Unique Opportunity for Those Hoarding Cash & GIC’s

Your Liquid & Tax Friendly Alternative to GICs: Bonds….Discount Bonds

By: Marc Morais

James is a successful business owner who has accumulated plenty of cash & GIC’s in his holding company from his “consulting” work. He’s a conservative investor who may be looking to use his funds to purchase a helicopter in the next year or two and would like fixed income investments instead of equities.

The rapid interest rate hikes we’ve experienced over the past 18 months have provided a unique opportunity for James.

Where traditional retail investors are looking: GICs

PROS:

(+) Interest rates have risen, and you can now find GICs offering over 5%

(+) GICs are insured by Canadian Deposit insurance Corporation (CDIC) on the first $100,000/issuer

CONS:

(-) GICs generate interest income which is 100% taxable at your marginal tax rate

(-) With GICs you will often face liquidity issues, it can be challenging to recoup your principal and interest if you don’t hold the GIC to maturity

(-) With current inflation levels you are forfeiting your current purchasing power when factoring in GIC interest rate and tax payable.

Where savvy high income earners & corporations are looking: DISCOUNT BONDS

PROS:

(+) Tax Friendly: A bond trading at a discount will have a significant portion of the investment return as a capital gain which attracts 50% less tax as the interest income earned in a GIC

(+) Liquid: The bond market is much larger than the stock market which makes it easy to turn your high-quality bonds into cash when/if needed

(+) Rates/Yield to maturity: With the quick climb in rates, more bonds than ever are trading at a discount offering a yield to maturity/return in line with GICs

(+) Time Horizon: Flexible options for short term, medium term, or long term based on need.

(+ and -) Market Value Fluctuation: If you sell a bond prior to maturity your return is not guaranteed by the issuer. Instead, your return will be determined by the current interest rate environment. If rates have risen, your return is likely to be less. If rates have fallen, your return is likely to be higher. *Moving forward, RBC expects interest rates to come down*

(-) Unlike the first $100,000 of a GIC purchase, bonds are not covered by CDIC insurance but guaranteed by the government or corporation issuing the bond

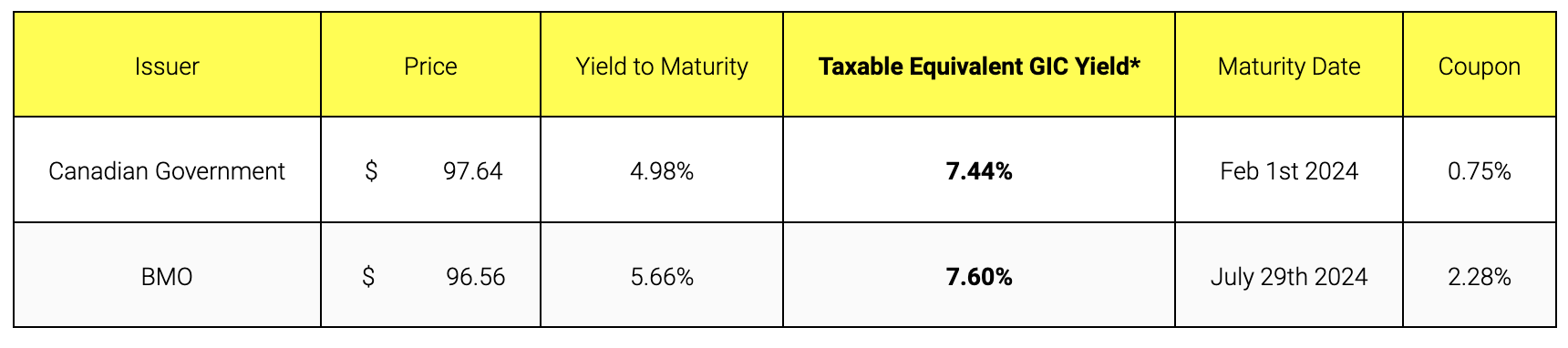

Two sample bonds available for sale on July 4, 2023:

The two bonds above that will mature @ $100.

A Canadian Government bond that pays a 0.75% coupon of interest on $100 plus the capital gain from $97.64 to $100.

A Bank of Montreal bond that pays 2.28% coupon of interest plus the capital gain from $96.56 to $100.

Simply put: *An Ontario resident in the highest income tax bracket would need a GIC paying 7.44% or 7.66% of interest to achieve the same net after tax return as the bonds above. Today the average GIC is paying approximately 5.30% for a one-year term.

James understands that what you get to keep (net) is more important than what you earn (gross) and opts for a portfolio of discount bonds instead of GIC’s.

Please be sure to discuss any investment decisions with your qualified Investment/Wealth Advisor.

Marc