The U.S. Federal Reserve (Fed) has formally announced its plans for tapering the pace of its QE program – ending sometime around mid-2022. Investor attention may now start to shift towards discussions about the timing of next rate hike cycle. Considerations about rate hikes would be a natural evolution of the broader discussion around the Fed’s guidance on gradually dialing back their significant monetary stimulus support that has fueled a swift recovery for the U.S. economy from last year’s pandemic-induced recession, which has coincided with a strong burst of inflation.

RBC’s analysis suggests that historically the first Fed rate hike has not significantly impacted the equity markets, as equities tend to perform reasonably well in the year before and after the start of Fed rate hike cycles.

The Next Fed Rate Hike Cycle

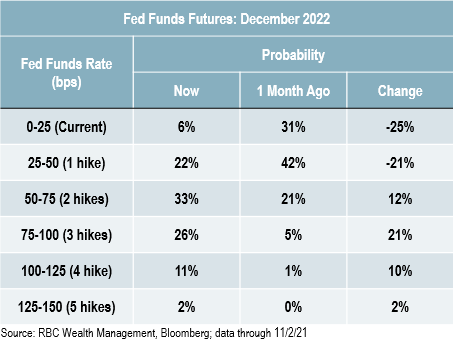

The combination of resilient economic growth, improving labour market, and elevated inflationary pressures have prompted financial markets to considerably pull forward Fed rate hike expectations in recent weeks. At present, the Fed Fund futures market, which tracks short-term rate expectations, is anticipating the first Fed rate hike to come in the summer of next year. Current Fed Funds Futures reflect a zero probability of a rate increase in 2021. Looking out to December 2022.

How Have Equities Performed Around The Arrival Of The First Fed Rate Hike?

The U.S. economy has already made a full recovery from the pandemic in GDP terms. With the economic expansion on solid footing and expected to continue in coming quarters, debate around the start of the next rate hike cycle has inevitably started to heat up, particularly as inflation has thus far been behaving less transitory than policymakers initially expected.

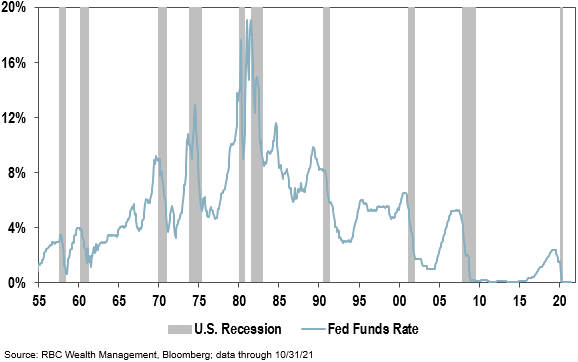

Given tight monetary policy has historically been one of the more common contributing factors of U.S. recessions and equity bear markets (see graph below), some investors may be pondering whether the start of the next rate hike cycle could negatively impact equities.

To put this notion to test, we looked back at how equity markets have typically performed before and after the start of the 18 Fed rate hike cycles we identified since 1958.

- Equity markets have historically performed well in the 12 months leading up to the start of Fed rate hike cycles, with the S&P 500 and TSX Composite posting median returns of 18.5% and 10.9% and positive returns roughly 80% of the time.

- Volatility tends to emerge in the first six months after the Fed begins to hike interest rates as markets digest the impact of the Fed’s move to tighten monetary policy on the economy. While returns were, on average, positive, it has historically not been unusual for equity markets to experience some downside volatility following the start of a rate hike cycle, particularly in the first three months.

- Looking past the short-term volatility following the first Fed rate hike, equity markets have historically maintained upward momentum on a 12 months horizon, with the S&P 500 and TSX Composite delivering median (average) returns of 7.0% and 11.3%, and positive returns on roughly 70% of the time.

While investors may be inclined to interpret monetary tightening by the Fed as a bad omen for risk assets, the analysis above shows that equity markets have broadly performed reasonably well in the year before and after the start of Fed rate hike cycles. The fact that market participants are discounting at least one rate increase over the next year shows investors have confidence in a continued U.S. economic expansion.

Thank you to Roberto Andrade, CFA, from RBC's Portfolio Advisory Group for sharing research and content with me for my blog.