ANOTHER GOOD YEAR

Our equity portfolios are up approximately 15% on average this year. This is consistent with our performance over the seven years since we moved to RBC: in six of them, our equity portfolios have grown by double digits.

Equity markets have continued to climb the proverbial “wall of worry”, delivering worthwhile returns for investors year-to-date. This supports the fact that long-term investors should stay invested and not let their short-term worries push them into emotional investment decisions that can cost them.

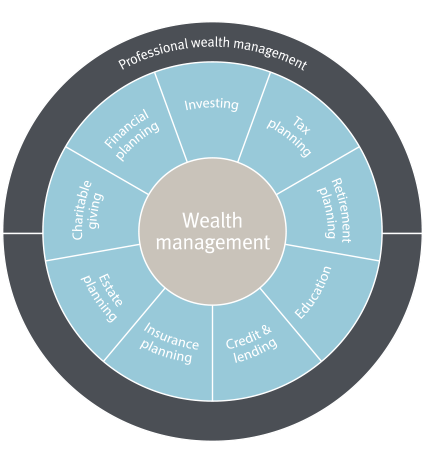

Something I want to reinforce with our clients is that they do not own the market at all. Instead, they own a portfolio that is professionally managed by our team and customized to each client’s specific goals as expressed in the investment policy statement and comprehensive financial plan we created for them and that guides everything we do.

GETTING A BIT DEFENSIVE

As I mentioned in the October Marche Monthly, our portfolios are now in a more defensive position than at any time since before the Covid pandemic truly took hold in March 2020. The S&P 500 declined by approximately 24% between the first and 23rd of that month. There had been a lack of businesses trading at prices we found attractive, so we had already adjusted our portfolios to be more conservative, i.e. less vulnerable to decline. As a result, we were able to be quite assertive in buying businesses on sale, once that large drop took place.

What does it mean to be conservative (a posture we are taking now because we view the market as potentially overpriced)? It means intensifying our focus on finding dividend-paying companies in regulated industries – those firms having strong management and business models we clearly understand. Those firms trading, in our view, at prices below their intrinsic value.

A WARM HUG IN A HARSH WORLD

This formula may sound familiar. It is very much taken from someone we are proud to say we copy: Warren Buffett, the world’s greatest value investor. Earlier this year, he handed the reins of his company, Berkshire Hathaway, to his long time protégé, Canadian Greg Abel. He has just written his final letter to shareholders, a highly anticipated piece of communication, as for decades he has been composing his own letters, including those released each year at the BH annual meeting in Omaha, Nebraska.

A Globe and Mail headline nicely sums up the tone of this year’s letter: Warren Buffett’s words are a warm hug in a harsh world.

As the Globe says, the letter “…is vintage Buffett, but even more so: deeply personal, transparent, self-reflective and newsy – a warm hug at a time of turbulence in world financial markets that treats readers like close friends, not investors.

“It is unrushed, witty, self-deprecating, a bit wandering in places, but completely unabashed in its quirkiness. Artificial intelligence could never have created such a gem.

“Mr. Buffett, 95, has earned the latitude to be sentimental. After all, he is one of the world’s wealthiest people, with an estimated net worth of about US$160-billion, according to Forbes.”

Here is the most important passage for us:

“His strategy was, not surprisingly, plain and simple, too: invest for the long term in companies you know.”

When I was 14 years old, someone left behind, in my mother’s car, a book about Buffett. I picked it up and was immediately inspired. Buffett wrote about investing in a very clear and concise way that made a lot of sense to me. Thanks to Buffett, from the time I became an investment advisor in the year 2000, I have believed that wealth management doesn't need to be complicated. Instead, it needs to be simple. This point of view is captured in our brand promise here at Marche Wealth Management: Your life, uncomplicated.

Greg Abel will be carrying on the approach which Buffett made famous, as will we.

A BIG STEP FORWARD?

Our federal government and the province of Alberta have struck a memorandum of understanding on a deal that includes construction of an oil pipeline from Alberta to the BC coast, to better access Asian markets. Canada and Alberta describe the MOU as a step toward making Canada a global “energy superpower,” unlocking Alberta’s resource potential, creating jobs, and balancing energy development with emissions reduction.

