The process outlined below: from the first preliminary meeting through to the ongoing relationship, is only as effective as the effort and attention to detail put into it. That is equally the work and preparation that we commit upfront, as well as the thought, time, effort and transparency provided by the client.

We make the process thoughtful, thorough and engaging.

We go through questions and scenarios that encompass more than a traditional asset liabilities income template. The result of this is a robust financial plan, unique to your situation

Wealth planning for my clients is rarely straightforward, but it's always illuminating. As the client, you are involved actively in setting the goals, objectives and comfort with risk – my role is translating this information and objectives into optimal investment strategies for your unique situation.

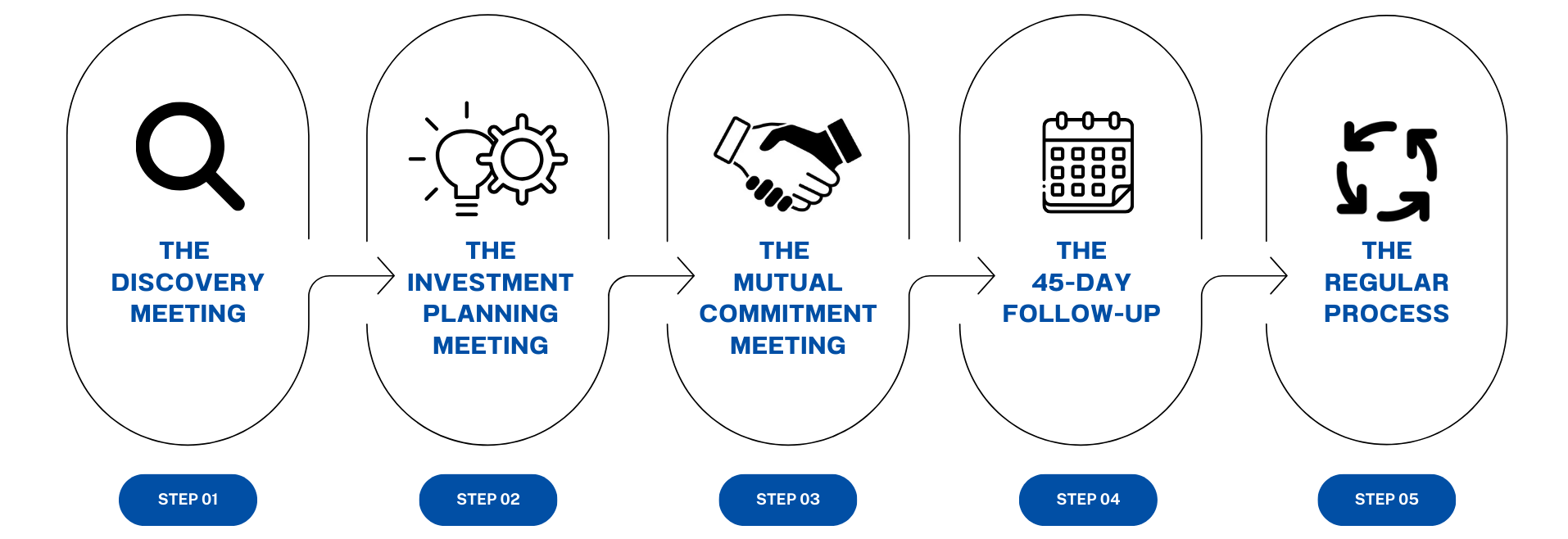

Our Wealth Management New Client Onboarding:

Please don't hesitate to contact us for a detailed explanation of the process.

We would be happy to discuss and exploring the opportunity to work together.

We look forward to hearing from you.