First and foremost – Thank you readers for an amazing 2024.

Portfolios were up across the board, you referred us over a dozen new clients, and we’ve all survived another year where change is happening faster than we can keep up.

I look forward to this next trip around the sun, and grateful you’re part of it.

Holiday event

- A special thank you for Valeriia Chernenko for all the beautiful photos - The feedback from those who have received finished edits are amazing.

- Valerria is finalizing edits, and sending out links as she finishes each gallery.

- If you ever need a photographer – I can’t speak highly enough of her work. Valerria’s contact info is cc’d.

Updates from the Top & Tail and DS

- Reviewing fees for 2025

- We live in a world where years of loyalty is often overlooked

- Personally – I believe operating a good business means acknowledging your ongoing support

- A big part of my practice is fair work for fair pay.

- Reviewing fees from the year past and the year ahead is an annual exercise.

- With markets up, account balances are too.

- We’re compensated more on a relative basis if we’ve made money.

- Should some of that margin be shared? I certainly believe so.

- Wherever possible, we’ll be adjusting fees to reflect this philosophy

- Firm wide update - DS update to trade allotments

- In an effort to continually serve clients better - RBC Dominion Securities has removed all trade allotment caps for fee based accounts.

- The limits were quite generous to begin with - This means there is no restriction on the number of trades allotted to any particular account.

- This is not an offer of unlimited trades – there is an unknown amount that can be labelled as excessive.

- I have no concern any clients will cross that threshold.

- In an effort to continually serve clients better - RBC Dominion Securities has removed all trade allotment caps for fee based accounts.

Geopolitical Shifts and Shocks for 2025

Trudeau – Gone

Biden – Fired

Sunak – Good day

2024 was a year of political disruption. One after another, incumbent leaders around the world faced the wrath of voter displeasure. Ripping markets didn’t matter – people were pissed and wanted change.

2025 is lining up to be a year of geopolitical shifts and shocks. This week, I’ve been attending RBC DS’s annual Portfolio Management conference. One presentation that has stood out was from Paul Ashworth, Chief North American Economist. Below are a few of his predictions.

- Strong Possibility of a US-brokered ceasefire in Ukraine

- Hopes for further de-escalation in the Middle East, but Iran tensions a wild card

- Intense US/China Rivalry

- Canada Federal Election won’t lead to radical change

- Tariffs won’t cause a major pullback in world trade, but there will be big effects for some

- Slowdowns in US and China, offset by stronger growth in Middle east, North Africa, and UK

- Rate cuts continue

- High public debt will prevent additional fiscal stimulus

All in all, Paul predicts more headline risk than anything. All these events will be important for future trade relationships and growth paths, but immediate effects likely to be limited.

My two cents – anticipating what geopolitical changes will come is chasing the magic dragon. Maybe Trump lays the Tariff hammer on Canada and the Loonie goes below 60 cents, but maybe he doesn’t do anything. It’s impossible to tell.

When it comes to Geopolitics, we will be reactionary, and take what the market gives us.

