Navigating Uncertainty and Exploring Global Opportunities

Highlights

- We entered the year with the U.S. economy on solid footing, supported by strong household and corporate balance sheets

- In response to early tariff actions, we proactively reduced equity exposure and shifted to a more defensive posture

- The escalation of tariffs in April triggered sharp volatility across asset classes and led to a swift repricing of equity valuations

- While recent policy signals have helped calm markets, ongoing uncertainty continues to pose risks to near-term economic growth

- Amid significant outflows from U.S. equities, we are emphasizing greater geographic diversification and evaluating increased exposure to non-North American businesses

- Despite the turbulence, history shows that staying invested through disciplined portfolio construction remains the most reliable path to long-term success

Global Trade, Economic and Market Developments

The U.S. economy expanded +2.8% in 2024 (annual GDP growth rate) – entering calendar year 2025 with positive momentum. Despite strong U.S. household and corporate balance sheets, investors remained wary amid ongoing global economic and trade uncertainties. In response to President Trump’s imposition of tariffs on Canada and Mexico in early March, we proactively reduced risk, lowered equity exposure, and adopted a more defensive posture.

In early April, President Trump and the Republican administration announced reciprocal tariffs on over 100 trade partners, prompting a material increase in volatility across major asset classes. Equity valuations quickly adjusted lower, pricing in a growth scare scenario—similar to market reactions seen in 2010, 2011, and 2018—rather than a full-blown recession. During growth scares, a range of economic indicators usually soften and recession fears rise, but an economic hard landing (recession) does not materialize. Growth scares happen when economic data becomes weaker, and the market becomes concerned that central bank policy is not properly calibrated, or that unexpected factors (such as tariffs) will negatively influence economic health and market performance. Current concerns for market participants include the potential for a slowdown in business activity, capital investment (including reduced capital expenditure, less mergers and acquisitions activity, deferring growth and expansion opportunities) and global supply-chain challenges. Following an announcement from President Trump of a 90-day tariff pause and a more measured communication from Treasury Secretary Bessent, capital markets have begun to show some signs of stabilization. Although the doors are now open for negotiation, it seems likely that global trade relationships with the U.S. will involve a higher level of effective tariffs moving forward than they have in recent history.

When evaluating trade policies, including imports, exports, and other value added tax; reciprocal tariffs are meant to equalize trade. The U.S. has run annual trade deficits for the last 25 years. Not only has this benefitted the global economy, but this concept (known as globalization) has allowed for strong global economic growth and has resulted in only moderate levels of inflation in the developed world. The specialization of manufacturing and service capabilities amongst individual countries leads to distinct comparative advantages – including inexpensive and highly skilled labour, greater access to specific resources, and highly efficient production.

We recently had a private meeting with Howard Marks, Co-Founder of Oaktree Capital - a leading private credit and distressed debt investment manager. Howard shared a basic example of the merits of globalization, stating: we are all better off because Italy makes the pasta and Switzerland makes the watches - but if trade barriers were to require Italy to make their own watches and Switzerland to make their own pasta, the citizens in both countries would probably end up paying more for products they used to buy cheaper from abroad, or consuming inferior products made locally, or both.

