Elevated U.S. bond yields are now presenting investors with a wider range of investment options than they’ve had in many years, which means stocks and bonds are competing for investment dollars. The S&P 500’s above-average valuation and Wall Street’s rosy corporate profit outlook leave little wiggle room for economic disappointments. We think the bond market could potentially deliver strong returns, particularly in certain sectors that have lower credit risk.

U.S. equities

A wide range of potential economic outcomes calls for nimble positioning.

Long-term investors should be used to the U.S. stock market typically wading through multiple economic and policy crosscurrents at any given time. But for 2024, we think there are more crosscurrents than usual.

First, the range of potential economic outcomes is unusually wide. There are plausible scenarios in which the Fed could achieve a much-coveted soft landing—in other words, avoid a recession—and even for above-trend growth. But investors should leave open the possibility the economy may succumb to recession. RBC economists anticipate the Fed’s aggressive rate hike cycle will ultimately constrain GDP growth, pushing the economy into a mild recession in 2024.

Second, the market seems positioned for a rosy scenario. Currently, we don’t think the S&P 500 is calibrated for economic headwinds or turbulence. Following the rally in 2023, there is evidence the market is set up for a smooth, soft-landing scenario. Industry analysts’ S&P 500 consensus earnings forecast of $245 per share in 2024 represents 11.4% year-over-year growth. This forecast, combined with the market’s 18.4x above-average price-to-earnings ratio, leaves little wiggle room for economic disappointments. When recessions play out, consensus estimates typically come down and profits contract for at least a couple of quarters.

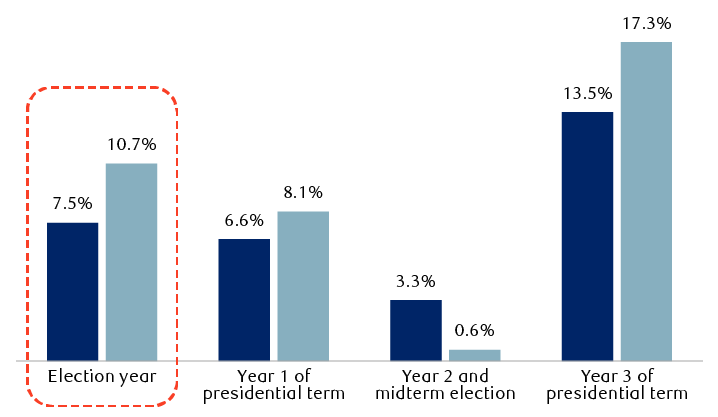

Third, the election will likely generate noise. On the heels of controversial elections in 2016 and 2020, the 2024 campaign season could generate more angst for investors. As news headlines and social media posts fan the flames, investors should keep their cool because the market has historically performed well during presidential election years. Since 1928, the S&P 500 rose 7.5% on average and ended the presidential election year in positive territory almost 75% of the time. We believe Fed policy and the economic cycle play greater roles in shaping market returns than political party control in Washington.

The U.S. stock market has historically traded in a four-year pattern associated with elections

S&P 500 performance during presidential election cycles since 1928

The column chart shows average and median S&P 500 performance during the four-year U.S. election cycle from 1928 through 2022. The respective average and median returns are as follows: 7.5% average and 10.7% median return in the election year; 6.6% and 8.1% in year one of the presidential term; 3.3% and 0.6% in year two of the presidential term (this is also the midterm election year); 13.5% and 17.3% in year three of the presidential term.

Source - RBC Wealth Management, Bloomberg; based on annual data through 2022

Fourth, the stock market has competition. For years, the stock market had an advantage over the bond market. Bond yields were unusually low, so more money flowed into stocks than would have otherwise. But now interest rates are elevated, and the Fed could potentially start cutting rates in 2024 which would be a catalyst for bond prices to increase. Therefore, we think a greater proportion of incremental cash could flow into bonds instead of stocks in 2024. This would not preclude the stock market from rising. It’s just that investors now have a wider range of options than they did in the past 10 years, and the stock market will need to adjust to this competition.

There are a bevy of other factors that could confront the market in 2024 including uncertainty about the timing and magnitude of Fed rate cuts, ongoing budget dysfunction in Washington, the potential widening out of existing military conflicts, and other geopolitical risks.

But we think S&P 500 returns for the next 12–18 months will largely depend on whether a U.S. recession materializes—to us, this is the biggest crosscurrent. The good news is that even if a recession occurs and sets a correction in motion, the market typically bounces back and establishes a new uptrend partway through recession periods. Long-term investors have historically benefited by using such corrections as opportunities to add market exposure.

