I hope this message finds you well and that you're enjoying the summer with your loved ones. Here at the Correia household, we've been cherishing the joyful chaos brought by the newest member of our family, Yoshi, our adorable mini Bernedoodle puppy. Between the laughter, cuddles, and many (many) house training misadventures, I've been reflecting on the importance of adaptability and embracing change, both in our personal lives and in the rapidly evolving world of finance and technology.

As I navigated some significant personal financial decisions recently, I found myself turning to artificial intelligence (AI) for guidance and insights. With my mortgage up for renewal, I was faced with the choice between a fixed or variable rate. To help me make an informed decision, I leveraged generative AI to create a complex spreadsheet that incorporated Bank of Canada meeting schedules and various interest rate scenarios. The AI-powered analysis provided me with valuable insights, helping me determine the breakeven point at which a variable rate would become more favorable than a fixed rate. I was genuinely impressed by the results and felt empowered to make a confident choice for my mortgage renewal.

Generative AI has also proven to be an invaluable tool in my home renovation projects. I've decided to redo my front and back yard and am currently evaluating contractors to carry out the work based on my landscape designs. I input the landscape design and PDF detailed quotes from three landscape contract companies into an AI system. The AI provided a comprehensive assessment of each quote, helping me identify key differences in the proposed scope of work and quality of materials. This analysis equipped me with targeted follow-up questions for the contractors, ensuring that I had a thorough understanding of each bid. With the AI's assistance, I was able to make an informed decision and ultimately get the best value for my investment.

These personal interactions with generative AI have been truly eye-opening and have reinforced my conviction that we are witnessing a technological paradigm shift with profound implications for our financial future. In this month's commentary, I want to share how we at Correia & Reynolds Wealth Management are strategically positioning your portfolio to navigate this AI revolution.

The Generative AI Landscape: A Brave New World

Generative AI is no longer just a futuristic concept; it's a tangible force driving innovation across industries. The economic potential of generative AI is staggering, with estimates suggesting it could boost global GDP by about 1.2% annually[1] . However, as with any disruptive technology, there are challenges and uncertainties to consider.

A recent Goldman Sachs report titled "Gen AI: Too Much Spend, Too Little Benefit" raises important concerns about the current state of generative AI investments[2] . The report suggests that many companies are overspending on AI without seeing significant returns on investment. It argues that while AI has the potential to revolutionize industries, the current hype surrounding the technology has led to a "spend first, ask questions later" mentality, resulting in suboptimal investments and unrealistic expectations. The report serves as a reminder that while AI holds immense promise, a strategic and prudent approach to AI investments is crucial.

Similarly, a thought-provoking CNBC segment, "AI's Trillion Dollar Time Bomb," explores the potential risks and challenges associated with the rapid advancement of AI[3] . The segment highlights the need for responsible development and deployment of AI technologies to mitigate unintended consequences and ensure the benefits are distributed equitably. It raises important questions about job displacement, privacy concerns, algorithmic bias, and the potential for malicious use of AI.

While these reports provide a cautionary tale, we believe that the long-term potential of generative AI remains immense. As the technology matures and finds real-world applications, we expect to see transformative impacts across sectors. However, it's crucial to approach generative AI investments with a balanced perspective, recognizing that the path to realizing AI's full potential may not be without volatility and challenges.

Your AI-Focused Investments: Riding the Wave of Innovation

Your portfolio includes exposure to companies at the leading edge of AI innovation and adoption. We have key holdings in tech giants like Microsoft (MSFT), Alphabet (GOOGL), and Amazon (AMZN), which are at the forefront of AI research, development, and application across various domains. Microsoft is leveraging AI to enhance its cloud computing services, productivity tools, and enterprise solutions[4] . Alphabet's Google is a pioneer in AI, with cutting-edge research and applications in areas like natural language processing, computer vision, and autonomous systems[5] . Amazon is harnessing AI to revolutionize e-commerce, logistics, and cloud computing, with AI-powered services like Alexa and Amazon Web Services[6] .

In the semiconductor space, we have positions in ASML Holding (ASML), Cadence Design Systems (CDNS), and Monolithic Power Systems (MPWR), which play crucial roles in enabling the AI hardware revolution. ASML is the world's leading supplier of lithography systems for the semiconductor industry, providing the advanced tools needed to manufacture the complex chips that power AI applications[7] . Cadence Design Systems offers software and IP for designing the next generation of AI-optimized chips[8] , while Monolithic Power Systems provides high-performance power solutions for AI data centers and edge computing devices[9] .

We also recognize the importance of the broader AI ecosystem, with investments in companies like nVent Electric (NVT) and CrowdStrike (CRWD). nVent Electric provides critical infrastructure solutions for data centers and industrial automation systems, supporting the growing demands of AI workloads[10] . CrowdStrike is a leader in AI-powered cybersecurity, using machine learning to detect and prevent sophisticated cyber threats in real-time[11] . As hackers increasingly leverage AI to launch more complex and targeted attacks, CrowdStrike's AI capabilities become even more essential in staying ahead of evolving threats. We also want to address the recent IT outage caused by CrowdStrike through a faulty update to their Falcon sensor for Windows hosts. This was not a cyber attack but rather a defect in a content update. While this incident has temporarily impacted CrowdStrike’s reputation, we believe the company’s long-term potential in the AI-powered cybersecurity space remains strong.

