AI AND NVIDIA

The market’s positive start to 2024 continues. Similar to 2023, much of its performance has been driven by a handful of tech companies with exposure to artificial intelligence (AI) - most notably, Nvidia.

In a February 22nd story, the Associated Press summed it up well: “Nvidia’s stock price jumped 16% on Thursday, increasing the company’s market value by a staggering $273 billion in just one day, a record amount. The chipmaker has been seeing soaring demand for its semiconductors (purchased by companies including Meta, Amazon, Microsoft and Alphabet), which are used to power artificial intelligence, or AI applications. The company’s revenue more than tripled in the latest quarter compared with the same period a year earlier.”

In our growth portfolios, Nvidia - due to its recent surge - is now one of our top holdings. It is the undisputed leader in graphics processing units (GPUs) used to power computing platforms for gaming, design, and, more recently, the training of AI. We believe the company’s dominance of the GPU market for AI training is likely to persist for the foreseeable future. Moreover, Nvidia’s competitive advantage appears to extend beyond its state-of-the-art hardware: its software, fully embraced by developers, is fully integrated with its GPUs, and effectively locks in customers.

DIVIDEND STOCKS - A MORE FAVOURABLE OUTLOOK

As we have said many times over the years, including in the December issue of this blog, we are committed to our longstanding investing philosophy, especially as it pertains to dividend stocks. In our equity portfolios, we favour companies that pay dividends and have the ability to grow those dividends over time. Dividends are not only a hedge against inflation, but also there is this advantage: over the long run, the majority of gains from investing in the stock markets come from dividends, and not growth in share prices.

In 2023, rising interest rates reduced the attractiveness, relative to bonds, of dividend-yielding stocks. We believe that this year, the dividend component of our strategy will be back in favour - that the outlook for dividend stocks is more favourable this year than it was in 2023, because inflation is in decline, and thus central banks should start reducing interest rates this year, which would lead to a decline in bond yields. This will increase the attractiveness of dividend-paying stocks relative to bonds.

HOW $100 BECOMES $400 MILLION

Our investing philosophy, as our clients and regular readers will know, is driven by the philosophy of Warren Buffett and his company, Berkshire Hathaway, which, by investing in other compuanies, has posted a 4,400,000% return since Buffett took control in 1965.

Suffice to say, Mr. Buffett’s investing approach is something to be emulated.

The S&P 500, by comparison, has posted a 31,000% increase over that period, which is very impressive - and yet, has been outdone by Buffett by a multiple of 140.

In February, Mr. Buffett published his hotly-anticipated annual letter to shareholders, something he has been doing for almost 60 years. The full letter is here. Some especially interesting nuggets:

-If you had invested $100 with Buffett when he took over Berkshire, you would now be worth more than $400 million.

-Berkshire has more cash on hand, $168 billion, than the total valuation of companies including General Electric, Uber, Nike, Walmart, American Express, and Pfizer.

-Berkshire earned approximately $6.1 billion in interest and other investment income last year, 10 times what it collected in 2021, which Buffett primarily attributes to higher interest rates.

-Berkshire's head office, in Omaha, Nebraska, has only 26 employees. This for a company with a total of 400,000 workers across the many businesses it owns.

We adhere to Buffett’s investment philosophy, a key part of which are his many famous maxims. Here are three that are especially crucial:

-"Never invest in a business you cannot understand."

-"Risk comes from not knowing what you are doing."

-"The stock market is designed to transfer money from the active to the patient."

THE END OF GROUNDHOG DAY

That was the title of our blog in February, 2023. It references Groundhog Day, the classic 1993 film starring Bill Murray and Andie MacDowell, in which Murray wakes up every morning to the exact same day: February 2nd, otherwise known as Groundhog Day.

We use the film as a metaphor for a phenomenon we always see at this time of year: now that investors have had time to digest their portfolios’ prior-year performance, and are working on their taxes and reviewing their overall financial situation, they are asking themselves, “Can I do better?”

The answer, often, is a resounding “yes.”

And then our proverbial phone starts to ring. From potential clients, from accountants whose clients are interested in our opinion, and from current clients who’d like to refer someone they know to us – someone close to them who wants a new perspective on their investments and overall wealth plan.

Do you know someone who should be talking to us? Fans of Murray’s movie have estimated that his character, Phil, was trapped in the same day for anywhere from 10 to 1,000 years, doing the same thing over and over again (see here for some entertaining estimates). Here in the real world, it doesn’t have to be that way. We would be happy to hear from you, or someone you know and care about, and as always will provide a complimentary analysis of the situation, with absolutely no cost or obligation.

IMPORTANT RULE CHANGES: TRUSTS

The federal government has introduced new filing and disclosure obligations regarding trusts - including “bare trusts,” which many people aren’t even aware they are part of. This is a significant issue, because monetary penalties exist for not filing in accordance with the updated rules.

As stated in a Globe and Mail story, “The requirements affect many Canadians who had their names added to a family member's home title or financial accounts, even if they never intentionally or formally set up a trust…Common scenarios often involve people who hold title to their adult children's home because they co-signed their mortgage and those who have their names on their elderly parents' bank or investment accounts.”

The deadline to submit the required forms for the year 2023 is April 2nd, 2024. This document has a comprehensive list of the changes. Please review it, or simply contact us for a consultation.

OUR MOST IMPORTANT JOB

As we said in the January edition of Marche Monthly, taxes will sooner or later go up. That is because, in recent years, our national debt has ballooned. It is a debt so large, more than $1.2 trillion, that interest payments alone are more than $46.5 billion per year, double the amount of interest we were paying prior to fiscal 2021-22.

Thus, our most important job at Marche Wealth Management is maximizing your after-tax returns. Which is why we focus so intensely on optimizing what you keep after tax, in order to preserve and grow your family wealth as efficiently as possible.

On that note, RRSP season, so important because of the power of tax-sheltered compound growth, ends February 29. Tax season continues, and we are working as always with our clients and their accountants. To help you with your filings, the RBC Client Guide to 2023 Tax Reporting is here. It summarizes the important dates and information, and provides online access to tax slips, required to prepare your annual tax return. Key dates include:

-February 29, 2024 – last day for 2023 RRSP contributions.

-April 30, 2024 – last day to file your 2023 tax return without penalty.

-June 17, 2024 – last day to file your 2023 tax return without penalty if you are self-employed.

Accompanying this information is RBC’s 2024 Handy Financial Planning Facts, downloadable here.

If you would like any further information or support, please do not hesitate to contact us.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

WHO WE ARE

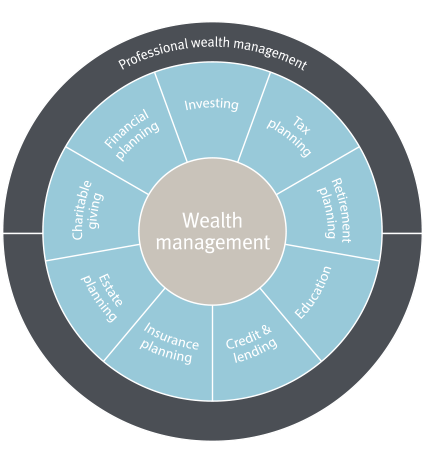

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO