GAME-CHANGERS

We have been watching developments in the realm of AI - artificial intelligence - very closely. In some ways, the picture is just taking shape. Bill Gates, for example, says that most of the companies that will win at AI do not even exist yet. We will continue to look for opportunities to capitalize as AI emerges.

In other ways, however, the picture is crystal clear.

First, for example, AI is very important now, and will be extremely important in the future, because it has impacts across almost every major business and will impact every aspect of every company, especially those in the technology sector. I believe it is the biggest game-changer since the 2007 launch of the iPhone - which put a powerful, pocket-sized personal computer in our hands, one that has changed the way we work, interact with others and even how our brains are wired (consider this RBC Disruptors conversation with a Duke University physician and brain scientist).

And second, that an early leader has emerged: Nvidia. Since AI jumped to prominence, we have been constantly reviewing how artificial intelligence is impacting all of our holdings. After months of research, in September of last year we determined that Nvidia met our stringent investment criteria for growth investors (our overall criteria is described on our website and in past blogs including this one). That said, we had already achieved exposure to AI through many companies, notably Alphabet and Amazon, in our portfolios.

Last September, Nvidia achieved our criteria threshold, especially in terms of its price to expected future earnings. And so, since that time, we have made two major purchases of Nvidia for many of our portfolios, and it is now one of our top holdings; regular readers will know that each and every one of our portfolios is custom-made for each client, driven by their comprehensive wealth plan.

As we reported last month, Nvidia has been a key driver of the market’s positive performance so far this year. As we said, in part: “The chipmaker has been seeing soaring demand for its semiconductors (purchased by companies including Meta, Amazon, Microsoft and Alphabet), which are used to power AI applications…Moreover, Nvidia’s competitive advantage appears to extend beyond its state-of-the-art hardware: its software, fully embraced by developers, is fully integrated with its GPUs, and effectively locks in customers.”

THE TWO “I’s”

Speaking of the overall market, the positive influence of Nvidia and the other members of the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Meta and Tesla) is still strong, but has eased somewhat on a relative basis. The breadth of the market rally has been notable, coming from a variety of sectors - not just technology. We view this broadening as a healthy sign, as it suggests growing confidence in investment outlook and portfolio performance that may be less reliant on a narrow part of the market.

On the matter of inflation, Canada’s consumer price index report for February revealed lower-than-expected inflation for the second month in a row. There was a broad easing in prices, with the exception being shelter-related costs including rents, mortgage interest, and the expenses tied to owning a home.

So it is not a surprise that cuts to the second “i,” interest rates, are expected this year in both Canada and the US - three of them, starting as early as June. Historically, declining interest rates tend to be a good thing for investment returns. The strong equity market performance in recent months may reflect some of this optimism.

We have long been positioned for lower inflation and lower interest rates. Our clients’ portfolios are benefitting, and we expect them to continue to do so.

CORPORATE OPPORTUNITIES

Preservation of capital is of paramount importance, especially after taxes and inflation, as is maximizing your returns. Which is why we focus so intensely on optimizing portfolio performance on a risk-adjusted basis, in order to consistently grow what you keep after tax, in order to preserve and grow your family wealth as efficiently as possible.

For clients who are business owners or incorporated professionals, we have long been using corporately-owned, tax-exempt life insurance as a tool to generate high after-tax rates of return on a guaranteed basis with the ability to get funds out of your corporation with minimal to no tax. Lately we have had some especially strong outcomes.

If you wish, please see this two-page explanation. Such insurance policies can be used for a number of strategic planning purposes, including:

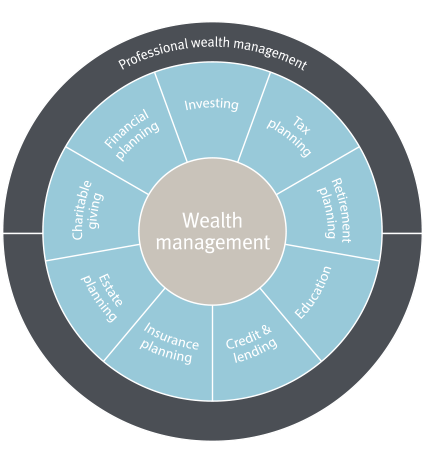

One of the key strengths of partnering with Marche Wealth Management is that we have the deepest team of experts in Canada, across the broadest range of financial matters. Our expert on insurance as an asset class is Andrew Sipes, CLU, CFP, Insurance and Estate Planning Specialist, whom we featured in the November, 2022 edition our blog. If you would like Andrew to join us in a consultation, just let me know. Andrew is expert on a full range of estate and insurance planning strategies, including critical illness and disability.

END OF A SEASON

In the GTA, it does not exactly feel like winter is over. But another season - tax season - is definitely coming to an end. If you are our client, you should have all the tax documentation you require from us. If there is anything you, or your accountants, wish to discuss with us, please let us know.

IMPORTANT UPDATE: BARE TRUSTS

NEW! At the last minute, CRA has reversed its decision to introduce new filing and disclosure obligations regarding “bare trusts,” which many people aren’t even aware they are part of. This was going to be a significant issue, because monetary penalties were set to be levied for not filing in accordance with the updated rules. Tax filers won’t have to report bare trusts this year unless the agency makes a direct request for the files.

In a statement, CRA said it was exempting bare trusts because it recognized that the new reporting requirements have had “an unintended impact on Canadians.”

The requirements were set to affect many Canadians who have had their names added to a family member's home title or financial accounts, even if they never intentionally or formally set up a trust. Common scenarios often involve people who hold title to their adult children's home because they co-signed their mortgage, and those who have their names on their elderly parents' bank or investment accounts.

The deadline to submit the required forms for the year 2023 was going to be April 2nd, 2024. While many Canadians will be relieved at not having to make bare trust-related filings, it is very unfortunate that many other Canadians, including many of our clients, had already spent money fulfilling a requirement that no longer exists.

DO YOU KNOW…

…Someone who should be talking to us?

We told the story in last month’s edition of this blog that every year around this time, now that investors have had time to digest their portfolios’ prior-year performance, and are working on their taxes and reviewing their overall financial situation, they are asking themselves, “Can I do better?”

The answer, often, is “yes indeed.”

We would be happy to hear from you, or someone you know and care about, and as always will provide a complimentary analysis of their situation, with absolutely no cost or obligation.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.