Highlights

-

The Canadian Dollar (CAD) has strengthened this year relative to the U.S. Dollar (USD), appreciating in value by +4.2% since January 1st

-

The appreciating Loonie can be more chalked up to USD weakness as opposed to CAD strength, as other currencies have appreciated much more relative to the USD

-

U.S. Dollar investments have seen a decline in their value when measured in CAD which has had a negative impact on portfolio returns in 2025

-

Strategic currency hedging and global diversification remain critical for managing portfolio risk and taking advantage of opportunities in non-Canadian markets. USD exposure has been a significant tailwind for investors for well over a decade and has boosted returns up until recently

-

Currencies are extremely difficult to forecast and over/under valuation can persist for some time. We view our non-Canadian Dollar investments as important parts of the portfolio where we can enhance return, mitigate risk and reduce volatility

We remember a time many years ago when we entered back into the U.S. equity market after having outsized exposure to Canadian investments. In late 2011 to early 2012 following the U.S. sovereign debt downgrade from its coveted AAA credit rating by Standard & Poors, U.S. large-capitalization equities were trading at very cheap valuations after having a near “lost decade” of no returns. At the same time, the CAD and the USD were trading at par with one another. Fast forward to today and strong returns have been realized in U.S. equities where the large-cap market is now trading at over 22x forward earnings – compared to the Canadian equity market trading at a discount of approximately 26.8%. U.S. equity market performance and exposure to the USD has led to enhanced returns for Canadian investors over a near 15-year time period. However, more recently, we have experienced a small reversal in this trend where the CAD has appreciated by +4.2% relative to the USD in 2025 and the weakness in the USD has translated negatively when performance results for U.S. assets are measured and reported in CAD. In this special report, we provide some perspective to the recent currency dynamics, and review how we evaluate foreign currency exposure as it relates to our portfolio construction process.

