Embracing Chaos: From Our Family Beach Photos to the Financial Markets

As I sit down on this Sunday evening to write this month's commentary, the sounds of crashing waves and children's laughter—and yes, a few tears—still echo in my mind from our family photo session at the beach this afternoon. We had planned every detail: the kids dressed in their cute new outfits and shoes, the perfect coastal backdrop, and a photographer ready to capture our family's togetherness. But if there's one thing that parenthood teaches you, it's to expect the unexpected.

The moment we set foot on the sand, our youngest, Bobbi, was irresistibly drawn to the ocean. Clad in her brand-new jeans and high-tops, she made a beeline for the water. Before we could intervene, she was joyfully splashing in the surf, soaking her new clothes without a care in the world. Meanwhile, Asher became engrossed in collecting seashells and hunting for crabs, his pockets quickly filling with sandy treasures. Isabel, ever the adventurer, found her excitement in climbing all the rocks around, scaling them with fearless enthusiasm.

Attempts to gather them for a posed photo were met with stubborn refusals, mini tantrums, and the occasional tearful plea of "Just one more minute!" While our visions of the perfect family portrait faded, I realized that the chaos unfolding before us was, in its own way, a beautiful snapshot of reality.

An Unexpected Calm in a Historically Volatile Season

This experience got me thinking about unpredictability—not just in family life, but in the financial markets. Much like our beach outing, the markets are influenced by countless variables, many of which are beyond our control. As we reflect on this incredible year in the markets, I've been preparing clients to expect some volatility in September and October, trying to caution that a bit of market downside might interrupt the incredibly generous 12 month gains in markets.

Historically, September is the worst month for the stock market. Data shows that the S&P 500 has, on average, delivered lower returns in September compared to other months. Additionally, with an election cycle this November, it's typical for October to experience increased volatility as markets react to political uncertainties.

However, this anticipated turbulence hasn't come to pass. Despite economic indicators suggesting short-term weaknesses in the economy, the market has been resilient, and corporate earnings have remained robust. It's a reminder that while patterns and historical data can guide our expectations, the markets, much like children at a beach, have a way of surprising us.

Chaos Theory and Financial Markets

This brings me to Chaos Theory, a concept that offers valuable insights into why predicting short-term market movements—typically those spanning days, months, or even a year or two—can be as challenging as orchestrating a flawless family photo with three energetic kids.

The Origins of Chaos Theory

Chaos Theory emerged in the 1960s through the pioneering work of meteorologist Edward Lorenz. While developing computer models to predict weather patterns, Lorenz discovered that tiny variations in initial conditions could lead to vastly different outcomes—a phenomenon he famously

termed the "butterfly effect." The idea is that something as seemingly insignificant as the flap of a butterfly's wings could set off a chain of events resulting in significant and unpredictable consequences, like a tornado forming weeks later in a different part of the world.

Lorenz's findings challenged the deterministic belief that, with enough information, we could predict future events with precision. Instead, he demonstrated that complex systems are highly sensitive to initial conditions, making long-term prediction inherently uncertain. French mathematician Henri Poincaré also made significant contributions to this field in the late 19th century, studying how small changes can drastically affect outcomes in complex systems like planetary motion.

Level One and Level Two Chaos

Chaos Theory helps us understand unpredictability in various systems by distinguishing between two levels:

Level One Chaos

Level One Chaos refers to situations where the environment is highly unpredictable, but this unpredictability is not influenced by the actions of participants. It's like dealing with random weather events—although we can't predict them precisely, our actions don't change their occurrence. In investment terms, this is similar to events like natural disasters or sudden economic shocks (e.g., unexpected inflation spikes). These events can significantly impact markets, but they are external factors that investors cannot control or influence.

Level Two Chaos

Level Two Chaos involves situations where unpredictability is influenced by the actions of others, and the environment adapts to those actions. It's akin to a strategic game where each player's move affects the outcome. Financial markets fall squarely into this category because the behavior of investors influences prices and outcomes.

In Level Two Chaos, unpredictability arises not just from the complexity of the system but from the interactions and adaptive behaviors of its participants. Predictions must account for complex feedback loops, where each participant's actions influence the overall outcome.

The Challenges of Predicting Short-Term Markets

Level Two Chaos suggests significant limitations to the predictive capabilities of market analysis, especially over the short term. Since markets are heavily influenced by the behavior and psychology of participants, traditional forecasting models that rely on historical data may fall short.

- Behavioral Contagion: Emotions like fear and greed can spread rapidly among investors, leading to herd behavior that amplifies market movements.

- Adaptive Strategies: As investors react to new information and to each other's actions, they continually adjust their strategies, altering market dynamics in unpredictable ways.

