The influences of inflation are widespread, from household cash flows and consumer spending patterns to expectations for equity market performance and long term interest rate forecasts. Inflation is the result of supply constraints, such as labour, raw materials and finished products, that cause prices to be bid higher, eventually getting passed on to the end user. Rising inflation is deemed to be negative for these things – cash flows get squeezed, spending gets trimmed, and growth rates for corporations decline. Ultimately, interest rates rise as central banks attempt to contain the increase in prices and maintain stability in their economies. These dynamics are all part of a normal market cycle.

For many years, and certainly over the past 15 months during the Covid-19 pandemic, inflation has not been a consideration when setting expectations and forecasts. Publicly, central banks have stated their intentions of getting inflation rates to 2.0%, but with little success. Despite extremely accommodative policies and historically low interest rates, inflation pressures have yet to be a threat.

Change is afoot.

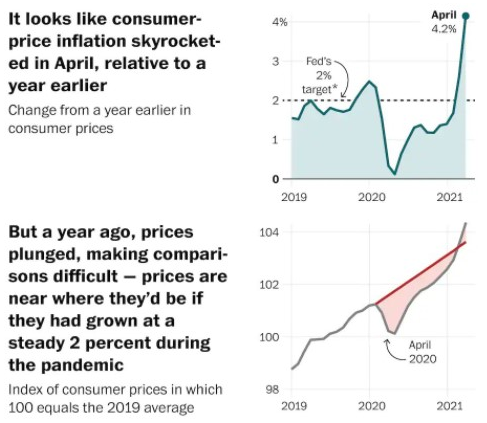

Canada’s inflation rate for April, as measured by the Consumer Price Index (CPI), at 3.4%, has just posted its highest year-over-year increase in 10 years. This compares with 2.2% in March, and exceeds the 3.2% consensus prediction from economists. The core CPI figure, which strips out some of the more volatile factors such as food and energy, measured 2.1% for April, the highest since 2012. The trend for the U.S. figures were no different. U.S. CPI rose by 4.2% from one year ago, the highest increase in year-over-year gains since 2008. And core CPI rose by 3.0%, also well above expectations.

Source: https://awealthofcommonsense.com/2021/05/animal-spirits-a-shortage-of-everything/

There are two differing arguments for where we go from here. The first is that we are entering a period of ‘transitory’ inflation, but the long-term risks of higher inflation, and therefore higher interest rates, remain minimal. I stand in this camp for the following reasons.

The year-over-year increase in pricing pressures are based from a period last March and April when global economies were essentially closed for business and inflations was particularly weak. These ‘base effects’ will continue to bias year-over-year comparisons for another several months, if not through the remainder of the year.

Source: https://awealthofcommonsense.com/2021/05/animal-spirits-a-shortage-of-everything/

Recent supply chain challenges are a dynamic that influence inflation measures and may continue to produce a false of direction for inflation. This is evident in such things as the semiconductor and chip sector, automobiles, lumber, and recreational goods. While some of the price increase is a result of increased demand, broken supply chains during the pandemic and the resulting lack of inventories has had a greater influence on inflation. Higher expenses to maintain and attract workers, costs associated with new workplace protocols and safety measures, and increased costs to get products to end markets have all contributed to prices getting pushed on to consumers. There are several commodities that have shown material price increases as well, including copper, iron ore, steel and many of the specialty input metals required for battery production. I expect these supply chain challenges to subside over the coming 12-18 months. Manufacturing sector efficiencies, transportation capabilities, and the eventual return of a robust and motivated workforce will inevitably restore balance to both domestic and global markets.

Lastly, our economies have changed from an old assembly line base, as has the nature of the workforce. The assets of corporations have historically been measured by their plants and equipment, and higher demand required time to produce more from additional plant and equipment investments. Much more of today’s economies are made up of intangible assets, such as software, patents and trademarks, brand equity, databases and even vaccines. An increase in demand requires far less investment and spending, and therefore price increases are less common. A more flexible and mobile workforce has a similar effect of preventing a sustained inflation of prices. The modern worker, with employment growing in the gig economy, is expected to gravitate easily to sectors requiring increased production. The recent reports of rising job openings and some sectors having difficulty filling roles should be short lived and don’t yet appear to be driving pricing pressures. These employment reports have also been distorted by extended government aid leaving some of the workforce less incentivized to rush back to work.

The opposing view of the recent rise in inflation pressures argues that these prices will continue to rise for longer periods. This will inevitably create a slowdown in economic growth due to higher interest rates and reduced consumer spending. The end result will be muted equity market performance and a decline in the value of current fixed income assets.

Overall, the inflation that investors were anticipating appears to have arrived. The next several months are expected to be noisy, but we will have to wait to see whether it becomes something of greater concern, or whether the year-over-year comparisons become less distorted and some of the supply chain challenges become less pronounced. We expect to continue to monitor it as we move through the rest of this year.