Currency Dynamics and Portfolio Performance

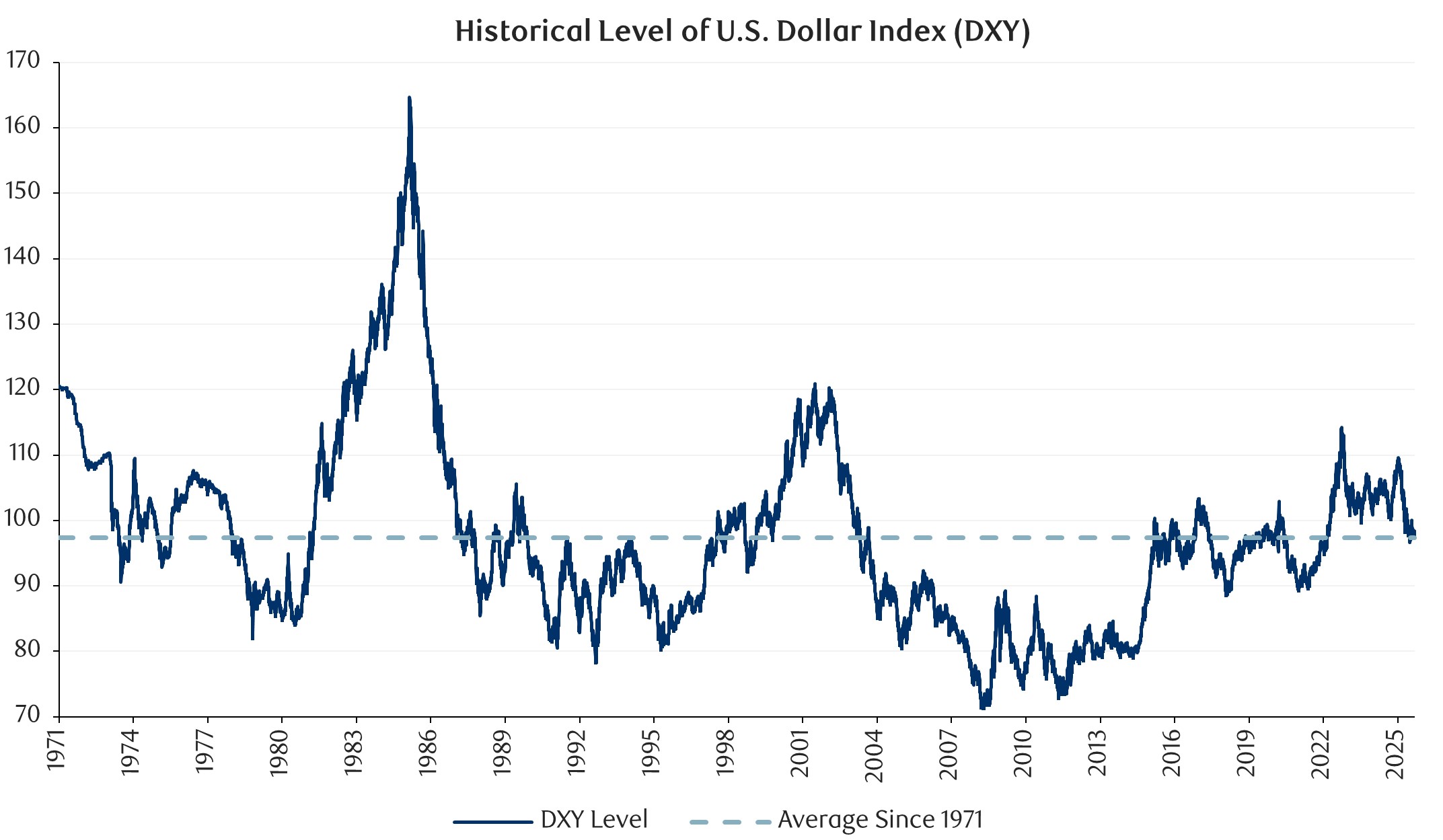

The theme of USD strength relative to all major currencies was consistent for many years until Trump entered his second term earlier this year. There is a widely followed USD index, called the DXY, which comprises six major currencies – the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and the Swiss Franc. As shown in Figure 1, we came into 2025 with the USD index trading at elevated levels not seen since the early 2000’s. The strength seen in the CAD in 2025 is not a result of strong fundamentals of the Canadian economy relative to the U.S. economy or the difference in shorter-term interest rates. In fact, all of the other major currencies that comprise the USD index (DXY) have appreciated to an even larger extent than the CAD (relative to the USD: Euro +13.6%, Japanese Yen +7.2%, British Pound +8.2%, Swedish Krona +18.4% and Swiss Franc +14.0%).

Figure 1:

Source: YCharts. Data is presented from January 4, 1971 to September 8, 2025.

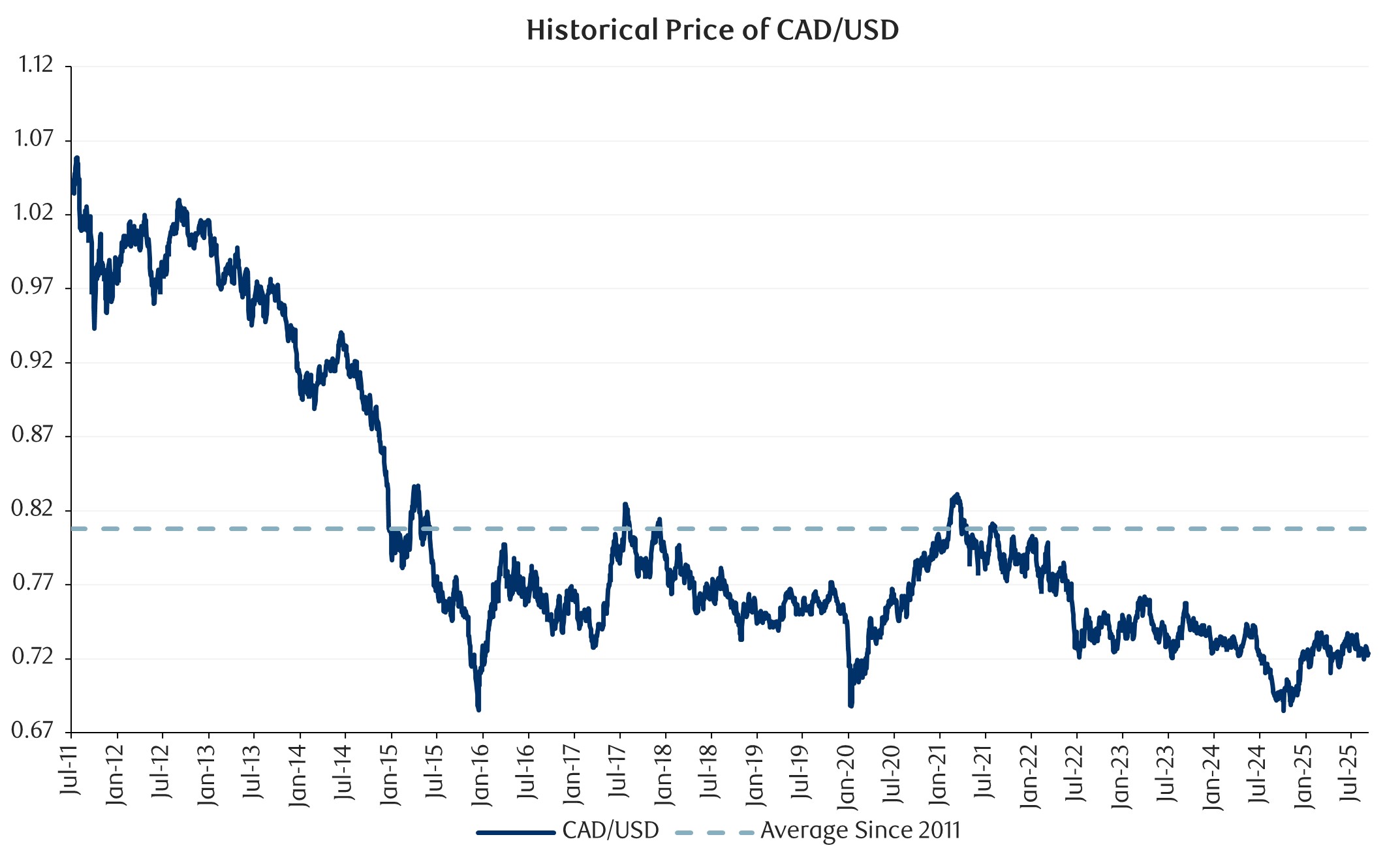

There has been a steady decline in the CAD over the last 15 years. Figure 2 shows the historical value of the CAD in relation to the USD. Shortly after the Great Financial Crisis of 2008/2009, Canada emerged as a bastion of stability as our Canadian banks weathered the credit crisis largely unscathed and Canada benefitted from strong natural resources demand from emerging countries such as China – all of which helped drive our currency higher at the time. However, over the last decade and a half, Canada’s competitiveness has diminished, and our economy has lagged other developed nations from a per-capita GDP and productivity perspective. A lack of broad-based economic growth and increased and uneconomic government spending has weighed on Canadian economic data more recently.

Figure 2:

Source: YCharts. Data is presented from July 1, 2011 to September 8, 2025.

As shown in Figure 2, the shorter-term strength of the CAD more recently has resulted in a negative currency translation for U.S. Dollar denominated investments, which has weighed on overall portfolio returns in 2025. To place an approximate number on the impact this year – if we were to assume the overall weighting in a portfolio to U.S. Dollar denominated investments was held constant at 40% throughout the year, the +4.2% appreciation in the CAD relative to the USD would have had a meaningful -1.7% adverse effect on the overall portfolio’s performance in 2025. However, it is important to keep in mind that in 2024, the CAD weakened by 8.3%, so having USD currency exposure has still led to positive returns when viewed over the last 18+ months.

Global Diversification and Risk Management

Investing outside of Canada is a deliberate strategy to enhance returns, gain exposure to different sectors, and diversify risk. U.S. equities represent roughly 65% of the global market capitalization compared to Canada’s less than 3%. The U.S. equity market also provides increased access to leading sectors such as technology (bolstered by AI advancements), pharmaceuticals, and global consumer brands not available in Canada. Additionally, non-Canadian markets offer differentiated investment opportunities in alternative assets like private equity, private credit, and infrastructure, managed by sophisticated global investment firms.

In addition to the return enhancements and complementary investments that may exist as noted above, investing outside of Canada also requires consideration of the foreign currency. Unless there is a specific need or individual preference to own foreign currency such as the USD, like our snowbird families who winter in the southern U.S. or Mexico, we strongly believe actively hedging some of the investment portfolio (particularly within fixed income investments) is appropriate. U.S. and European credit markets provide a broader and deeper investable universe that provides industry diversification beyond financial institutions, energy, and telecommunication issuers that form most of Canada’s corporate bond market. When we invest further down in the credit quality spectrum into high yield and private credit, the currency exposure we retain will vary at times and we generally have dual investment structures that allow us to hedge or accept the currency risk of these investments. Lastly, with riskier assets such as public equities and alternative investments like private equity, assuming the currency risk of the securities that comprise this part of the portfolio has historically provided added benefits – as traditionally the USD exposure has mitigated risk in times of market volatility.