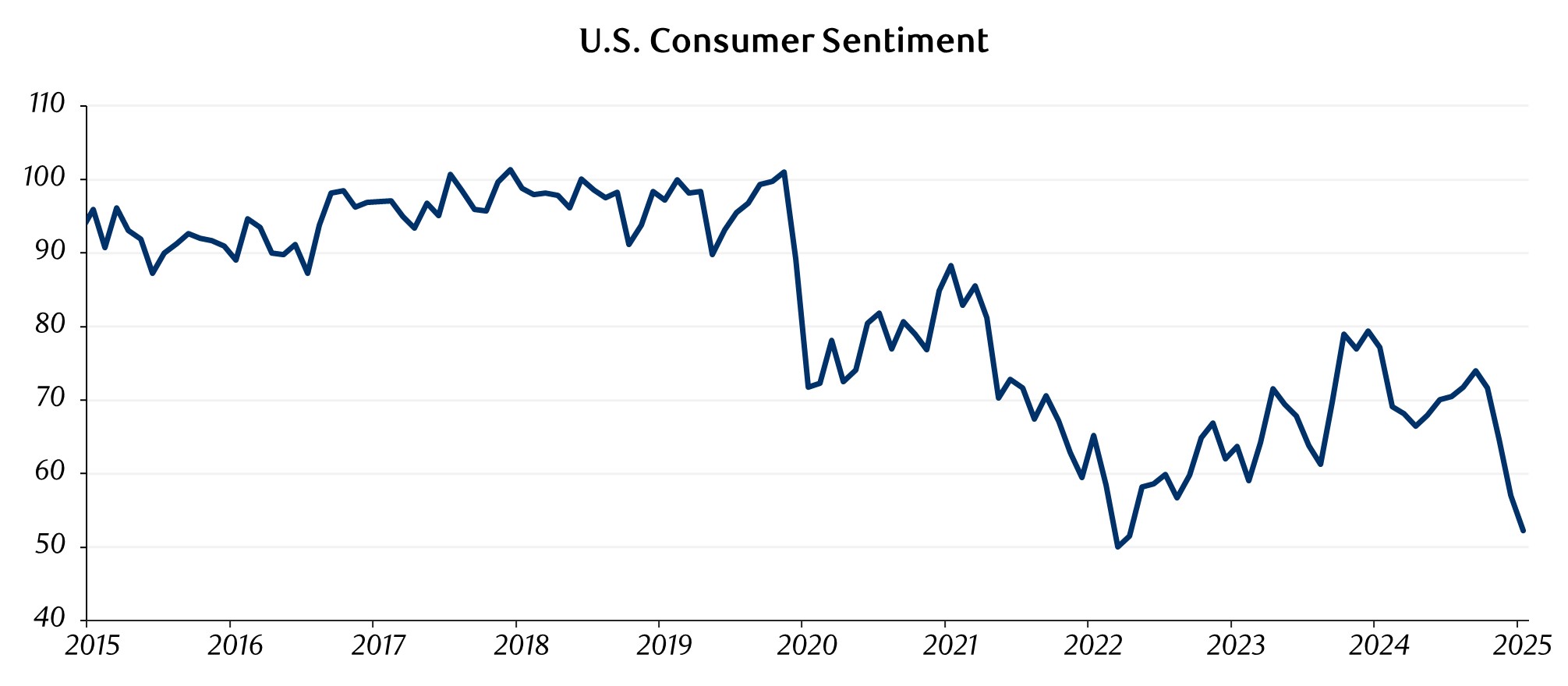

Recent developments in global trade continue to shape a dynamic and complex landscape. Today, policy uncertainty persists, and economic growth may face headwinds in the quarters ahead. Central banks are now navigating a delicate balance between supporting growth and managing inflation. While survey-based indicators have deteriorated sharply, hard economic data and early Q1 earnings reports remain relatively resilient. CEO guidance, however, has been broadly cautious since the start of the year. Figure 1 and 2 show U.S. consumer and CEO sentiment levels based on current surveys.

Figure 1

Source: Ascendant Wealth Partners, The Index of Consumer Sentiment – University of Michigan. Data presented as of April 2025.

Figure 2

Source: Ascendant Wealth Partners, CEO Confidence Index – ChiefExecutive. Data represents U.S. CEO Forecast of Business Conditions (12-Months out) presented as of March 31st, 2025.

We are vigilantly monitoring real time data, including indicators such as: retail sales, jobless claims, credit card and auto loan delinquency levels, and monthly credit card spending momentum, to help assess the correlation between weak survey sentiment with actual spending trends and the overall health of the U.S. consumer. One leading aggregate indicator measuring the health of the U.S. economy is the Weekly Economic Index (WEI), which historically has been a strong predictive signal of the pulse and state of the U.S. economy. It represents the common component of 10 different daily and weekly indicators (e.g., retail sales, jobless claims, steel production) covering consumer behaviour, the labour market and production. As of April 30th, at a level of 2.3 (compared with 1.8 approximately 1 year earlier) the WEI suggests that the U.S. economy is in good standing. Figure 3 illustrates the actual growth of the U.S. economy (annualized GDP) and the basket of inputs of the Weekly Economic Index (WEI).

Figure 3

Source: Ascendant Wealth Partners, Federal Reserve Bank of Dallas, Federal Reserve Bank of St. Louis. Presented as of March 31st, 2025 (Q4 GDP Growth) and April 30th, 2025 (Weekly Economic Index).