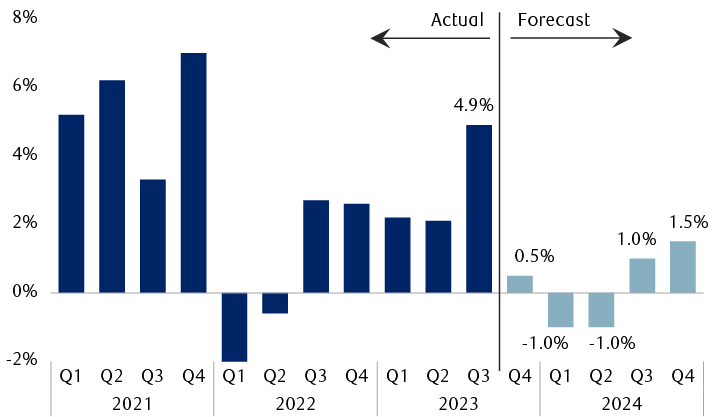

Economic growth expected to pull back in 2024

U.S. real Gross Domestic Product (GDP) growth and RBC forecasts

The column chart shows historical quarterly U.S. real GDP growth from Q1 2021 to Q3 2023, and RBC estimates from Q4 2023 to Q4 2024. The actual historical results for 2021 are: Q1, 5.2%; Q2, 6.2%; Q3, 3.3%; Q4, 7.0%. For 2022: Q1, -2.0%; Q2, -0.6%; Q3, 2.7%; Q4, 2.6%. For 2023, actual results are: Q1, 2.2%; Q2, 2.1%; Q3, 4.9%. RBC estimates 0.5% for Q4 2023. For 2024, RBC estimates are: Q1, -1.0%; Q2, -1.0%; Q3, 1.0%; Q4, 1.5%.

Source - Bloomberg (actual results), RBC Economics (estimates); data as of 11/13/23

Heading into 2024, we recommend holding Market Weight exposure to U.S. equities, a stance intended to balance the risk of a recession against the possibility that one may be averted. The wide range of potential economic outcomes call for nimble sector and industry positioning. We anticipate market performance will broaden out beyond the seven technology-oriented stocks and three sectors that led the rest of the market by a wide margin, contributing significantly to S&P 500 gains for much of 2023. We would tilt portfolio holdings toward reasonably valued stocks of high-quality companies with reliable cash flow generation, sustainable and growing dividends, lower debt levels, and strong management teams. We also view small-capitalization stocks favorably, as their unusually low absolute and relative valuations seem to us like they are already pricing in a recession.

U.S. fixed income

After a long and rough road, bonds look poised to bounce back in 2024.

Overcoming adversity. U.S. bond markets have faced considerable adversity in recent years. Prior to 2021, the Bloomberg U.S. Aggregate Bond Index (often referred to simply as “the Agg”) had only posted three years of negative total returns since its inception in 1976, and never in back-to-back calendar years. As of Nov. 12, it remains on track to deliver its third year of negative returns in a row.

But just as some people perform best under pressure, the same is often true of bonds, and we expect a strong bounce-back year to play out over the course of 2024.

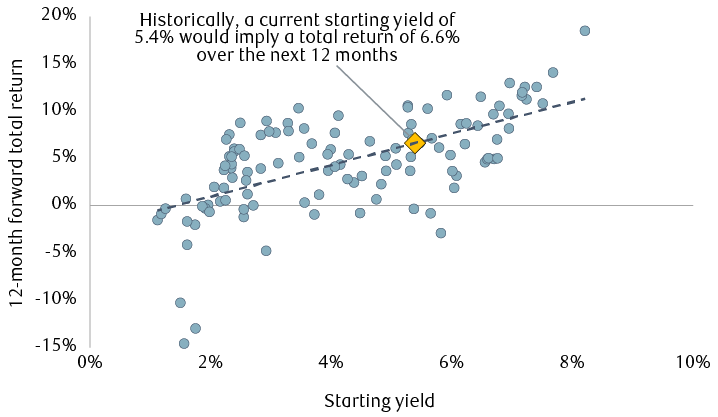

The primary reason that bonds have had a storied track record of delivering steady performance for investors is simply the income they provide. When yields are high, the income earned is often enough to offset most price fluctuations. As the chart above shows, there is a strong correlation between the starting yield that investors can expect to earn over the following year and subsequent total returns. With this in mind, it’s no surprise that 2022 was the worst year on record for bonds, as the starting yield was just 1.75%. The rise in yields—and the decline in bond prices, which move inversely to them—didn’t even come close to being offset by coupon payments.

