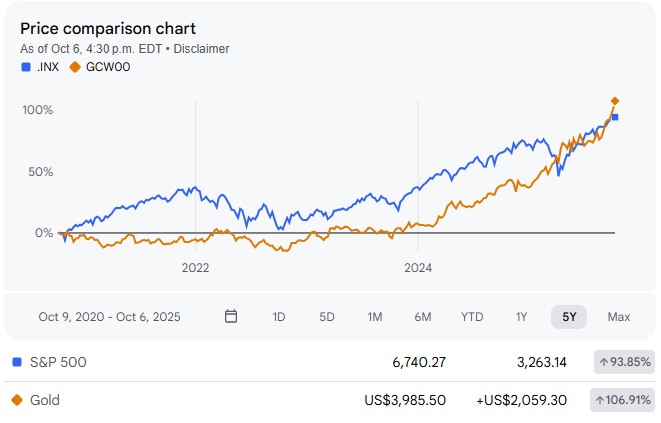

What’s up with Gold? Prices of the shiny stuff have been on fire. Up 10% in the last month, +50% in 2025. In the last few weeks, the 5 year return of Gold surpassed that of the S&P 500….

That’s right. The 500 biggest companies in America that are leading the AI revolution is being outperformed by a shiny metal that’s worth what the next person is willing to pay for it. What gives?

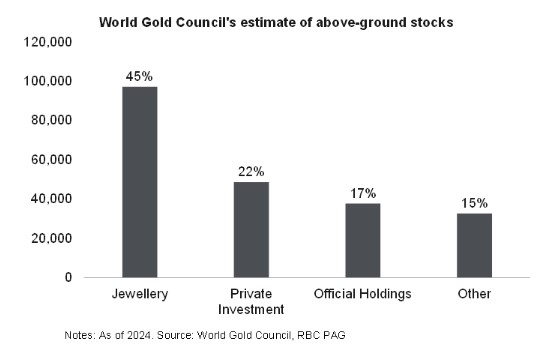

First – we have to acknowledge Gold has few industrial purposes. For the most part, we just like to look at it.

Personally, I dislike all the explanations and rationales for predicting gold prices.

Inflation hedge, dollar weakening hedge, Mad Max hedge.

Analysts can conjure up a reason to buy gold for every day of the week.

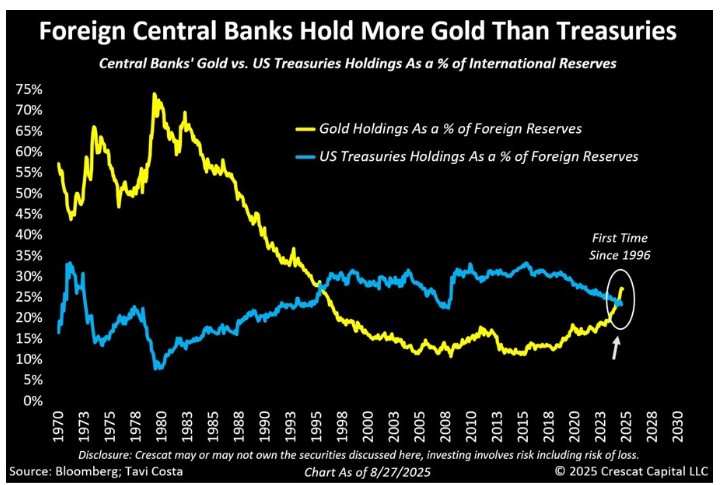

Adding gold bullion to portfolios in 2023 was a fortuitous decision, and the rationale simple. Gold is worth what the next person is willing to pay for it, and the biggest buyer on the street, Central Banks, we’re adding it to their reserves hand over fist.

For now, I’m content holding gold in our portfolios. We’ll be watching for any changes in Central bank buying to signal it’s time to pivot.