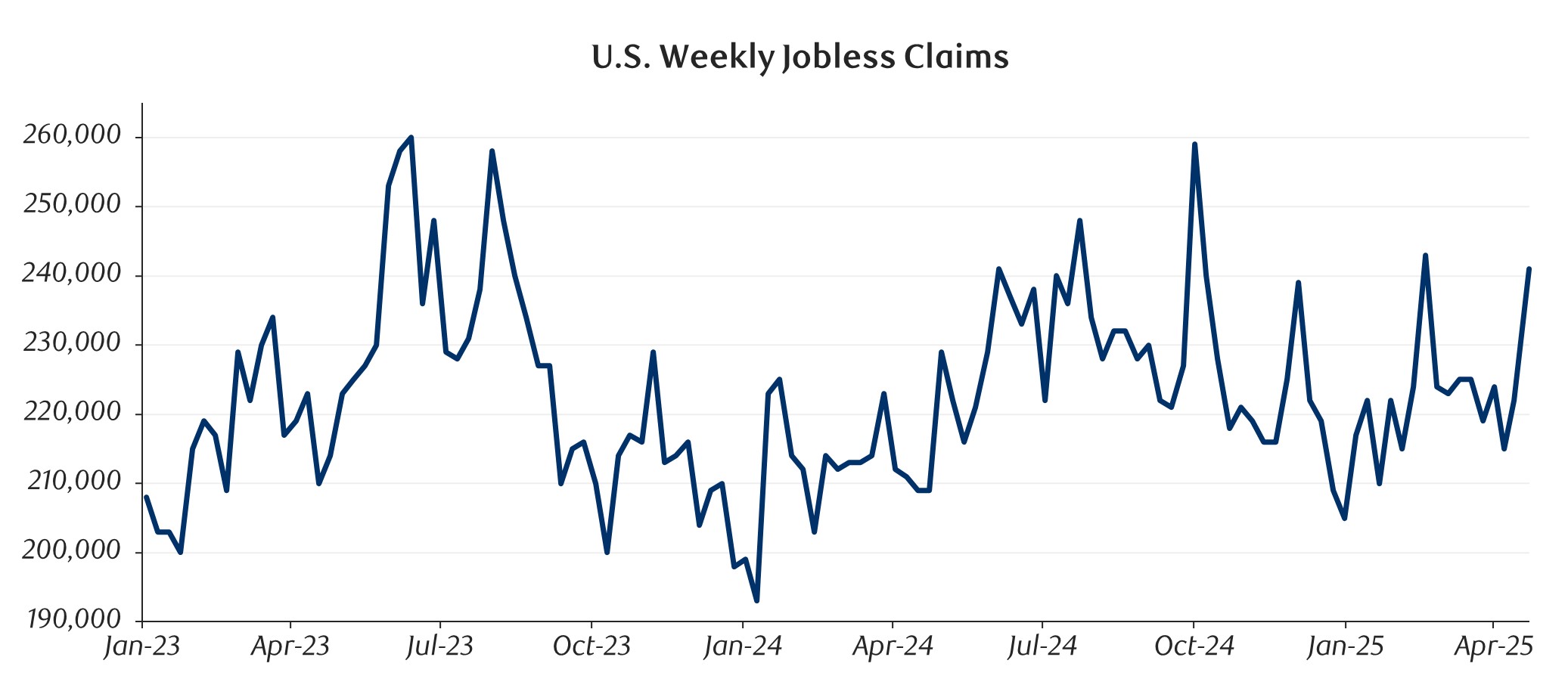

Another statistic often considered a key indicator of economic health is the weekly trend in jobless claims. Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time since the prior week. As illustrated in Figure 4, U.S. weekly jobless claims are holding steady.

Figure 4

Source: Ascendant Wealth Partners, Federal Reserve Bank of St. Louis. Presented as of April 26th, 2025.

