are affiliated. Members of the RBC Wealth Management Services Team are employees of RBC Dominion Securities Inc. RBC PH&N IC is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. RBC, RBC Wealth Management and RBC Dominion Securities are registered trademarks of Royal Bank of Canada. Used under licence. © RBC Phillips, Hager & North Investment Counsel Inc. 2024. All rights reserved.