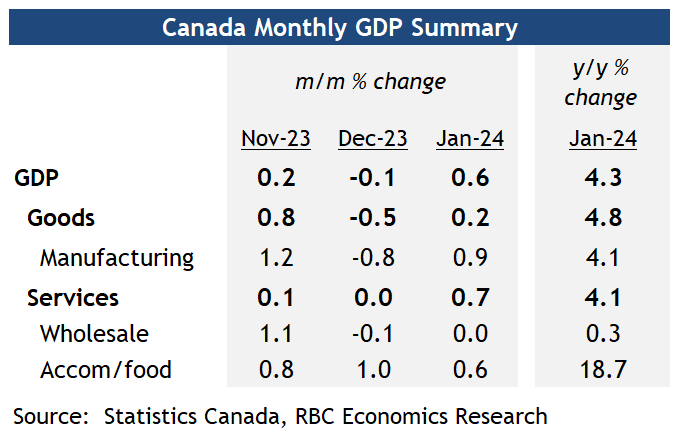

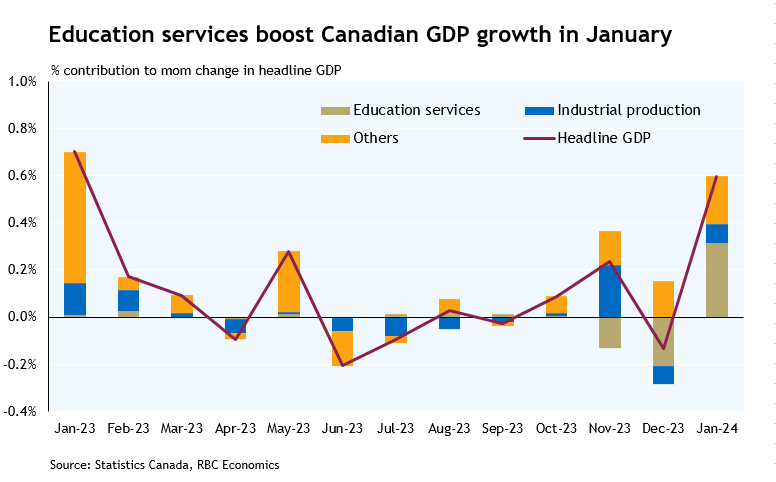

- Canadian GDP rose by 0.6% in January led by a 6% increase in educational services, as public sector workers (mostly teachers) in Quebec return to work after being on strike in November and December. Excluding impact from education services, GDP grew by 0.3%.

- The advance estimate from Statistics Canada was for another large 0.4% rise in GDP in February, with the gain being “broad-based”. These estimates have been highly revision-prone, but still suggests considerable upside risk to our tracking of +0.3% quarter-over-quarter annualized increase in Q1.

- Back to January, goods-producing sectors saw output grow by 0.2%. Increases in manufacturing (+0.9%) and utilities sectors (+3.2%) were offset by contractions in oil and gas extraction (-4.4%). A lot of the monthly volatility was driven by weather related factors - cold weather boosted utilities sector output but lowered oil production and rail transportation in the Prairies.

- All services-producing sectors saw output grow in January. Activities for real estate and rental and leasing rose 0.4% upon higher resale activities in the same month.

- Bottom line: Canadian GDP readings over early 2024 have been substantially stronger than expected, although partially driven by one-off factors such as the ending of the Quebec teachers’ strike that are unlikely to sustain growth in the coming months. Nonetheless, another solid advance monthly reading for February would leave the quarterly GDP tracking at above 3% (annualized), higher than our current tracking of +0.3%. We’ve learned to take the advance estimates with a grain of salt as they have been highly revision prone. Labour market conditions also continue to weaken into early 2024 as the unemployment rate edge higher, and separately reported job vacancies for January from this morning continued to decline. All told, we retain our assessment that the economic backdrop remains weak, and continue to look for the Bank of Canada to start cutting interest rates in June.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.