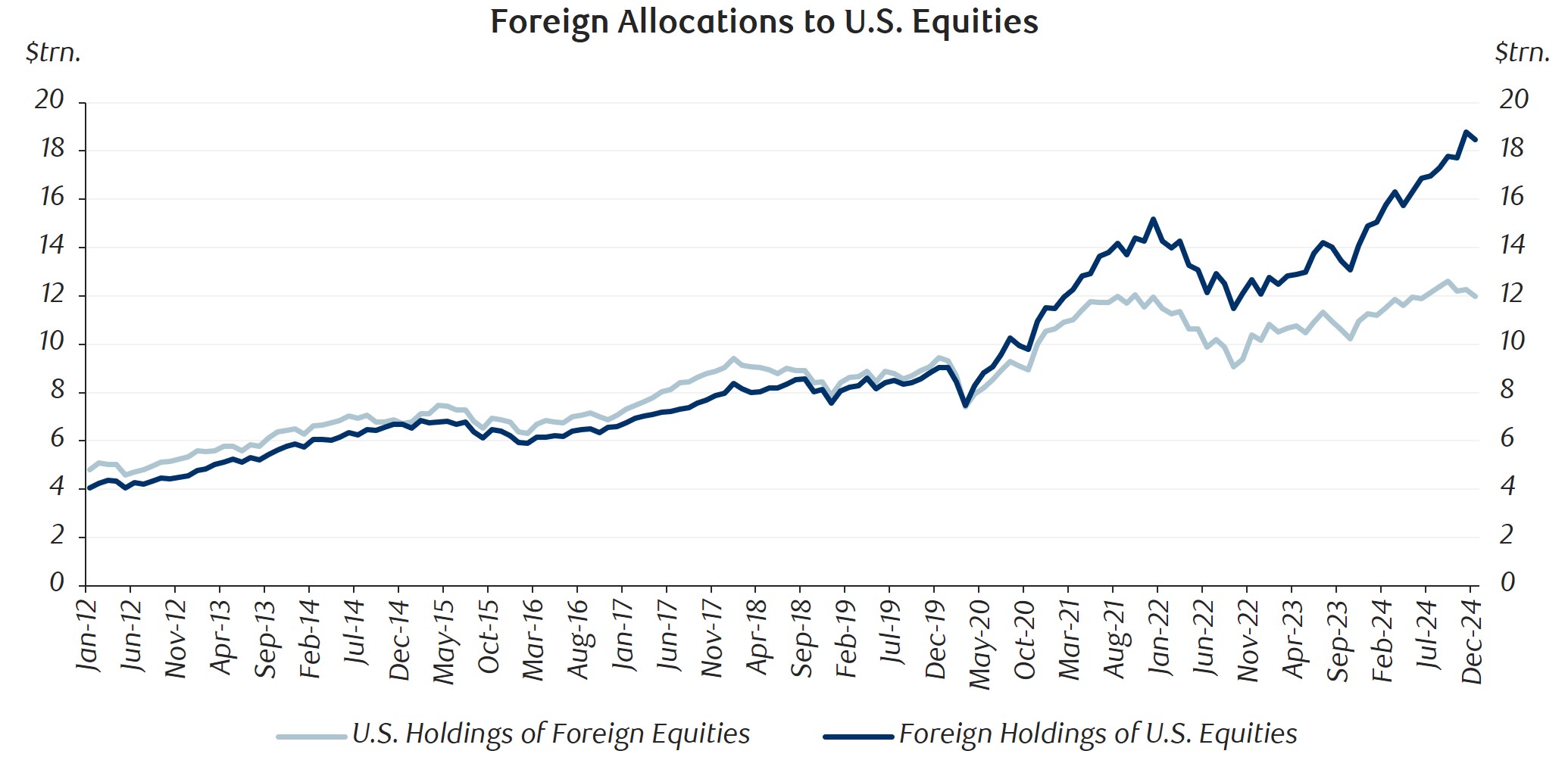

International equity markets have shown resilience. In Europe, trade tensions with the United States have prompted action. The potential for a new fiscal package was announced in Germany, consisting of defence spending, a EUR 500bn infrastructure fund, and an increase in the allowable structural deficit. Investors have reacted positively as attractive valuations, accommodative monetary policy, and strong projected earnings growth support a constructive outlook on German equities, which is likely to support economic growth. The use of stimulus packages (both fiscal and monetary) will be an important factor for near-term performance in other global economies as policy makers navigate challenging conditions. Figure 5 illustrates equity valuation levels for different regions around the world. International equities appear attractive when compared to current valuations in the U.S. and Canada, trading in-line with their 20-year median levels. Foreign allocations to U.S. equities have significantly outpaced the U.S. allocation to foreign equities. Figure 6 illustrates this trend, with a sharp acceleration post-2020.

