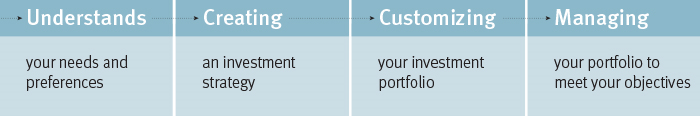

Creating your portfolio and helping you achieving Your Goals is done through a simple 4-step process:

Understand your needs and preferences

Before we start creating a portfolio that’s right for you, we need to get a clear idea of your investment requirements. To do that, we’ll sit down and go over important factors with you such as:

- your investment objectives

- timeframes

- risk tolerance

- need for capital growth and its subsequent preservation

Creating an investment strategy

Once we understanding your objectives and preferences, we can design your investment strategy. As experts in asset allocation, we’ll articulate this strategy in a framework that clearly outlines several things:

- investment objectives

- income needs

- tax situation

- time horizons

- asset mix guidelines

- security selection criteria

- review process

We’ll also determine whether your portfolio requires Advisory, Discretionary, or Third-Party Investment Management—or perhaps a combination of these and other services.

Customizing your investment portfolio

We’ll implement your investment strategy through a custom-designed investment portfolio. The strength of our proprietary research is what sets us apart from other firms, because we don’t repackage or re-brand other people’s ideas—we bring you our fresh thinking, independent and in-depth analysis, and calculated portfolio strategy.

Managing your portfolio to meet your objectives

From here, your progress is monitored on an ongoing basis. We’ll review your portfolio with you on a pre-determined basis, and adjust your strategy as necessary to keep your portfolio aligned with your evolving needs and changing market conditions.