Reviewing your Options

If you have been a member of a pension plan for many years, the benefits that you have earned in the plan may be the largest source of income you will receive in retirement. When you leave your employer, your pension plan administrator will send you a written summary outlining your company pension plan options. You will be required to select one of the options by a specific deadline. Sometimes you may not have very much time to make your decision. Generally if you do not act before the deadline, the administrator may consider that you have chosen one of the options by default, which may or may not be the best option for you. Your pension plan options, including when you will receive the money, how much money you will receive and how your spouse and other dependents may be affected, will all depend on your specific pension plan as well as the applicable legislation that governs the benefits you have accumulated.

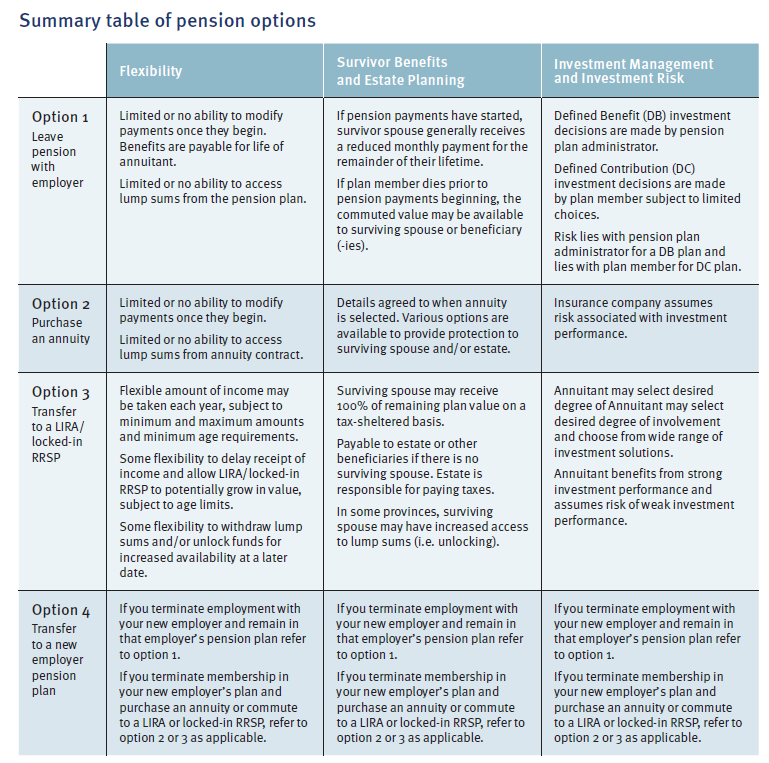

Summary Table of Pension Options

The table below summarizes the general implications of many of these considerations for each of the four pension options.

How do You Choose?

When analyzing which pension option is best for you, the goal is to find the option that will provide you with the best cash flow throughout your retirement at a risk level that is acceptable to you. You may want to choose the option that will provide the largest benefit to your spouse or to your estate upon your death.

While it may seem difficult to know which option is best for you and your family, working with RBC Dominion Securities Portfolio Manager and Investment Advisor, Abbas Fazal, your own qualified tax advisor and pension and benefits representative or a human resources specialist, may help you select the option that is best for you and your family.

Abbas will prepare a customized analysis of your situation and make a recommendation based on all of the important considerations that are unique to your specific personal goals and circumstances.