Figure 5

Source: Ascendant Wealth Partners, FactSet. Data presented as of April 30th, 2025.

Shaded bars highlight the maximum and minimum price/earnings ratio over the 20-year period shown.

Figure 6

Source: Ascendant Wealth Partners, Board of Governors of the Federal Reserve System, International Portfolio Investment Holdings of Long-Term Securities by Country. Data presented as of December 31st, 2024.

Many of the trends supporting a global rotation into U.S. equities, such as the dominance of U.S. technology, persistent U.S. dollar and consumer strength, and relative market resilience - collectively considered “U.S. exceptionalism” - are expected by many market participants to soften on the back of recent policy changes. Weakness in factors contributing to U.S. exceptionalism (either expected or actual) have the potential to materially change the direction of capital allocation trends. In light of heightened uncertainty and notable recent outflows from U.S. equities, we are placing a renewed emphasis on geographic diversification in our portfolio construction process. We are actively evaluating opportunities to increase exposure to high-quality, non-North American businesses.

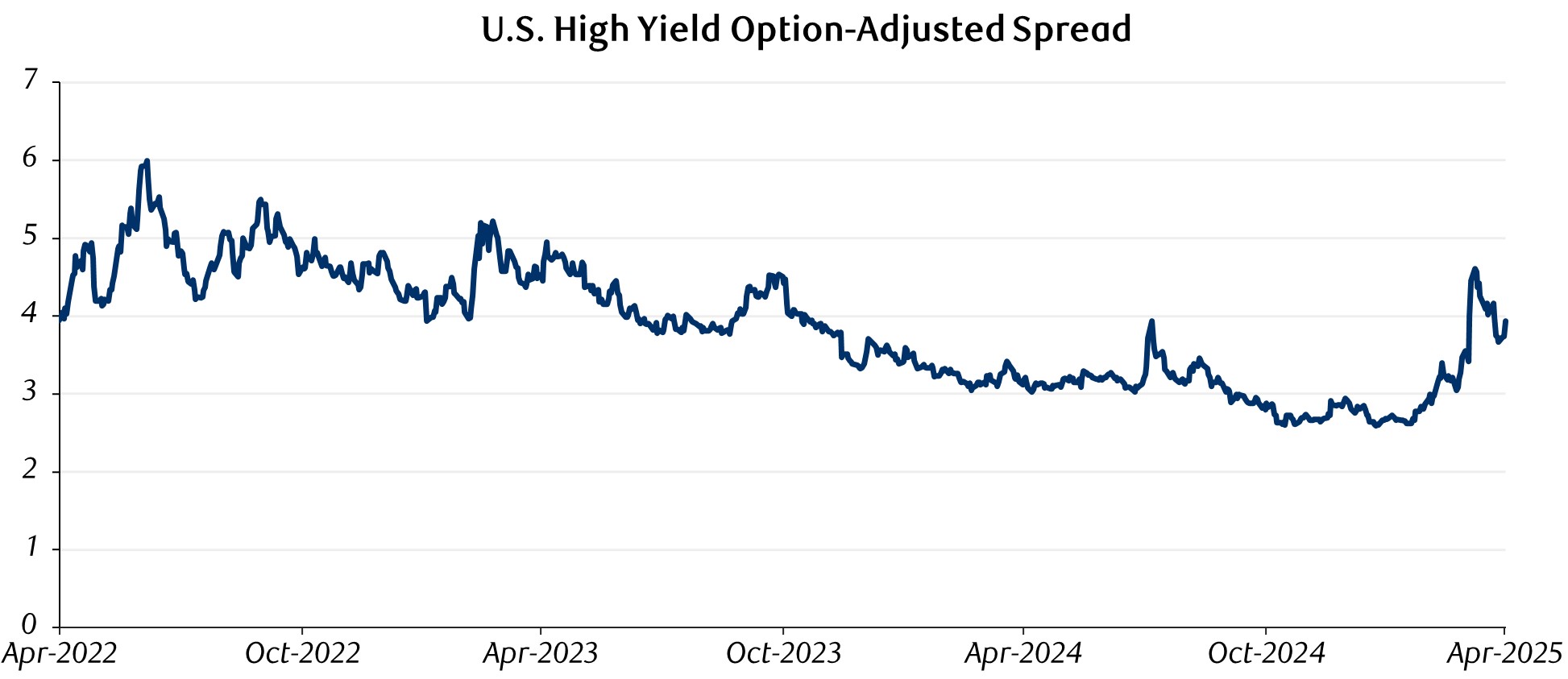

Corporate credit remains broadly supported by healthy corporate balance sheets and sustained income demand by investors. However, even with the recent widening of credit spreads, the additional compensation investors receive for taking on credit risk is modest by historical standards, as illustrated in Figure 7. Given ongoing economic and trade policy uncertainties, it is not surprising that default risk has risen, with certain sectors — such as consumer goods, telecom, and healthcare — appearing more vulnerable. We believe an active investment approach to credit investing, particularly within sub-investment-grade asset classes, is paramount in this environment.

Figure 7

Source: Ascendant Wealth Partners,YCharts. Data presented as of April 30th, 2025.

Time, Diversification and Staying Committed

“Financial success is not a hard science, it’s a soft skill, where how you behave is more important than what you know.” – Morgan Housel (The Psychology of Money)

Markets have weathered numerous challenges over time, but history shows that disciplined portfolio management and staying committed to a well-devised investment plan remain key to long-term success. While we understand that remaining focused on a long-term plan can be particularly difficult during periods of market volatility, research shows reacting and making decisions based on emotions can be counterproductive to your established investment objectives.

