As we head into the fall and reflect on an incredible year for equities in the rear-view mirror, below is an update on a few of the key principles that our team continuously implements as part of the RBC Private Investment Management (PIM) discretionary wealth management program:

Rebalancing

Maintaining the strategic (long-term) asset mix of each account is important, and rebalancing quarterly is a minimum. In volatile markets such as 2022, we were rebalancing more frequently to ensure we maintained our strategic (long-term) asset allocation. This benefited our portfolios in 2023-2024 as equities rebounded substantially.

Conversely, US equities as measured by the S&P 500 are up over +18% in 2024. We've used this strength to diversify a portion of our large-cap technology stock exposure that has led US equity performance, in favour of US large-cap dividend growers and low-volatility sectors.

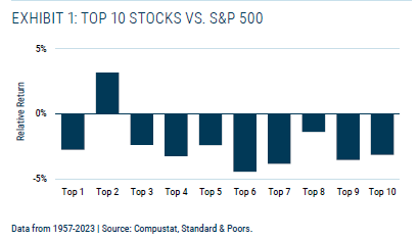

For clients that have had their annual update in the past several months, the below chart will be familiar and underlines our strategy whereby the top 10 stocks in the S&P 500 (currently led by AAPL, NVDA, MSFT, AMZN, META, GOOGL, TSLA) under-performs on a relative basis by -2.4% annually since 1957. Retail investors love piling into the same stocks the media loves to write about, and push valuations to extreme highs. This behaviour generally leads to under-performance long-term.

Optimize tactical asset allocation

With equity markets under pressure in 2022, we began over-weighting equities with the expectation of a rebound as inflation peaked. For example, a client with a 55% equity strategic (long-term) asset allocation, saw their allocation shift to 65% equity as part of our tactical (short/medium-term) asset allocation in late-2022.

Equity markets have rebounded meaningfully in 2023-2024, as inflation continued to decline and central banks begin lowering interest rates. With valuations and exuberance looking stretched short-term, we have taken some profits in equities and are currently under-weighting equities. For example, a client with a 55% equity strategic (long-term) asset mix, has seen their allocation shift to 45% equity as part of our tactical (short/medium-term) asset allocation.

Alternatives allocation

Our Alternatives allocation across every client account is 24%. The key objective of allocating to Alternatives is diversification, risk management, enhancing returns, and liquidity. When equities come under pressure, we rely on our Alternatives allocation to reduce volatility. For a refresher on our Alternatives philosophy, refer to our October 23, 2023 blog post.