Since our last commentary at the beginning of September, our scenario of a slowdown in the economy is now accepted by the market. After falling in September and October, the market rebounded strongly in November. Investors celebrated the latest economic and inflation figures as they hope it will cause interest rate cuts starting next spring.

Since we had positioned ourselves for this scenario, our robust performance relative to our indices widened. This will be the third year in a row that we have outperformed them.

Economic slowdown

There are additional indicators indicating that the economy is slowing down, because of elevated interest rates and inflation in recent years.

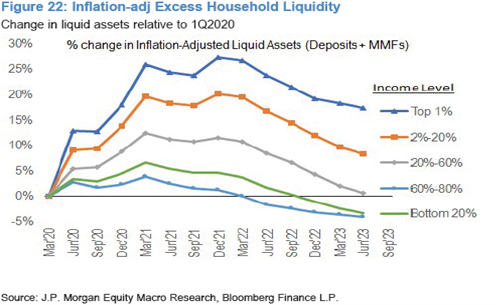

Companies are starting to react to declining profit margins by reviewing their expenses and cutting job. For now, the consumer is holding on, but we doubt that it will last. The chart above shows that nearly 80% of the U.S. population has spent its excess reserves acquired during the pandemic. Canadian consumers are in a worse position because they are more indebted and face shorter term mortgages.

We intend to remain cautious and selective in equities as we are not yet certain about the economic situation in the upcoming months. Many industries are still facing major challenges.

Interest Rates

The market believes interest rates will start decreasing in the spring with 4 rate cuts by the end of 2024. This forecast is based on history, as central banks usually cut rates before recessions set in, when growth and employment slow down. Furthermore, there is on average a gap of 6 months between the last rate hike and the first-rate cut.

However, central banks have repeated for almost 2 years that they target 2% inflation. This explains why rates in Europe have not yet decreased, even though most of their economies are now in recession. Inflation in North America is still high at more than 3% year over year and it is impossible to say for now that it has been overcome. We believe that we may have to live with higher inflation in the long term because of demographics, housing shortages, deglobalization and energy transition.

All of this strengthens our strategy of staying cautious in equities until central banks start cutting rates.

Returns of Bonds in the past 3 years

Three years ago, we wrote that fixed income was undergoing one of the biggest bubbles in history, paying 1.5% for a 30-year bond. Most of the bonds were at a premium, which caused negative after-tax returns, as interest is taxed twice than capital gains. We had decreased fixed income and increased equities in our portfolios at the time.

Since then, the bond index has fallen by 21% as rates have risen from less than 1% to nearly 6% for high-quality issuers with a maturity of less than 5 years. Since the bond market is larger than the equity market, losses were massive.

With our underweight position, we have enjoyed a positive return in this asset class for the past 3 years, by having very short maturities via cash and GICs. This has contributed to our strong outperformance in our balanced models.

Opportunity in Fixed Income

Rising interest rates are causing substantial changes in asset classes. Cash and GICs are now generating more than 5%, the most they have in 20 years.

We have benefited from this, but we believe an opportunity now lies in discount bonds, for the first time in 15 years.

We started investing in them in our models this past month for the following reasons:

- The basis of capital markets is that equities do better than fixed income which in turn perform better than cash, so the current situation should bring this back.

- The yield on a 10-year bond is at its highest level since 2007. We do not need rate cuts because the yield and maturity of a bond are known in advance. While we are not convinced that interest rates will come down as the market hopes, we believe they are close to peaking.

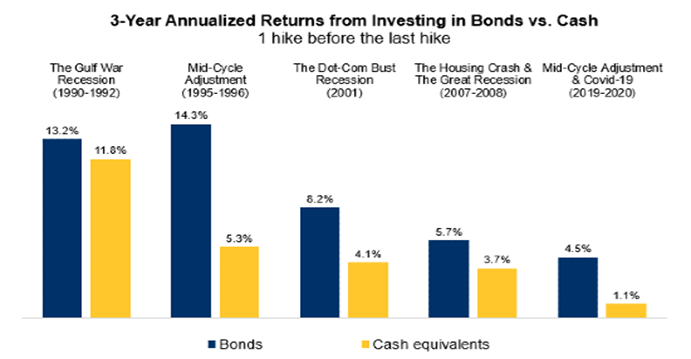

- Fixed income outperforms cash by around 4% three years following the last rate hike. (See table below)

Tax-Efficient Bonds

Discounted bonds invested in taxable accounts are now extremely attractive. For the first time in 40 years, we can find high-quality bonds at deep discounts, because they were issued when rates were low. The average price of bonds today is $90 (see table below). Three years ago, it was $117. As they will be bought back at $100, this creates an interesting after-tax return.

We can find high-quality bonds with maturities of 1 to 10 years paying less than 2% interest. This means that a capital gain of more than 4% per annum is guaranteed if we hold the bond to maturity.

This equates to an equivalent interest yield of more than 8% in a regular taxable account, and almost 10% in a company holding account with the advantages of the CDA. This is much higher than most interest income such as cash, GICs, or even real estate.

Strategy & Asset Allocation

We have just increased the long-term fixed-income allowance for our retired or near-retirement clients.

In the very long term, equities earn 3% more than bonds, so the former will continue to be more than half of our portfolios. We will be cautious in the upcoming months, but the opportunity with discount bonds will allow us to achieve our after-tax return targets while taking less risk.

We have purchased maturities between 3 and 7 years in our managed portfolios, but this strategy can be customized and is valid for any maturity longer than 6 months. To benefit from it, we must hold individual bonds. It is also an alternative to bank deposits and GICs.