We hope you’re enjoying the final weeks of summer! As we prepare for back-to-school, we’re eyeing up cozy sweaters and rain gear (still from a distance). As you settle back from the relaxation and reflection of summer, we welcome your thoughts and questions. Whether you’re curious about investment opportunities in AI, interest rate moves, what to make of upcoming elections, the dizzying pace of tax changes or the confusing legalese of estate planning… we’ve got you covered.

Family First

Family First

Your child or grandchild’s books are packed, and they’re off to university! It’s an exciting time, and they need to know how to be financially prepared. We share several RBC tips and tools to help them get ready.

- – 3 Tips to Maximize Your Budget – Make the most of your budget with tips on how to maximize it.

- – RBC Student Budget Calculator – Use the RBC Student Budget Calculator to help you figure out how much money you'll need to get through the school year.

- – A Student's Guide to Building a Strong Credit Score – If you're starting to use credit, whether it's with a credit card, student loan or other form of credit, you're in a good position to start building.

- – Should You Rent or Buy a House for Your Student? – While many rent, some parents opt to invest by purchasing a home for their kids to live in while away. When does this option make sense?

- – Preparing for U.S. College: Student Checklist for Canadians – Are you moving to the U.S. to start college or university? This checklist can help you get ready for the journey.

- – Grandkids Studying in the U.S.? 3 Steps to Consider – If your grandkids are studying in the U.S., you can help prepare them – and their parents – for a successful year ahead.

Market Moment

Market Moment

- – RBC’s MacroMemo for August 27 – business cycle update / fed rate cut nears / U.S. election update / U.S. economic check-up / Is the U.S. economy still overheating? / Geopolitical tensions rise further / Canadian corner.

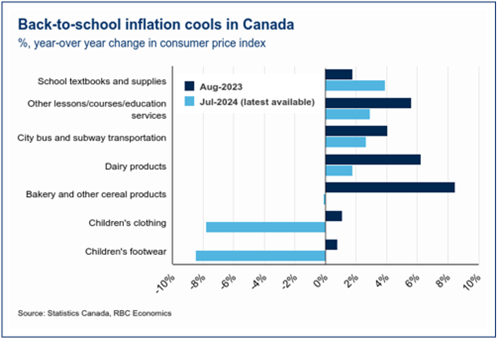

- – RBC Canadian Inflation Watch – Last week’s CPI print should be enough to quell concerns about sticky inflation pressures in Canada. The hurdle for more BoC cuts this year is low, and we continue to look for another 0.25% cut at their next meeting in September.

- – RBC Housing Market Update – The latest interest rate cut from the BoC came at the end of July, doing little to entice buyers into the housing market. Home sales remain largely static with softness concentrated in the Ontario and B.C. markets.

- – Canadian Labour Markets Continued to Cool in July – The unemployment rate remained steady due to a pullback in the labour force participation rate to 65% from 65.3% in June.

- – U.S. Unemployment Rate rose to 4.3% in July – Lower job gains of 114,000, and a higher unemployment rate of 4.3% both pointed to a larger deterioration in the U.S. labour market than expected.

- – RBC Global Insight Special Report – No free rein: The realities of U.S. presidential power – A whirlwind of unprecedented events has upended the U.S. election, injecting even greater noise than usual into the presidential race.

Team Touch

Team Touch

The whole team is heading to Tofino for our annual Holland Group retreat from Sep 13-15. We’ll be out of the office on Friday, September 13. If you need assistance on this day, please call 604-665-9900, and ask to speak with Eric Floe, Jason Demmitt or David Fonseca – all amazing members of the RBC DS Royal Centre Management Team. They would be pleased to help you. We’ll all be back at our desks bright and early on Monday, September 16 if you’d prefer to give us a call then.

Chart Corner

Chart Corner