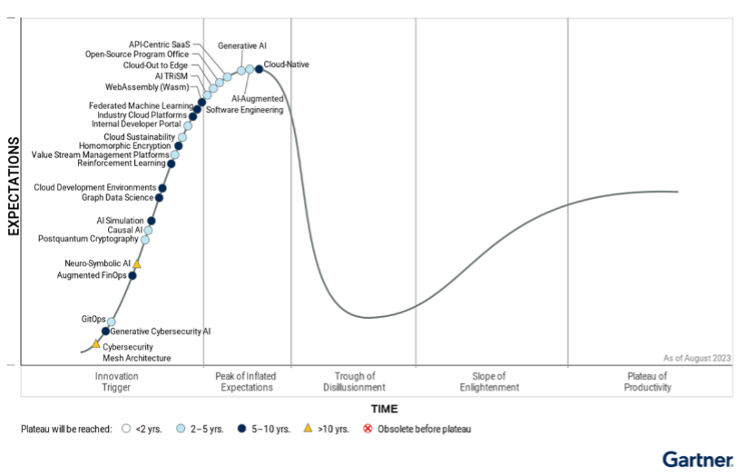

As we consider the future trajectory of generative AI, it’s helpful to examine it through the lens of the Gartner Hype Cycle[12] . This well-established framework provides valuable insight into the typical progression of emerging technologies, from the initial surge of excitement to the eventual plateau of productivity. By understanding where generative AI currently stands on this curve and anticipating its potential path forward, we can make more informed decisions about how to position our portfolio for long-term success. While we are optimistic about the long-term prospects of these investments, we acknowledge that the generative AI landscape is rapidly evolving, and short-term volatility is to be expected. As such, we will closely monitor the performance and strategic direction of our AI-focused investments, adjusting as needed to ensure your portfolio remains well-positioned to capitalize on the AI revolution while managing potential risks.

Your Portfolio: Diversification in a Changing World

While we are excited about the potential of our AI-focused investments, it's important to emphasize that AI is just one component of our comprehensive investment strategy. We actively explore other key thematic trends shaping the future of industries and economies, ensuring that your portfolio remains well-diversified and resilient.

By maintaining a diversified portfolio across sectors, asset classes, and geographies, we aim to mitigate the impact of volatility in any single investment or theme[13]. This approach allows us to capture the upside potential of transformative technologies like AI while managing downside risks.

The Road Ahead: Navigating the Future Together

As we navigate the generative AI revolution and other transformative trends, our commitment to your financial well-being remains unwavering. Just as I adapt to the ever-changing needs of my growing puppy Yoshi and leverage AI to make informed personal financial decisions, our team at Correia & Reynolds Wealth Management will continue to adapt and evolve our investment strategies to guide you through the dynamic financial landscape.

We will keep you informed of significant developments, provide regular updates on the performance of your investments, and offer insights to help you make informed decisions. We will maintain a balanced perspective, acknowledging both the opportunities and challenges associated with AI and other disruptive technologies.

Your trust and confidence in our expertise mean the world to us, and we are dedicated to helping you achieve your long-term financial goals. We will continue to monitor the AI landscape closely, making strategic adjustments to your portfolio as needed to ensure that you are well-positioned to benefit from the AI revolution while managing potential risks.

Thank you for taking the time to read this month's commentary. If you have any questions or would like to discuss your portfolio further, please don't hesitate to reach out. Our team is always here for you, ready to provide guidance and support as we navigate this exciting and transformative era together.

Warm regards,

Marc Correia, CFA CFP

Senior Portfolio Manager and Wealth Advisor

Correia & Reynolds Wealth Management

(& Yoshi Correia)

[1] McKinsey Global Institute. (2018). Notes from the AI frontier: Modeling the impact of AI on the world economy. https://www.mckinsey.com/featured-insights/artificial-intelligence/notes-from-the-ai-frontier-modeling-the-impact-of-ai-on-the-world-economy

[2] Goldman Sachs. (2023). Gen AI: Too Much Spend, Too Little Benefit. https://www.goldmansachs.com/intelligence/pages/gen-ai-too-much-spend-too-little-benefit.html

[3] CNBC. (2024). AI's Trillion Dollar Time Bomb. https://www.cnbc.com/video/2024/07/19/ais-trillion-dollar-time-bomb.html

[4] Microsoft. (n.d.). AI at Microsoft. https://www.microsoft.com/en-us/ai

[5] Google AI. (n.d.). Google AI. https://ai.google/

[6] Amazon. (n.d.). Machine Learning on AWS. https://aws.amazon.com/machine-learning/

[7] ASML. (n.d.). ASML Technology. https://www.asml.com/en/technology

[8] Cadence Design Systems. (n.d.). AI and Machine Learning. https://www.cadence.com/en_US/home/solutions/ai-ml.html

[9] Monolithic Power Systems. (n.d.). Artificial Intelligence and Machine Learning Power Solutions. https://www.monolithicpower.com/en/applications/artificial-intelligence-machine-learning

[10] nVent. (n.d.). Data Centers. https://www.nvent.com/en-us/our-brands/schroff/data-centers

[11] CrowdStrike. (n.d.). AI-Powered Cybersecurity. https://www.crowdstrike.com/products/ai-powered-cybersecurity/

[12] Gartner. (n.d.). Gartner Hype Cycle. https://www.gartner.com/en/research/methodologies/gartner-hype-cycle

[13] Investopedia. (2021, March 7). The Importance of Diversification. https://www.investopedia.com/investing/importance-diversification/

This commentary is based on information that is believed to be accurate at the time of writing, and is subject to change. All opinions and estimates contained in this report constitute RBC Dominion Securities Inc.'s judgment as of the date of this report, are subject to change without notice and are provided in good faith but without legal responsibility. Interest rates, market conditions and other investment factors are subject to change. Past performance may not be repeated. The information provided is intended only to illustrate certain historical returns and is not intended to reflect future values or returns. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license. © 2024 RBC Dominion Securities Inc. All rights reserved.