As 2023 comes to a close, the Agg now yields nearly 5.5%, among the highest levels of the past 20 years. From this elevated starting point, history suggests bonds are poised to return 6.6% in 2024. That’s a solid number, but we think bonds could do even better. Yield only explains about 40% of the bond market’s performance in any given year; the rest comes from price movements, and that’s where additional performance could come from.

Starting off on the right foot

High starting yields suggest a return to positive total returns for bonds in 2024

The scatter chart shows the starting yield on the Bloomberg US Aggregate Bond Index on the horizontal axis and the following-12-month total return for the index, based on quarterly data, on the vertical axis. The current yield on the US Aggregate Index is 5.4%. Based on the historical data, this would suggest bonds, on average, could deliver total returns of approximately 6.6% over the next year.

Source - RBC Wealth Management, Bloomberg US Aggregate Bond Index; based on quarterly data, 12/31/93 to 9/30/22

The benchmark 10-year Treasury yield largely underpins our performance expectations for the rest of the bond market. RBC Capital Markets forecasts the current yield of 4.6% fading to 3.95% by the end of 2024. That would drive a gain of approximately 5% in the price of the bond on top of the 4.6% yield earned over the year, for a total return of nearly 10%.

But what if yields keep rising? After nearly three years of negative bond performance, that’s a fair question. For the 10-year Treasury to deliver a negative return in 2024, the yield would have to rise to 5.3%. While this is not out of the question, it is a high bar, and relatively unlikely in our view. And that’s because we expect the Fed to begin cutting interest rates earlier than the Q4 2024 consensus expectation based on recent Bloomberg analyst surveys.

The Federal Reserve outlook. By the Fed’s own admission, interest rate hikes to this point have only just started to bite into the U.S. economy. We think this situation will play out as a mild recession in the first half of 2024, and the Fed is then likely to embark on a series of modest rate cuts beginning next summer.

We think the bond market’s repricing of rate cut expectations will be seen most dramatically at the short end of yield curves. RBC Capital Markets sees the 3-month Treasury Bill yield fading to just 3.9% next year, from 5.4% recently. Given this forecast, we believe investors should be proactive in rotating out of cash and/or cash-equivalent products, and into longer-dated securities, in order to lock in yields for longer—and before they fade away.

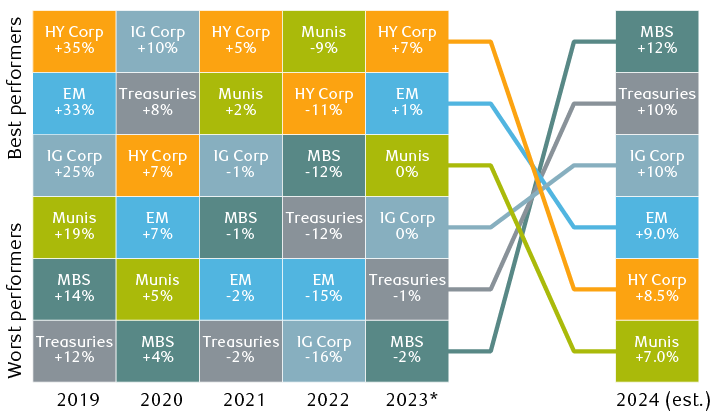

Sector strategy. The graphic below lays out our performance expectations for 2024. Most sectors are likely to perform strongly, but those with lower credit risks—such as Treasuries, mortgage-backed securities, and investment-grade corporate bonds—should outperform. High-yield corporate bonds and municipal bonds are currently too rich relative to Treasuries, in our view. We expect those valuations to return to more normal levels in 2024 as economic growth slows, and as a result, returns could modestly lag the rest of the market.

2024 should see a return to form for bond market performance

Historical and projected returns from U.S. fixed income asset classes

The graphic shows total return data for major U.S. fixed income sectors for the past five years, and estimated return projections for 2024 based on RBC’s interest rate and economic forecasts. The 2024 estimates by sector are: municipal bonds, +7.0%; high-yield corporate debt, +8.5%; emerging markets, +9.0%; investment-grade corporate debt, +10%; Treasuries, +10%; mortgage-backed securities, +12%.

EM = emerging markets; HY Corp = high-yield corporate debt; IG Corp = investment-grade corporate debt; MBS = mortgage-backed securities; Munis = municipal bonds.

Source - RBC Wealth Management, Bloomberg Barclays Bond Indexes; *2023 returns through 11/09/23

View the full Global Insight 2024 Outlook here