Will it really be a big step forward in building much-needed wealth for Canadians? There is a chance, but only if we can actually get the project done.

I note a story coming out of Saskatchewan, where potash giant Nutrien recently announced they are bypassing the Port of Vancouver, instead investing $1-billion in a Washington state port to get their products to Asian markets, where demand for potash is surging.

Rail bottlenecks and repeated labour stoppages: that is what Nutrien blames for their decision. Vancouver’s port, Canada’s largest, is one of the least efficient in the world, ranking 389th out of 403 reviewed in a World Bank survey.

It is widely agreed that given the political situation in the United States, we need to diversify away, at least by some degree, from our American neighbours. As the National Post puts it, “Good luck diversifying exports without clearing this bottleneck.”

There are the logistics challenges, and then there is an ingrained acceptance, so deep that many Canadians are not even aware they have it, that our wealth from our resources should be suppressed.

We have the world’s third largest proven oil reserves, after Venezuela and Saudi Arabia and ahead of Iran and Iraq – and far ahead of the United States, which sits between #10 and #15 globally.

We have not turned that potential into wealth. We all understand that United Arab Emirates and Canada are very different politically and most Canadians would not subscribe to various UAE policies and points of view. That said, it is still worth mentioning that in part because of the way in which the UAE have capitalized on their oil wealth, they have no personal income tax, capital gains tax or inheritance tax and have only a 9% corporate tax on business profits above roughly $100,000 USD.

It is going to take more than a single memorandum of understanding to unlock our wealth to the benefit of all Canadians.

ECONOMIC UPDATE

Here in the final stretch of 2025, the Canadian and US economies appear well-positioned to extend their expansions.

The US economy is performing well, with household spending being the primary driver – showing that consumers, especially in higher-income households, are absorbing tariff-related price increases.

Canada’s economy is on track for a rebound after the sharp contraction in the second quarter, with the recovery fueled by normalizing trade flows and improving labour market conditions. Looking ahead to 2026, momentum is expected to build further, although the upcoming USMCA re-negotiation is a key risk we are monitoring that could inject uncertainty into the outlook (more on uncertainty just below).

In the United States, the futures market reflects expectations for roughly 1% in rate cuts over the next 12 months. In our view, this, along with the direction of US bond yields, remains heavily dependent on a number of factors, including the evolution of labour market trends, economic growth, and inflation.

In contrast, markets broadly anticipate that in Canada, rates will hold steady at 2.25% over the next year.

DOES IT MATTER?

All of that said, does the economy, or whether we can unlock our resource riches, matter to our portfolios? No.

What matters to our portfolios is the performance of the companies we own. Keeping in mind that we do not own the market, and that we use indexes only as points of comparison, earnings are on pace to grow roughly 13% this year for the S&P 500 – with another low double-digit increase anticipated in 2026.

While risks remain – including the unpredictability of US policy, high valuations, and increased market concentration in AI-related companies – the ongoing economic expansion offers a positive basis for corporate earnings into 2026. Balancing the risks and opportunities, we remain invested but defensive and diversified – and always prepared for occasional challenges to the global equity market uptrend that is now three years and counting.

The bottom line is that the performance of our portfolios, over the long term, is unaffected by political fluctuations – whether tariffs, the unpredictability introduced by President Trump, or anything else.

In fact, we are always positioned to take advantage of volatility by buying appropriate stocks at a discount. And our current conservative posture, mentioned above, puts us in strong position to do just that.

IT’S THAT TIME OF YEAR AGAIN

It’s that time of year again: many non-clients are looking at their portfolios and wondering if they could have done better over the past 12 months. In many cases, the answer is yes.

We are very honoured by the number of referrals we receive from our clients, who have realized that people close to them – family, friends, work colleagues – are questioning their returns. Do you know someone who fits this profile? As always, we will be very pleased to have a confidential, complimentary discussion with them, to address their questions and provide some guidance that can set them on a better path.

Just reach out.

HAPPY HOLIDAYS

However you celebrate, here at Marche Wealth Management we are wishing you peace, health and happiness with loved ones this season and always.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Gord McFarland, FCA, CFP, FCPA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO