PLAYING THE LONG GAME

After all of the winter weather that has walloped the GTA and Canada overall this year, you deserve a break. Perhaps you are getting away for a while, but even if you are not, the Milan-Cortina Olympics will be underway to lift you up. Drama and excitement are ahead, courtesy of some athletes who are not yet household names and some, in sports like curling and hockey, who are. Go Canada Go!

The Olympic Games are a burst of intense competition that lasts just 18 days. There will be many sudden ups and downs. The outcomes, as much as we might wish otherwise, are highly uncertain, in part because the competitions are extremely short-term.

We view wealth management, on the other hand, as a long-term endeavour. Yes, there will be market volatility, and it can be uncomfortable. But we believe that staying invested – while remaining attentive to evolving risks – continues to be a prudent approach.

See you on the podium!

A NEW CHAIR

US President Trump has made clear his wish for lower interest rates, and his selection of Kevin Warsh as the new Chair of the US Federal Reserve suggests that US rates will indeed decline. This despite the Bank of Canada and the Fed leaving interest rates unchanged at their latest meetings. This reflects confidence, under outgoing Fed Chair Jerome Powell, in the underlying strength of the US economy – even as inflation remains above target.

Among the effects of lower US interest rates would be a stronger Canadian dollar. Over the past 12 months, it has strengthened by roughly 4-5 % against the American dollar. That said, a decline in US interest rates could be upended by USMCA negotiations, which are scheduled to take place later this year.

The US dollar has been showing weakness since Mr. Trump’s return to power. This is a result of the uncertainty created by his administration with respect to trade and overall policy as well as Mr. Trump’s pressuring of the Fed.

PORTFOLIO PERFORMANCE

Why is US dollar weakness relevant to our clients? As Canadian investors, currency movement can act as a headwind or a tailwind to returns on US securities when converted into Canadian dollars. If the US dollar weakens relative to the Canadian dollar, a US stock underperforms by the same percentage as the currency decline, assuming the share price itself doesn’t change.

The good news for us comes in a couple of forms:

-We own high-quality businesses that do well and generate above-average returns regardless of outside factors

-The types of businesses we own are carefully selected to create portfolios that have a natural hedge against a decline in the US dollar

WHAT WE UNDERSTAND

Speaking of that hedge, there is much talk in Canada, as there should be, of diversifying our economy in order to reduce our reliance on American markets. As our clients and regular readers of Marche Monthly will know, it is our strict investment philosophy not to invest in things – or jurisdictions – we don’t understand.

When it comes to our portfolios, many of the US-based companies we own do business around the world. Some – Mastercard and Visa for example – in more than 200 countries. As a result, we do not have what is called “concentration risk” by being overexposed to the American economy per se.

The businesses we own are in fact international companies based in the United States. And so we benefit from owning high-quality, well-managed businesses that are subject to US regulations, laws and norms which we understand and have served us well over the long term.

ENCOURAGING EARNINGS

US earnings season is well underway, with more than a quarter of S&P 500 companies reporting Q4 2025 results so far. We consider the S&P 500 to be the authoritative index of how the markets are doing, even though our clients do not own the market at all. Instead, they own a portfolio that is professionally managed by our team and customized to each client’s specific goals as expressed in the investment policy statement and comprehensive financial plan we created for them, and that guides everything we do.

Overall, reported results have been encouraging. That said, elevated valuations suggest a fair amount of optimism may already be reflected in prices. As mentioned in recent editions of this blog, we remain in a conservative position as a result: intensifying our focus on finding dividend-paying companies in regulated industries, those firms having strong management and business models we clearly understand. Those businesses trading, in our view, at prices below their intrinsic value.

Here in Canada, earnings season is still in its early stages. Major Canadian banks reported solid results late last year, with more companies set to report in the weeks ahead — a positive signal for our portfolios. It is also true that strong performance from Canada’s banks is a healthy sign for the broader domestic economy: because these institutions are deeply exposed to Canadian households and businesses, their strength reflects underlying economic resilience.

ARTIFICIAL INTELLIGENCE

As we all know, there are large-scale changes occurring in our world, including in the technology field – AI in particular. For our clients, this presents opportunity, which we are prudently capitalizing on by owning carefully selected companies operating in that sphere – including, for example, Amazon and Alphabet, both of which we purchased more of last month.

As always, we are in a position of constantly scanning the horizon for macro changes on the technology and AI fronts, just as we are always ready, in the right set of circumstances, to capitalize on volatility and buy AI-related assets we believe are trading below their intrinsic value.

In recent years, many companies have been investing heavily in AI. Now, we are seeing that markets are becoming more discerning about AI investments, favouring companies that can demonstrate tangible returns on AI spending alongside durable cash flows, strong balance sheets, and consistent shareholder returns via dividends and share buybacks. These are all positive developments, capable of enhancing resilience if market conditions become more challenging.

KEEP MORE OF YOUR MONEY

On that note, it is that time of year to remind you of two things we are certain about:

-Taxes are going to remain high.

-Tax planning, therefore, is more important than ever.

Because of the power of tax-sheltered compound growth, your registered plans are one of the most important components of your financial plan. A strategy of careful planning, consistent management and making your maximum allowable contributions on a consistent basis is essential to maximize the value of these vehicles.

As we approach the RRSP deadline and tax season, we wanted to remind you of the details surrounding the use of tax-sheltered savings plans as an effective way to grow your savings.

RRSP Deadline and Contribution Limits

The 2025 RRSP contribution deadline is March 2, 2026 and the RRSP contribution limits are $32,490 for 2025 and $33,810 for 2026.

If you have the funds available, consider making your 2026 RRSP contribution early in 2026 rather than waiting until the deadline in 2027. The simple act of contributing early maximizes the tax-deferred growth of your investment portfolio.

TFSA

You are allowed to contribute $7000 to your TFSA in 2026. If you did not contribute to a TFSA in prior years, with the contribution room from 2009-2026, you will be able to contribute up to $109,000 to grow tax free.

FHSA

The First Home Savings Account is a new registered plan that gives eligible Canadians the ability to save up to $40,000 on a tax-free basis, for the purchase of their first home. It combines the features of a RRSP and TFSA where contributions are tax deductible (like RRSP) and withdrawals, including earned income are tax free (like TFSA) provided funds are used to purchase a qualifying home. The annual contribution limit is $8,000 with a maximum lifetime contribution limit of $40,000 (see attachment for more information).

Click here for more information on the FHSA.

Determining your available contribution room

Check your latest Notice of Assessment, RRSP Deduction Limit Statement (Form T1028), or log on to your Canada Revenue Agency account by clicking here.

Please give us a call if you would like to explore these strategies and we will help you develop a plan that makes the most sense for your situation. You can also make a contribution by transferring funds to your RBC Dominion Securities account directly from any RBC Royal Bank account through DS Online. For DS Online help or more information on transferring funds, contact Tanvir at 416-974-4811.

For our 2026 list of handy financial planning facts, click here.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Gord McFarland, FCA, CFP, FCPA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

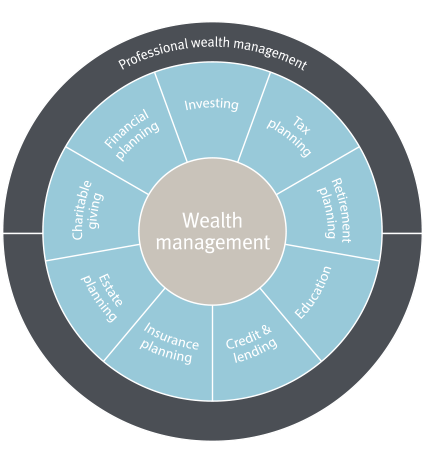

WHAT WE DO