- Feedback Loops: Predictions themselves can influence outcomes. If many investors believe a market downturn is imminent and sell off assets, their actions can trigger the very decline they anticipated.

The Impact of Algorithmic and AI Trading on Market Chaos

Adding another layer to this complexity is the rise of algorithmic trading, high-frequency trading (HFT), and AI-driven trading strategies. These technologies have transformed the financial markets, especially in the short term.

- Increased Market Volatility: Algorithmic trading can execute large volumes of trades in fractions of a second. While this improves liquidity, it can also exacerbate market volatility, as algorithms may react simultaneously to market signals, amplifying price movements.

- Reduced Predictability: The use of complex algorithms and AI means that trading decisions are often based on patterns and signals that are not immediately apparent to human investors. This can make short-term market movements even more unpredictable.

As of recent estimates, algorithmic trading, including high-frequency and AI-driven strategies, accounts for a significant portion of trading volume in U.S. equity markets. While precise figures vary, some studies suggest that algorithmic trading may represent over 60-70% of total trading volume. This substantial presence underscores how these technologies contribute to the complexity and unpredictability of short-term market movements.

Strategies for Navigating Level Two Chaos

Given that short-term markets are impossible to predict due to Level Two Chaos—and further complicated by algorithmic trading—how should investors approach their investment strategies? By accepting this unpredictability, we can focus on approaches that are resilient to short-term volatility and uncertainty.

Short-Term Strategies Rooted in Unpredictability

- Avoid Market Timing: Attempting to predict short-term market movements often leads to missed opportunities or losses. Instead of trying to time the market, consider a disciplined approach to investing regularly, regardless of market conditions.

- Maintain Liquidity: Keep sufficient liquid assets to meet short-term needs. This reduces the risk of having to sell long-term investments during unfavorable market conditions.

- Focus on Quality Assets: In the short term, holding high-quality investments can provide some cushion against volatility, as these assets are generally more stable and better able to withstand market shocks.

Long-Term Strategies Rooted in Fundamentals

- Align with Long-Term Goals: Invest with your long-term financial objectives in mind. This perspective helps you stay the course during short-term market fluctuations.

- Diversify Broadly: Spread investments across various asset classes, sectors, and geographical regions to mitigate risk. Diversification reduces the impact of any single market event on your overall portfolio.

- Emphasize Fundamental Strengths: Focus on companies with strong fundamentals—solid earnings, robust business models, and competent management. Over time, these factors tend to drive investment returns.

- Regular Portfolio Review: Periodically assess and rebalance your portfolio to maintain your desired asset allocation. This disciplined approach helps counteract market swings by buying undervalued assets and trimming overvalued ones.

The Correlation Between Earnings and Market Returns

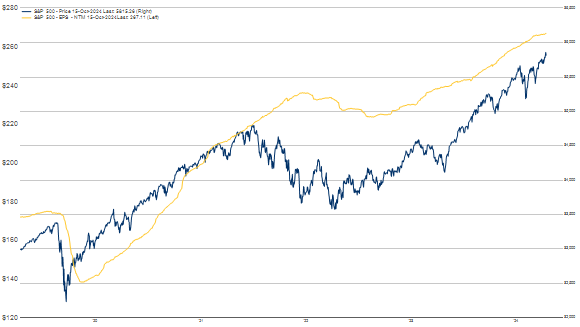

To reinforce the importance of focusing on long-term fundamentals, consider a chart that illustrates the correlation between long-term S&P 500 earnings and long-term S&P 500 returns. Over extended periods, the growth in corporate earnings has shown a strong correlation with the overall performance of the stock market.

Source: FactSet

This correlation highlights that, despite short-term volatility and unpredictability, the market tends to reflect the underlying profitability and health of its constituent companies in the long run. By aligning investment strategies with these fundamental factors, investors can better navigate the chaos inherent in short-term market movements.

Conclusion

Chaos is an integral part of both life and investing. Recognizing the limitations imposed by Level Two Chaos—and the amplifying effect of algorithmic trading—on short-term market predictions frees us from the often counterproductive pursuit of market timing. Instead, we can focus on strategies that acknowledge unpredictability while positioning ourselves for long-term success.

In both family life and investing, the unpredictable moments often become the most memorable and impactful. By accepting and even welcoming the chaos, we allow ourselves to experience life—and the markets—in a more authentic and rewarding way.

So, as we await the photos from today's beach adventure, I'm embracing the anticipation and uncertainty, much like I embrace the inherent unpredictability of the markets. Both remind me that while we can't control every outcome, we can choose how we respond—and sometimes, that's where the real growth happens.

This commentary is based on information that is believed to be accurate at the time of writing, and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.'s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2024 RBC Dominion Securities Inc. All rights reserved.