Balanced Model – Monthly update for our paper portfolio

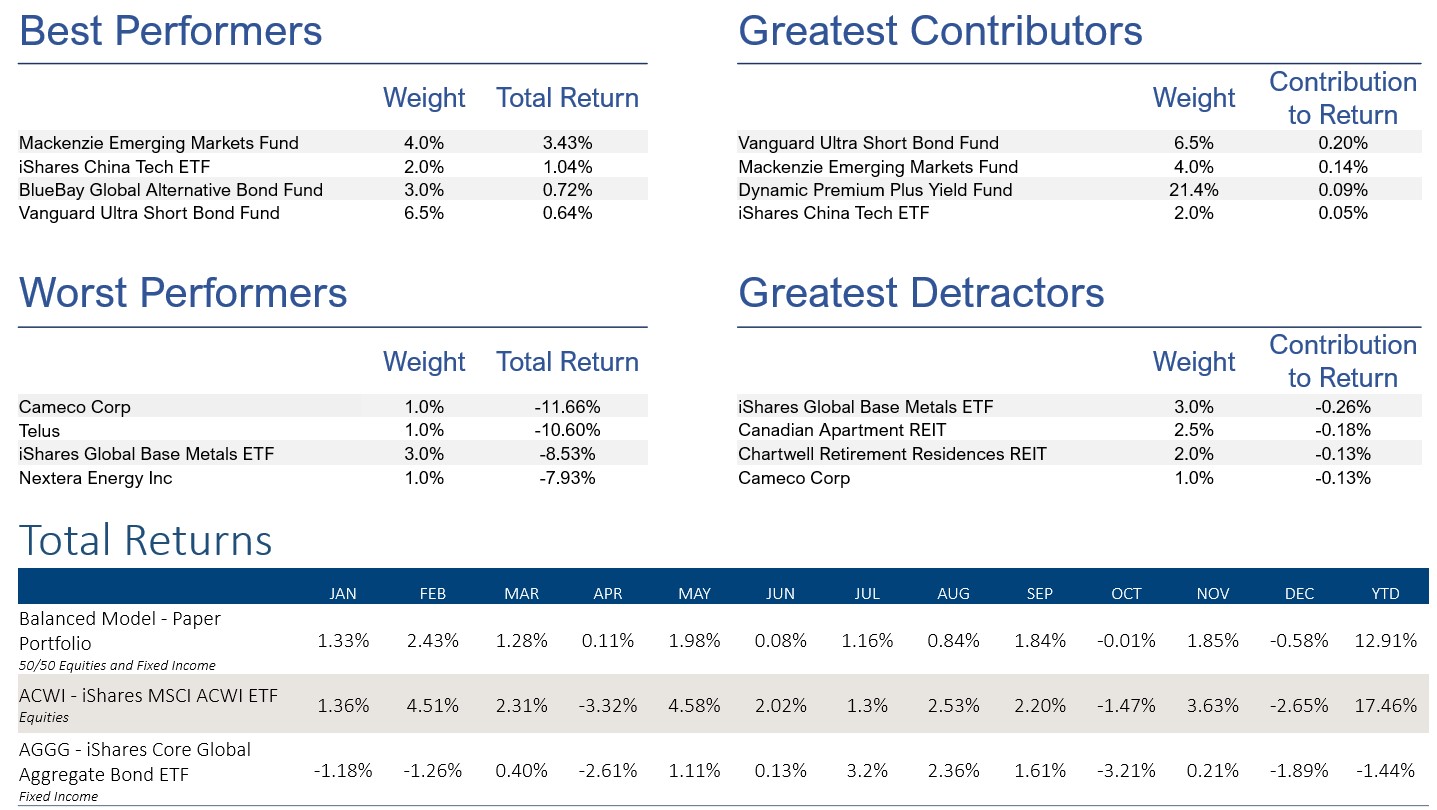

-0.58% in December to $1,129,192 and +12.91% ytd

- Markets had a rocky month to close out 2024.

- Stocks were down -2.65%, while bond indices declined -1.44%.

- December was the model’s worst monthly performance of 2024, decreasing 0.58%

- This is a win however, as the model did as it was designed to do – outperform the market on volatility.

- A strong dollar, a focus on short duration, and downside protection with yield led to our outperformance.

- USD strength pushed the Loonie into the $0.60’s, this was a tail wind for our USD holdings such as VUSB.

- As interest rates rallied, our focus on short term bonds insulated us from volatility

- Our largest holding, Dynamic Premium Yield Plus provided a +0.48% total return.

With a new calendar year, we will be resetting the portfolio balance to $1 million to provide a simpler illustration of portfolio performance.

Updates for January

- I’m happy with how the portfolio performed in December. With the uncertainty surrounding what the first few days of a Trump presidency will bring later this month, there are only minor changes

- Portfolio Rebalance – taking profits on holdings in the black, and topping up those in the red. We’re bringing our holdings back to target weights.

- Initiating a position in Accenture PLC (ACN)

- Accenture is a leading IT firm that provides consulting services

Implementing AI for business is one area I see upside as companies look to train employees and implement artificial intelligence day to day

As always, If you have any questions or comments – let me know!

Much love to you and yours,

Lucas

About the Paper Portfolio – Balanced Model

The Paper Portfolio is a model and NOT a real investment account. For any readers interested in a full list of positions and/or Monthly Performance, they are available upon request. No individual should act on this as investment advice, please consult a professional. The Paper Portfolio does not take into consideration taxes, or income requirements.