The framework for success

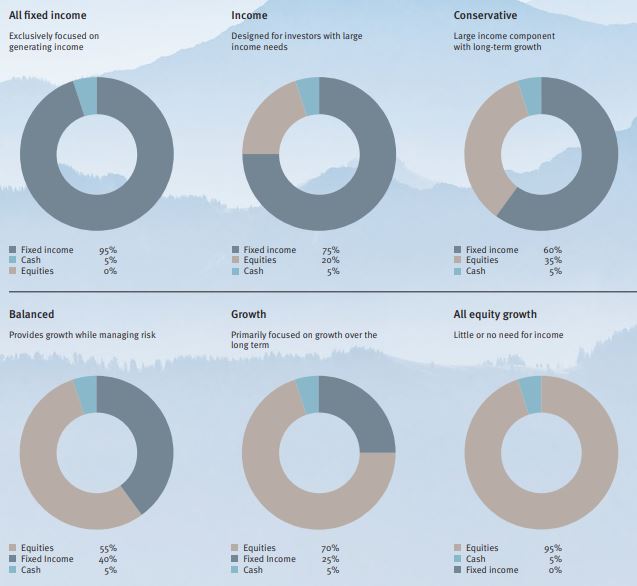

1. Create your investment policy Statement

The first step is to create your Investment Policy Statement—the document that guides your Portfolio Manager in making appropriate investment decisions on your behalf. Your Investment Policy Statement, created specifically for you, takes into account your return expectations, income requirements, risk tolerance, time horizon and unique preferences. It also addresses your tax situation in order to help your Portfolio Manager make investment decisions that minimize the impact of taxes. Based on all these factors, your Portfolio Manager can recommend an ideal asset-allocation model for your portfolio. How your portfolio is divided among the three main asset classes—cash, fixed income and equities—is the most important factor in determining the balance between managing risk and providing higher returns. Depending on your circumstances, a fourth asset class called alternative investments may also be included in your portfolio. Currently, this asset class deals primarily with the use of hedge funds to maximize portfolio diversification. In addition, your portfolio may be diversified along geographic lines, and with a variety of individual securities in each asset class, as shown below

2. Build your portfolio

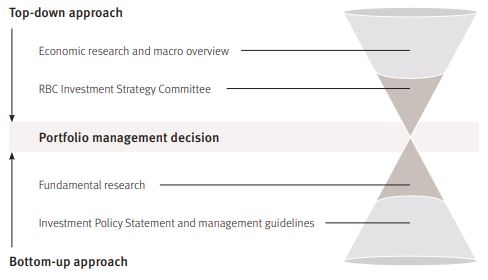

Based on your ideal asset-allocation model, your Portfolio Manager will select an appropriate combination of investments for your portfolio. Virtually every type of investment is available to help you meet your needs. In selecting your investments, your Portfolio Manager combines an understanding of the “big picture”—overall global economic and market trends—with fundamental research of individual investment opportunities. Senior economists, portfolio strategists and research analysts from various parts of RBC augment your Portfolio Manager’s insight into these key areas.

3. Manage your portfolio

Market and economic conditions change. Your personal situation and goals will also change. As a result, it is essential to make appropriate adjustments to your portfolio. Your Portfolio Manager will make day-to-day investment decisions on your behalf to respond to and anticipate the changing market and economic landscape. If the outlook for a certain sector of the economy brightens, your Portfolio Manager may increase your holdings in that sector. Similarly, if the outlook for a certain region of the world improves, your portfolio may be adjusted accordingly within the guidelines established in your Investment Policy Statement. In making day-to-day investment decisions, your Portfolio Manager is supported by a considerable array of resources:

-

RBC Investment Strategy Committee, which comprises our senior economists, strategists and analysts, makes quarterly recommendations for portfolio structure based on a well-considered outlook for the future direction of global markets and economies.

-

RBC Capital Markets Research Department, with over 40 research analysts, provides fundamental, quantitative and technical research on individual companies and sectors. Portfolio Advisory Group offers your Portfolio Manager day-to-day advice on portfolio structure and composition.

-

Fixed Income Advisory Group provides access to Canada’s largest inventory of fixed-income investments, including bonds and money market instruments.

-

Wealth Management Services team, through your Portfolio Manager, assists with your tax, estate and financial planning needs.

4. Third-party review and monitoring

Your portfolio will also be reviewed quarterly by our Private Investment Management Risk Management Group to ensure it is managed according to the terms of your Investment Policy Statement. The Private Investment Management Risk Management Group also reviews your portfolio based on a second set of guidelines that overlays the entire program. These guidelines are in place to ensure that all Private Investment Management clients hold quality investments and a suitable asset mix for their situation.

Investment management parameters

Your Portfolio Manager makes day-to-day investment decisions within the guidelines set in your Investment Policy Statement. Additional guidelines are in place to ensure the high level of investment management you expect:

• Clear portfolio focus (Canadian, North American or global)

• Diversification standards for your overall portfolio and each asset class

• Minimum liquidity requirements for all equities

• Fixed-income maturities staggered to mitigate the impact of fluctuating interest rates

• High-quality fixed-income investments

• Minimum credit rating for bonds

• Active fixed-income management when warranted in consultation with the Fixed Income Advisory Group

5. Adjusting your investment strategy

Your Portfolio Manager will also meet with you on a regular basis to review your portfolio and get an update on your personal and financial situation. Your goals are likely to change over time, and your portfolio needs to reflect that.

6. Keeping you informed of your progress

Depending on your account activity, you will receive either a monthly or quarterly account statement that details the activity in your portfolio and provides the current market value of all your positions. In addition, you can receive a quarterly rate-of-return calculation. You also have access to your accounts and timely market information through our online services.