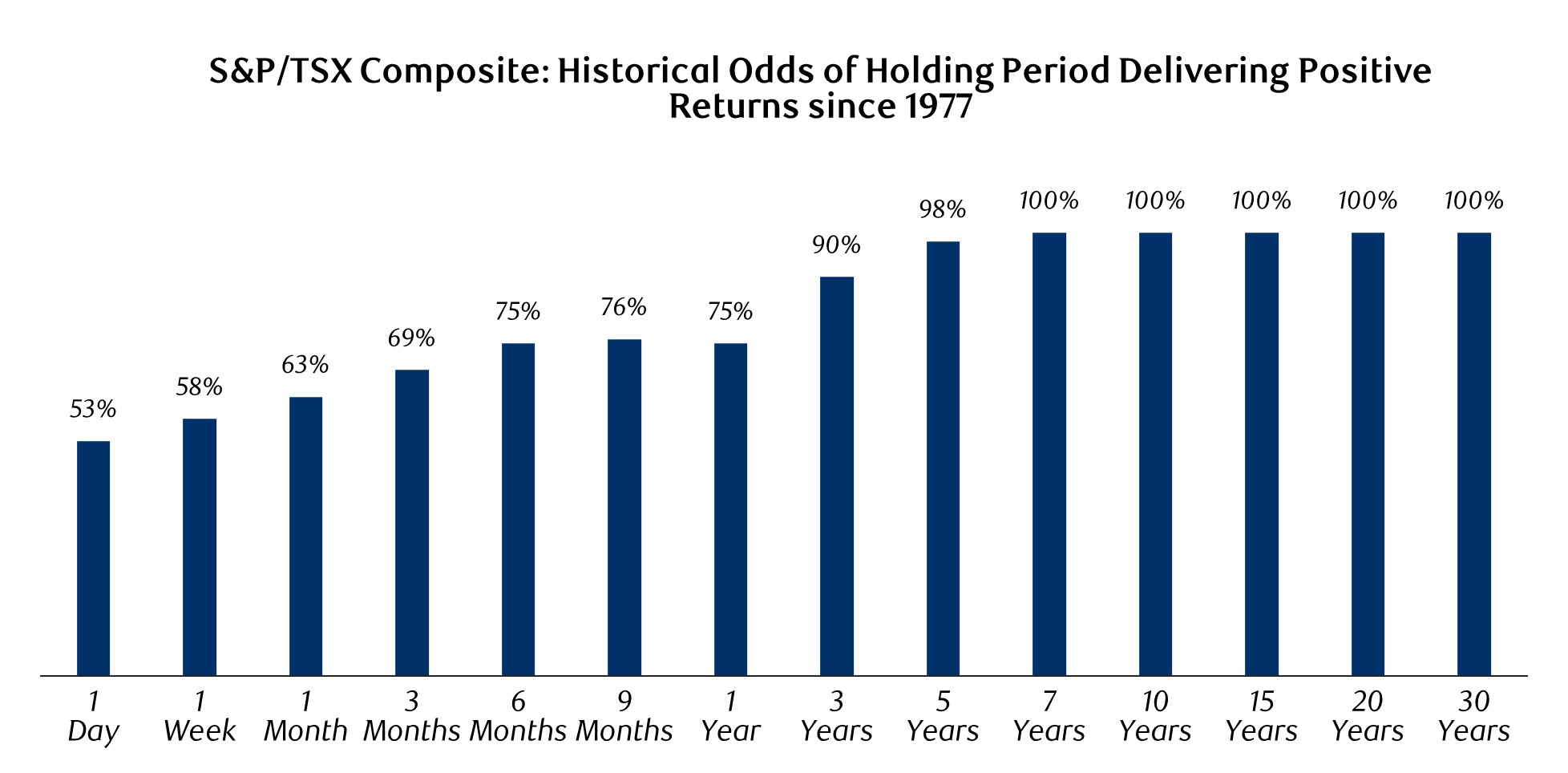

A long-term plan allows investments to compound, smoothing the impacts of market volatility, and maximizes growth potential over time. Figure 8 shows an illustration of the historical probabilities an investor had of earning a positive return in the Canadian Stock Market (S&P/TSX Composite Index) since 1977 – based on various holding periods.

Figure 8

Source: Ascendant Wealth Partners, RBC Wealth Management, FactSet. Data presented for returns of the S&P/TSX Composite Index as from 1977 to February 28th, 2025.

This example shows that a longer investment period is correlated with higher odds of earning a positive return. Notably, based on a 7-year holding period (or longer), the investor had 100% odds of earning a positive return.

In addition to the benefits of a long-term mindset, plan, and time horizon – we believe in the benefits offered from a disciplined portfolio management approach. While the appropriate approach can differ based on each individual investor’s circumstances – diversification is often a good place to start. For many clients, we have constructed well-diversified, multi-asset portfolios which offer benefits through ownership of assets with low correlation. In particular, the inclusion of bonds and alternative investments in portfolios have helped provide a cushion during recent market volatility. Figure 9 shows historical returns by holding period for stocks, bonds and a (hypothetical) balanced 60/40 portfolio, rebalanced annually, over different time horizons. The bars show the highest and lowest returns experienced during each time period (1-year, 5-year rolling, 10-year rolling and 20-year rolling) highlighting the benefits that diversification can provide.

Figure 9

Source: Ascendant Wealth Partners, J.P. Morgan Asset Management. Data presented as of March 31st, 2025.