Portfolio Update

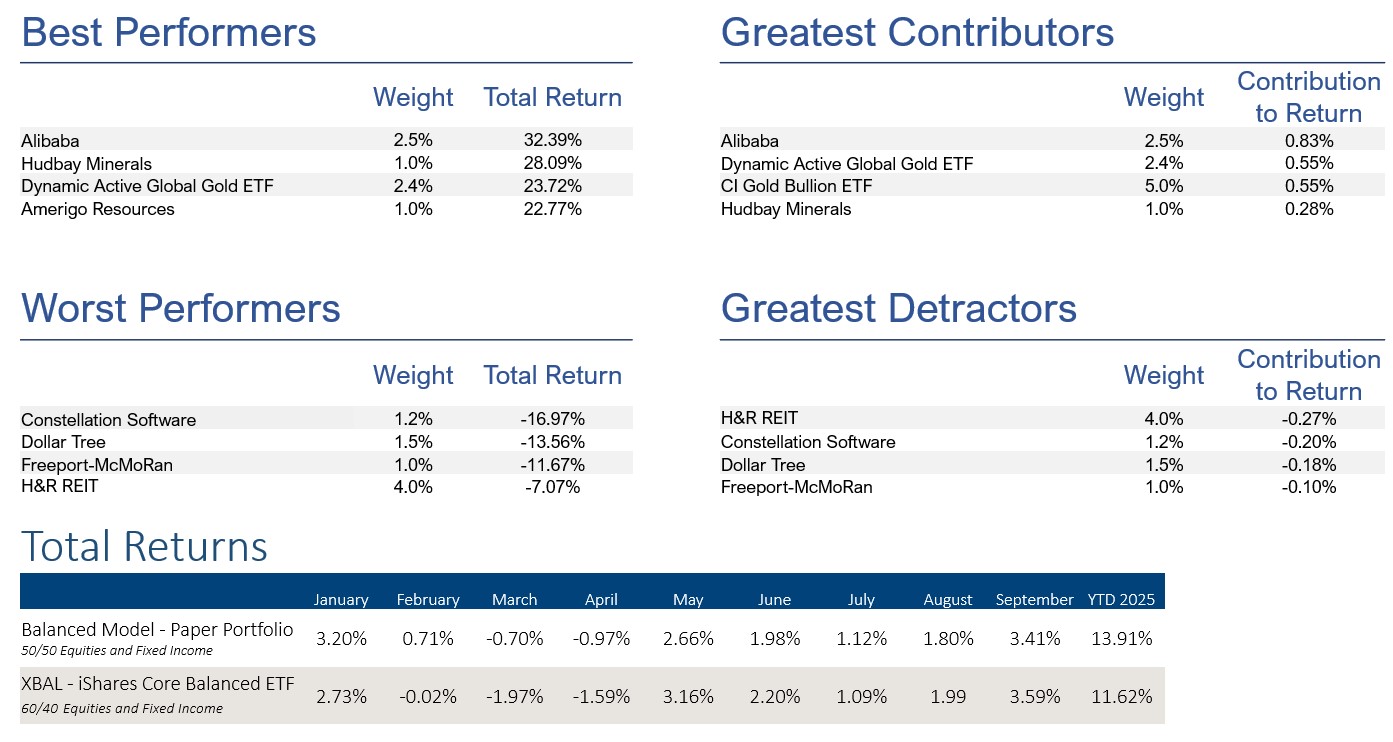

- Our Balanced Model was +3.41% in September

- The Paper Portfolio is up to $1,138,905, +13.9% ytd

What a September. Everything was up – Stocks, Bonds, Gold, you name it.

The dilemma?

This is a market where investors are likely going to compromise their own risk appetite in order to participate in this upside.

Tech/AI/Mag7 now make up half the market. You can’t be present in that enough without braking all of your own rules for risk.

But that doesn’t mean it’s not investable, and it doesn’t mean that this momentum is going to suddenly end tomorrow. This will likely continue on for a while until some sort of shock or surprise changes that.

Just as it was difficult to buy into a market in free fall last April, it’s also just as important to resist the enthusiasm of rising markets.

This month we’ve trimmed our profits, rebalancing the portfolio back to target allocations of a 50/50 split for stocks and bonds.

At this rate, our model will likely underperform going into year end.

Ultimately, I’m happy to insulate our almost +14% performance year to date and avoid one of those moments where Wile E. Coyote realizes he’s outrun the cliff’s edge.

As always, If you have any questions or comments – let me know!

Much love to you and yours,

Lucas