-

There is downside risk to earnings forecasts for this year and next, and the full profits recovery could be pushed back to 2022—later than the market seems to be assuming.

- Even if the earnings and economic recoveries are delayed, they should materialize more quickly than they did following the global financial crisis.

With the S&P 500 up 30 percent from its March low, and down just 10 percent year to date, the U.S. equity market is priced in a way that suggests it can quickly pass through the COVID-19 crisis and deep recession, and with hardly any consequences.

The market has jumped on improved virus statistics, unprecedented Fed and fiscal stimulus, the belief that the recession will be short-lived, and positive developments about a potential COVID-19 treatment—all valid reasons for a rebound, especially when they are combined.

However, from here on out, the recovery paths for corporate earnings and the economy may not be smooth.

It’s possible this highly unusual COVID-19 crisis will cast a longer shadow on profits and GDP growth than market participants are currently assuming. We think there are some potential pitfalls for investors to consider regarding the time it will take for conditions to get back to normal.

Near-term earnings: Knowns and unknowns

Corporate earnings are expected to retreat sharply this year. This is well known and accepted by market participants.

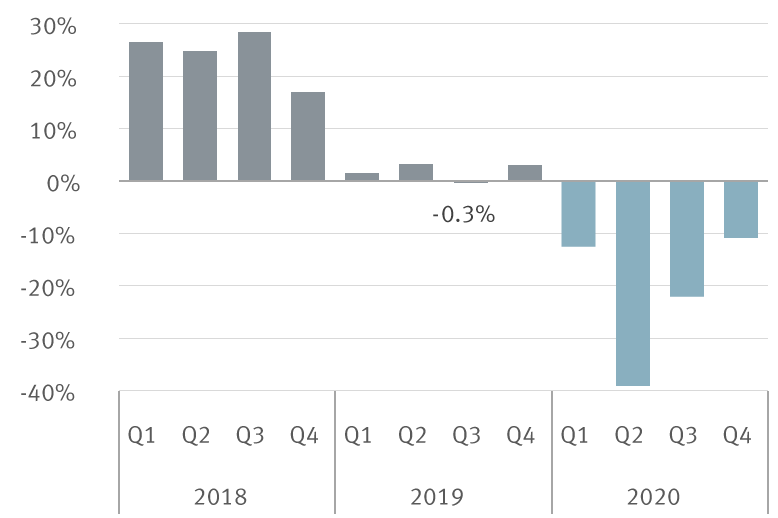

The 2020 quarter-by-quarter earnings path—with Q2 expected to be the worst—is reflected in the consensus forecast shown in the chart below, and is a reasonable estimate of how the trajectory could play out. The COVID-19 lockdowns in April throughout much of the country, and the step-by-step reopenings that we are likely to see in May and June, should make Q2 the worst-hit quarter of the year, in our view. The level of profit retrenchment should recede in the second half of the year.

S&P 500 earnings growth and forecasts by quarter

Quarterly earnings growth is compared to the same period one year prior (year-over-year)

Actual growth in gray; consensus forecasts in blue. The S&P 500 earnings growth rate will likely take the biggest hit in Q2. In our view, there is still downside risk to the 2020 consensus estimate.

Source - RBC Wealth Management, Refinitiv I/B/E/S (actual and consensus forecasts); data as of 5/4/20

Yet there are some important unknowns about the magnitude of the annual earnings decline.

First, management teams are understandably giving little direction about earnings and revenue growth for 2020 due to substantial COVID-19-related uncertainties surrounding the pace of reopening the economy, the effects of unemployment on aggregate demand, and any forthcoming COVID-19 outbreaks. By the time the Q1 earnings season ends in a few weeks, we believe only a small proportion of companies, perhaps as few as 16 percent, will have provided full-year earnings guidance. Improved clarity about the second half of the year may not come into view before the end of the Q2 reporting season in August.