Returns shown are based on calendar year returns from 1950 to 2024. Bonds represent Strategas/Ibbotson for periods prior to 1976 and the Bloomberg Aggregate thereafter. Growth of $100,000 is based on annual average total returns from 1950 to 2024.

Closing Thoughts

As the U.S. government continues to horse-trade on individual trade deals with the countries targeted by reciprocal tariffs, there are a few takeaways:

- Tariffs are not going away – we expect a new world order with higher tariff rates unseen in decades. Globalization is expected to slowly move towards more isolationism as countries form new trading alliances focused on nationalistic strategies – Canada included

- Uncertainty remains and extended trade tensions are expected to cause an economic toll. Current data indicates a resilient global economy, with earnings releases showing fundamental growth

- Trump tariffs, and the ensuing economic weakness, are in many ways self-inflicted. The worse the market reacts, and the more the economy slows, the more likely that Trump will adjust course accordingly - a single tweet could change market tone and direction very quickly

- An emphasis on diversification and the inclusion of uncorrelated assets (such as bonds and alternative investments) will act as a complement to equities – leading to attractive risk/return attributes for the overall portfolio

As Mark Twain famously said, “History doesn’t repeat itself, but it often rhymes” – and while some factors influencing today’s market environment differ from previous cycles, volatility is a commonality. Historically, volatile market conditions have created compelling investment opportunities. At Ascendant Wealth Partners, we continue to monitor economic and market developments closely - adjusting portfolios as conditions change.

Thank you for your continued confidence, trust and support.