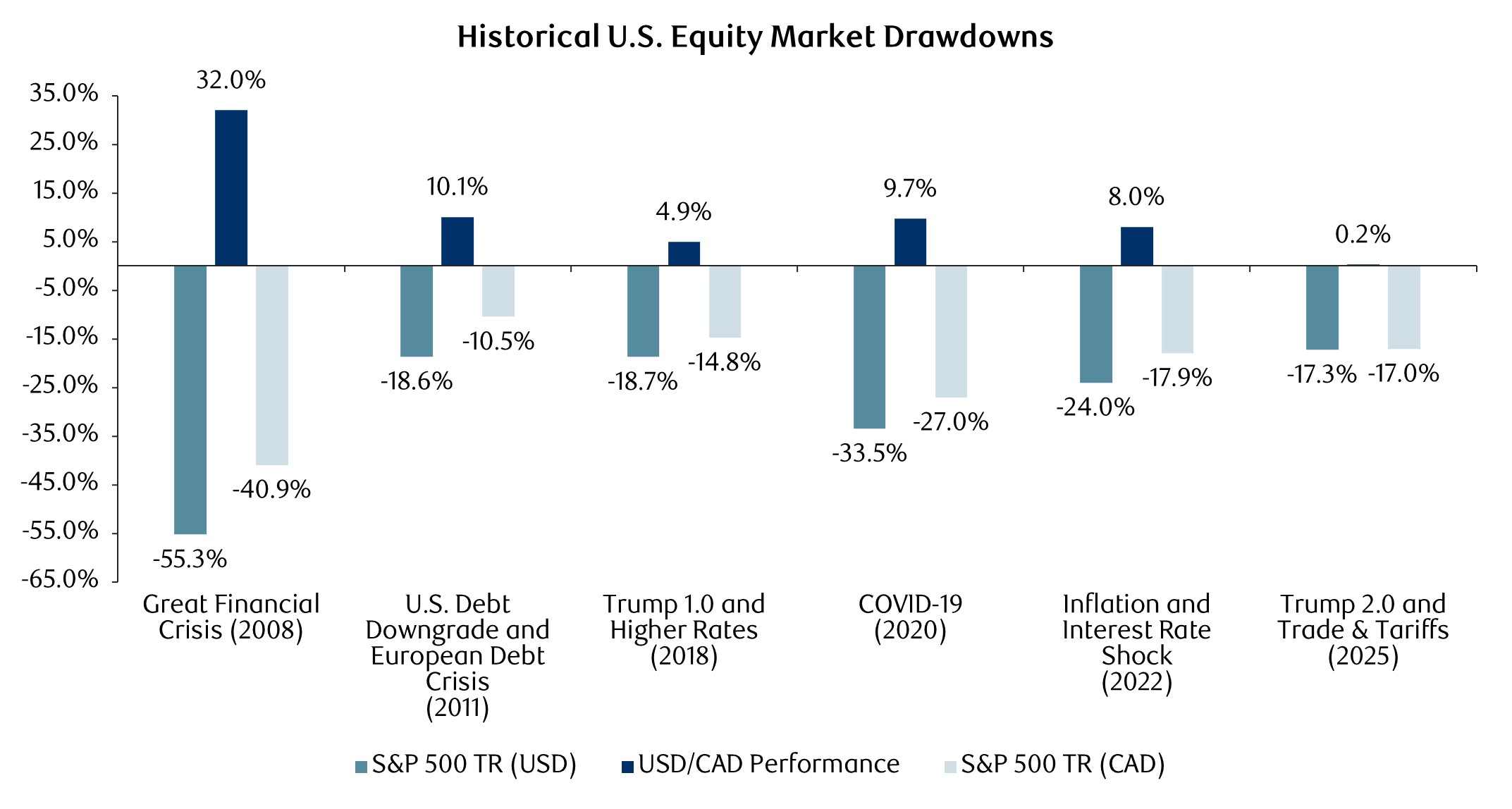

Figure 3 quantifies the USD’s historical role in mitigating drawdowns. In all six periods, USD appreciation reduced losses for Canadian investors by an average of 10.8%, with only the 2025 tariff-related event showing minimal protection. Theories for this anomaly in 2025 include concerns over growing U.S. debt and foreign investors hedging USD positions.

Figure 3:

Source: YCharts.

Conclusion

The strength of the CAD has had a negative impact on portfolio returns in 2025 however has been a positive contributor to results over the last several years. Despite recent currency headwinds, we continue to actively assess the currency dynamics that exist.

The following is a short list of factors that we are watching that could have an impact on the near-term direction of the CAD/USD:

- The tariff situation between Canada and the U.S. remains fluid with the USMCA agreement still to be ratified

- While the Bank of Canada has cut rates aggressively, the U.S. Federal Reserve has been slower as inflation has proven to be stickier. We are keeping a watchful eye on the employment and hard economic data to assess whether there is a deterioration in the economy, which may lead to a response and interest rate cut(s) from the U.S. – beginning as early as this month

- Geopolitical tensions are always difficult to predict, yet the USD generally strengthens during periods of exogenous shocks

Forecasting currencies is an extremely challenging exercise, though we strongly believe our thoughtful approach and use hedging strategies where appropriate can help reduce risk while also providing reliable returns across our portfolios.