Second, the process of reopening the U.S. economy (and the economies of other countries where S&P 500 multinationals generate revenues) may have a more restrictive impact on businesses than the market is assuming. Social distancing measures inside a vast array of businesses as well as the additional costs to implement new health and safety regulations might be deemed necessary from a public health standpoint, but it’s difficult to envision how they won’t constrain revenues and squeeze profit margins.

Third, a number of public health authorities are warning about the potential for a new wave of infections either as the public experiences “quarantine fatigue” or if infections pick up in the autumn and winter. Germany has already seen its daily infection rates creep higher as some quarantine measures were relaxed, and China has yet to fully stamp out the virus despite initial success.

Furthermore, the COVID-19-related rhetorical barrage leveled by the Trump administration and other elected officials against China poses risks for the market, particularly if the rhetoric goes beyond mere election-year posturing and actually leads to sanctions or tariffs, the latter of which the U.S. market struggled with in 2018.

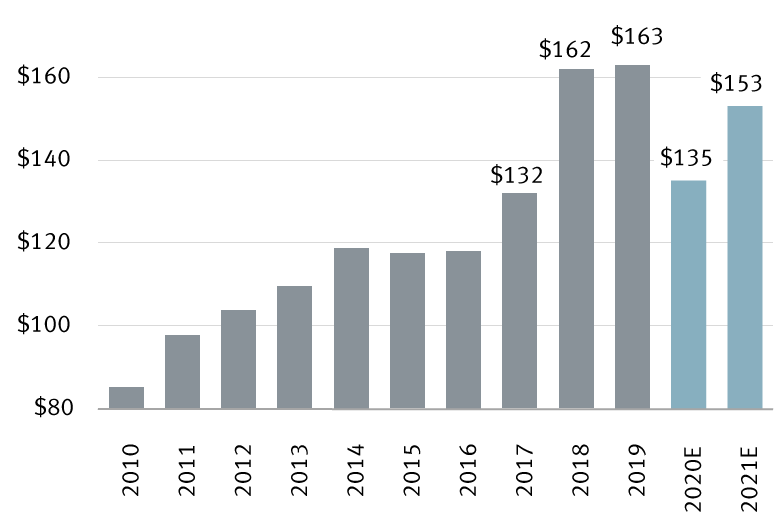

Because of these unknowns, we think there is some downside risk to the 2020 consensus earnings forecast of $131 per share for the S&P 500 and RBC Capital Markets’ forecast of $135 per share. At this stage, we’re more comfortable using a range of $125 to $135 per share.

How protracted is the path back to normal for earnings?

Regardless of how 2020 plays out, the market seems to be looking beyond that profits valley and has its eyes on an earnings recovery thereafter. This is reasonable considering stocks should be valued on a stream of future profits over multiple years, not just a few quarters.

Given the rocket-like rebound since the S&P 500’s Mar. 23 low, we think the market is priced for earnings to climb back to their pre-COVID-19 level in 2021. However, that level won’t be reached until 2022, in our view.

The consensus forecast for 2021 has come down sharply, from $197 per share at the beginning of the year to $168 due to the COVID-19 recession—as it should have. This looks closer to reality, but we believe it will likely head lower. RBC Capital Markets is penciling in $153 per share for 2021.

S&P 500 annual earnings per share and estimates

Actual earnings in gray; RBC estimates in blue

It’s unlikely S&P 500 earnings will surpass the 2019 peak until after 2021.

Source - RBC Wealth Management, RBC Capital Markets U.S. Equity Strategy, Thomson Reuters I/B/E/S; 2020–2021 data are RBC Capital Markets estimates.

We don’t rule out additional earnings downside even below RBC’s $153 forecast due to the significant economic headwinds and COVID-19 uncertainties. The S&P 500 and other major U.S. equity indexes may have to adjust further to additional downward pressure on 2021 earnings estimates.

Whether profits push beyond the 2019 level next year or in 2022, the good news is that this would be a shorter route back to normal than seen after the global financial crisis when it took four years to exceed the prior peak.

