What is a Special Purpose Acquisition Company (SPAC)?

A SPAC is an investment structure more commonly known as a shell company. They’ve been around for decades, and have been in the news headlines recently as they have surged in popularity. Their unique structure enables certain investors to participate in non-public company acquisitions and subsequent Initial Public Offerings (IPOs). They also offer a more streamlined and efficient way for private companies to go public.

Since the start of the pandemic, SPACs have become a popular way for private corporations to become public through an IPO that is faster, cheaper and more efficient versus the sale of shares by underwriters and the accompanying regulatory processes. According to SPAC Insider, 2020 saw 247 SPACs raise US$83 billion in capital through IPOs in the U.S. More SPACs were established in 2019-2020 than in the previous 18 years combined.

SPAC specs

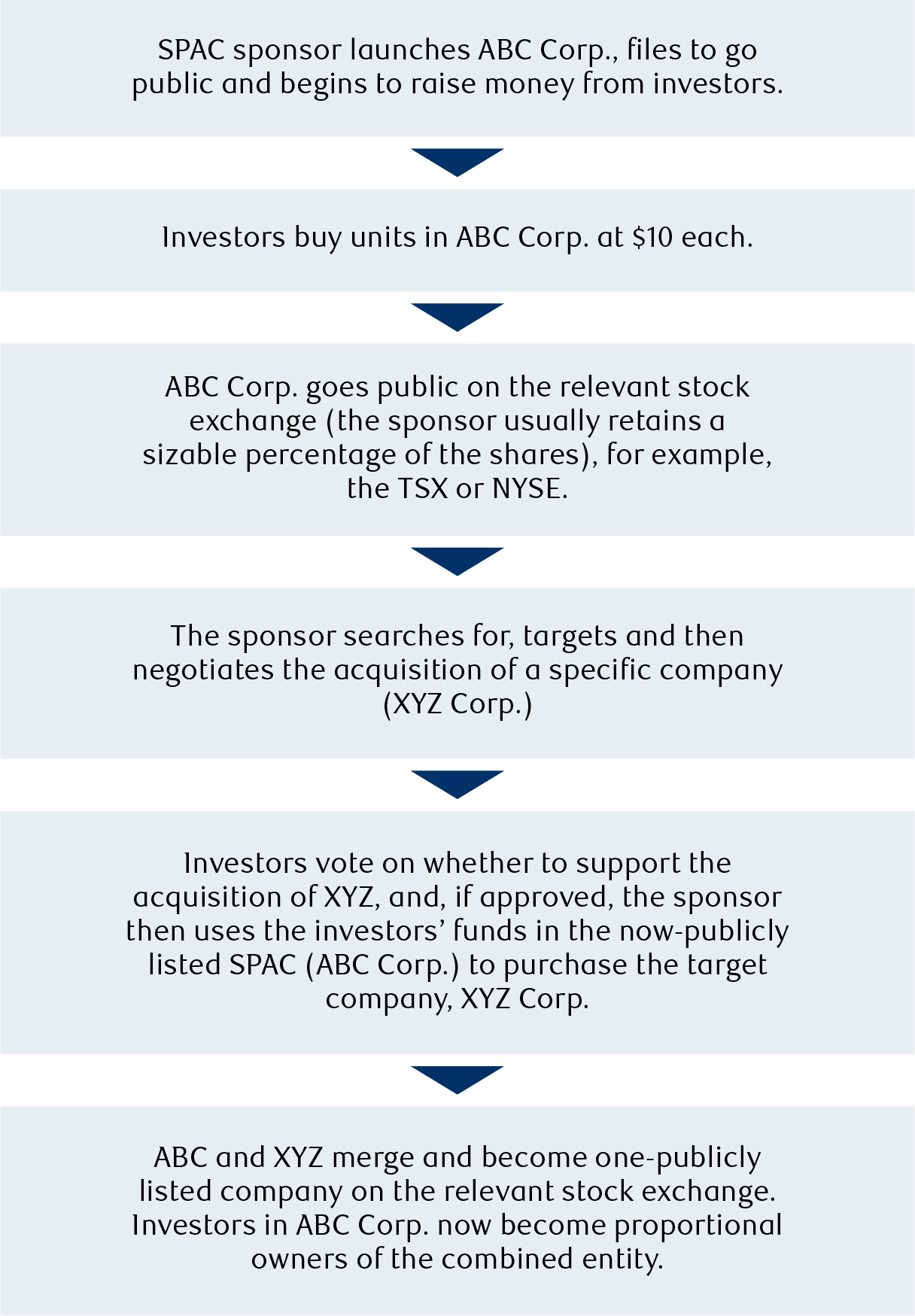

In its initial form, a SPAC is a “shell” or non-operating public company – meaning it has no actual operations. It is set up solely to raise money from investors in order to acquire an actual operational company, typically a private, non-publicly listed one. The SPAC is usually run or directed by a managing investor (or sponsor) who sets up the SPAC.

A SPAC’s two main functions are as an:

-

IPO alternative: Provide a company that wishes to go public with an alternative to launching an IPO directly into the equity market.

-

“Blank cheque” investment company: Investors essentially give SPAC sponsors a “blank cheque” in the expectation that they will eventually choose the most appropriate acquisition targets; then, when the sponsor goes public, provide a return to the initial investors.

Importantly, when the sponsor finds an appropriate company to purchase, investors can either remain invested in the SPAC, or they can cash out their original investment plus interest and walk away.

How they work

Think before you SPAC

While there is a lot of chatter these days about SPACs, they remain riskier than the standard IPO, as they are subject to far fewer regulatory rules and reviews. Also, the general lack of transparency around SPACs can make it difficult to establish the risks involved with the eventual acquisition, and whether they would be appropriate for your portfolio. Speak to us before considering an investment in a SPAC.

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license.