With the Canadian economy having nearly recovered all its lost ground from the pandemic-induced recession, the Bank of Canada has been steadily dialing back monetary stimulus support, and formally ending its quantitative easing program (in October 2021) paving the way for interest rate hikes this year.

The pandemic-induced recession in 2020 prompted a massive monetary policy response that helped to cushion the economic pullback brought on by COVID-19. The policies implemented by the Bank of Canada were among the most aggressive in history. Additionally, the Bank of Canada dropped the overnight lending rate by 150 basis points (1.5%) which currently sits at 25 basis points (0.25%).

Thanks, in part, to this fiscal-monetary stimulus, the Canadian economy has nearly regained all its lost ground, and is on course to secure a full economic recovery in the coming quarters.

Given the rapid economic recovery, persistent inflationary pressures, and an earlier-than-expected end to quantitative easing, financial markets have advanced the Bank of Canada interest rate hike expectations. At the present, markets have priced in approximately four hikes by September 2022 with the first rate hike not too far off.

As long as the economic impact from Omicron is modest and short-lived, and the Canadian economy remains on a solid growth path, the current expectation for rate lift off by the Bank of Canada, in the near future, seems reasonably justified.

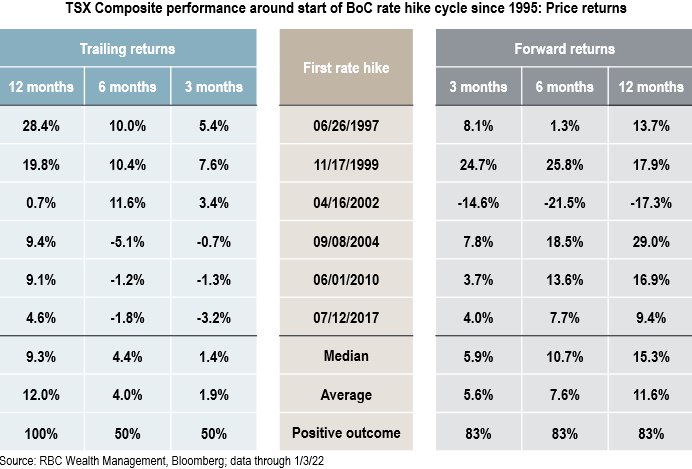

Canadian equities have historically performed well in the 12 months leading up to the start of Bank of Canada rate hike cycles, with the Toronto Stock Exchange delivering median and average returns of 9.3% and 12%. However, returns in the six months leading up to the first rate hike were more mixed and accompanied by more downside volatility, though this was more evident in the last three rate hike cycles (2004, 2010 and 2017).

The 12 months following the first Bank of Canada rate hike have typically seen Canadian equities maintain an upward trajectory, with the Toronto Stock Exchange posting median and average returns of 15.3% and 11.6%. Aside from 2002, when the equity market was still enduring the after effects from the bursting of the dot-com bubble, the Toronto Stock Exchange has historically delivered solid gains in the year following the first Bank of Canada rate hike.

Bottom line: Although the sample size is small, the historical performance of the Toronto Stock Exchange after the initiation of the first Bank of Canada rate hike suggests that the Canadian equity market – with a large benchmark weight in financials (32%) which typically benefit from higher rates – tends to be minimally impacted. Provided that economic and corporate fundamentals remain strong, we think the Canadian stock market can absorb moderately higher interest rates, which would still be quite low by historical standards even if the Bank of Canada raises the benchmark rate a few times over the coming year.

Thank you to Sean Killin, from RBC's Portfolio Advisory Group, for sharing research and content with me for my blog.

Disclaimer

This commentary has been prepared by Brad Weatherill using sources believed to be accurate and true. Data and other information are not warranted as to completeness or accuracy and are subject to change without notice. This material is not a complete analysis of all material facts respecting any security and therefore is not a sufficient basis alone on which to base an investment decision. Investors should refer to referenced research and news reports or consult with their advisor before making investment decisions. Except where otherwise stated, Featured Comments and italicized editorial comments represent views and opinions of Brad Weatherill, compiled from multiple sources in an effort to provide timely insight, and should not be presented as the views of RBC or RBC Capital Markets research.