A patient path back to normal for the economy

RBC Global Asset Management Inc.’s Chief Economist Eric Lascelles believes the path toward a full economic recovery—not just in the U.S., but also in other major countries and regions—will require some patience.

He now estimates U.S. GDP growth will retreat 10.6 percent in 2020, a more severe decline than his previous estimate of minus 7.7 percent, and the deepest dive since 1946. Lascelles also revised down his estimates for Canada, the UK, the eurozone, Japan, and overall global growth.

RBC Global Asset Management’s 2020 annual GDP growth forecasts

Annual average % change according to a medium-depth and medium-length recession scenario

Dev. mkts = Developed markets; Emg. mkts. = Emerging markets.

Source - RBC Global Asset Management; estimates as of 4/27/20

His U.S. GDP forecast for 2020 is well below the Bloomberg consensus estimate of minus 4.0 percent (which, in our view, has been slow to adjust to COVID-19 realities and often lags when economic momentum shifts even in normal circumstances). Lascelles is at the very low end of the rather wide range of forecasts that make up that consensus view.

He assumes a brief peak-to-trough GDP drawdown during Q2 of 22.5 percent, which is similar to the minus 20 to 25 percent range that the OECD (Organization for Economic Cooperation and Development) is estimating.

Lascelles believes a downgrade in U.S. growth is warranted principally because the table seems set for a slow recovery once authorities start lifting quarantine measures. The path back to normal will likely take longer than just a few months.

Lingering risk aversion about the pandemic could keep a lid on demand. Lascelles anticipates there will be less pent-up demand than typically occurs after a recession, as the population cuts back on activities for safety’s sake at least until effective therapeutics or vaccines are widely available. A revival in consumer confidence is likely to await some concrete improvement in the employment (and unemployment) picture. Supply chain complications are bound to occur as the rules about reopening vary from country to country and regions within countries, and if the virus rears its head on a localized basis, forcing businesses to temporarily alter or shut down specific operations.

If Lascelles’ forecast plays out, this would mean U.S. GDP would climb back to its pre-COVID-19 peak in February 2022, not in September 2021 as in his previous estimate. With the S&P 500 down only 10 percent year to date, we think the market is expecting a shorter resolution that gets the economy back to the pre-COVID-19 level sometime in 2021.

But even with this more cautious forecast, the U.S. economy would reclaim its lost ground faster than it did after the global financial crisis. Back then it took 3.5 years, while the COVID-19 rebound is forecast to require just two years.

GDP wouldn’t reach its “full potential” (where it would have been had COVID-19 never happened and had it kept growing) until the end of 2022. This is less than three years, whereas it took a grueling nine years for the economy to reach that stage following the financial crisis.

Maintain discipline

The U.S. equity market has priced in the worst economic retrenchment since 1946 and a swift rebound in growth and profits all in the span of just two months. While we think the duration and aftermath of the COVID-19 crisis will be shorter than that traced out following the global financial crisis, there are still many twists and turns that could put the market back on its heels between now and then.

Lingering uncertainties about the depth of the earnings decline and the trajectory of the profits recovery next year and in 2022, combined with the potential bumps that could occur as the economy recovers, underpin our view that it’s prudent to hold some dry powder and keep the equity allocation in portfolios below normal at Underweight.

Non-U.S. Analyst Disclosure: Jim Allworth, an employee of RBC Wealth Management USA’s foreign affiliate RBC Dominion Securities Inc. contributed to the preparation of this publication. This individual is not registered with or qualified as a research analyst with the U.S. Financial Industry Regulatory Authority (“FINRA”) and, since he is not an associated person of RBC Wealth Management, may not be subject to FINRA Rule 2241 governing communications with subject companies, the making of public appearances, and the trading of securities in accounts held by research analysts.

In Quebec, financial planning services are provided by RBC Wealth Management Financial Services Inc. which is licensed as a financial services firm in that province. In the rest of Canada, financial planning services are available through RBC Dominion Securities Inc.