Air Taxis Are the Next-Gen Way to Travel

By Ed D'Agostino | June 27, 2025

Tesla’s robotaxis are hitting the streets in Austin, Texas. If you’re in one of four test markets, you might have already shared the road with a self-driving Waymo. Amazon isn’t far behind with its Zoox cars.

After years of far-off promises from Big Tech, the market for robotaxis is becoming saturated with competition.

Media stories about self-driving taxis are interesting, but they are missing a bigger story. One that is about to play out and will have a profound impact on urban life: air taxis.

In places like LA, New York, Miami, London, or Dubai, those who can pay for convenience will find it. Helicopters are already an option for individuals looking to skip the traffic. Blade operates a helicopter service between JFK airport and midtown Manhattan, with a seat as low as $195. Not cheap, but less than I expected.

Electric vertical takeoff and landing vehicles (eVTOLs) will bring congestion-free transport to more destinations at a lower cost. Occasional eVTOL trips will soon become the norm for thousands of urban dwellers.

Air taxis will soon replace both helicopters and Ubers for many short passenger trips. If you could pay an extra $100 to skip New York traffic and get to the airport in minutes—not hours—would you? Heading to Cape Cod, the Hamptons, or coastal Maine for the weekend? You can sit in traffic for several hours, or jump in an eVTOL for $150 and be sipping your Friday beverage of choice in 20 minutes. I think a lot of people are going to take that option.

Source: Joby

People are already comfortable paying for the convenience of a taxi or an Uber—self-driving or not. If you’ve been in an Uber lately, you know they are no longer “cheap.” I was recently offered a $55 ride to go from mid-town Manhattan to Astoria, a 20-minute trip. The last time I was in New York, the same Uber cost half of that. When I asked my daughter what’s going on, she told me that Uber’s prices have gone through the roof in New York.

This is a good setup for eVTOLs. Major airlines like Delta are already partnering with eVTOL companies to explore this next avenue of travel.

Today, let’s look at three pioneers in the eVTOL space. If eVTOLs spark your interest and you decide to invest in them, let me know. I’m interested to hear your thoughts on which name appealed to you most.

Uber’s Ridesharing Pick: Joby Aviation (JOBY)

Joby’s goals are ambitious for a 7.2-billion-dollar startup. The company wants to vertically integrate and control every part of the eVTOL niche, from building vehicles and servicing the fleet to operating its own ridesharing services. Until Joby builds out a ridesharing app to offer direct services, the company will rely on its partnerships with Uber and Delta Air Lines.

Uber’s long-held plans for aerial ridesharing manifested in its Uber Elevate division, which launched the Uber Copter service in 2019 in New York City. Despite being limited to traditional helicopter rides, the service proved consumer interest in short-distance air taxis. Joby bought out Uber Elevate in 2020 to venture into the ridesharing space.

Joby’s management team carries diverse experience. CEO JoeBen Bevirt started out in robotic lab systems before turning to camera tripods. Chief Product Officer Eric Allison has even developed an autonomous air taxi before—Wisk’s “Cora”.

Joby’s board includes a former FAA administrator and executives from Google, Toyota, and Southwest Airlines. Toyota itself has invested $894 million in Joby and holds 9.95% equity. Joe Lonsdale of 8VC was an early backer. Here’s an interview between Lonsdale and Joby’s CEO:

Joby’s ridesharing platform won’t work without a wide network of infrastructure partnerships. It has some exposure to commercial and private aviation bases through Atlantic Aviation, though this reach is limited to the US.

Vertical takeoff and landing eliminates the need for a runway. Anywhere you could land a small helicopter (or a huge drone), you’d be able to land an air taxi. We’re not far off from being able to take an electric air taxi from the top of a Manhattan skyscraper and land on a heliport halfway across the city in minutes, without ever stepping out into the street.

So far, Joby has the most capable eVTOL, with top speeds of 200 mph and a range of up to 150 miles on a single charge. Its batteries were lab-tested to last for over 10,000 flight cycles. There’s room for four passengers plus the pilot, though this could change if Joby advances in autonomous flight.

Primed for Private Flight: Eve Holding Inc. (EVEX)

If you want to make inroads into eVTOLs, it helps to have the backing of the world’s third-largest manufacturer of commercial aircraft.

Brazil’s Embraer spun off its “urban air mobility” division in 2020, creating Eve Air Mobility. World-class management gives Eve a great head start, with board members coming from General Dynamics, Rolls-Royce, and BAE Systems—one of the largest US aerospace and defense contractors.

Embraer also has a global support network of service centers, field support reps, training centers, and warehouses. Vertically integrated companies like Joby will need to either build out these service facilities or partner with other providers to keep its eVTOL fleet running. Eve already has 24/7 worldwide coverage through Embraer.

Eve’s vehicle is similar to other planned eVTOLs, with capacity for four passengers and up to 90% less noise than comparable helicopters. Its 60-mile range is substantially shorter than the competition but could still meet the needs of most urban markets. Eve’s goal of autonomous flight would allow for up to six passengers in one vehicle. Driverless cars are already a huge mental adjustment for many people. How would you feel boarding a pilotless eVTOL?

Source: Eve Air Mobility

Even with Joby’s ties to Uber and Delta, Eve could edge out a first-mover advantage thanks to its partnership with Signature Aviation. Signature is an all-in-one “Fixed-Base Operator” that provides hangar storage, fueling, maintenance, and flight planning. This means Eve is already connected to the world’s largest network of private air terminals, with more than 200 locations in 27 countries.

Access to private terminals around the world could be Eve’s biggest advantage over Joby. Where will Joby+Uber land their eVTOLs? I could see Joby forming an agreement with Delta, but then you’re mixing fast, short-distance travel with already-congested long-distance terminals. Eve already has its private terminals and service network built out on a global scale.

Eve is also working on an “Urban Air Traffic Management” system to choreograph its fleet of eVTOLs through dense airspace. This technology is critical for a safe transition to unmanned flight. With this, Eve is looking to be more than just an eVTOL manufacturer. According to company filings:

We expect to offer eVTOL service and support capabilities to UAM fleet operators, and we plan to offer our UATM systems primarily to air navigation service providers, fleet operators and vertiport operators.

To date, Eve has 2,800 vehicle orders from 28 initial customers, worth about $14 billion. With Embraer’s reach and backing, Eve doesn’t carry the same level of financial instability as a more typical startup.

Targeting Defense & Cargo: Archer Aviation Inc. (ACHR)

Archer focuses on the cargo, logistics, defense, and military use cases for eVTOLs, which sets it apart from Joby and Eve. Archer’s Midnight eVTOL can transport four passengers plus a pilot at speeds of up to 150 mph.

NASA is interested in Archer’s battery tech for space applications. These batteries can recharge quickly: The Midnight would only need to recharge for about 10 minutes after a 20-mile flight before it’s back in the air. That makes this aircraft well-optimized for short-distance, back-to-back routes.

Source: Archer

Archer Defense has been a US Department of Defense partner since 2021. The company has a $148-million deal with the Air Force to adapt its eVTOLs for military purposes. Archer also partnered with Anduril Industries, which specializes in autonomous defense systems, to create hybrid-propulsion VTOL aircraft.

Like Joby, Archer manufactures its aircraft in the US, which can be expensive. Eve may have an edge here thanks to cheaper production in Brazil, plus Embraer’s global supplier network.

Each eVTOL maker has its strengths. Joby’s aircraft leads the pack in speed and potentially capacity. Joby wants to be the Uber of the skies—and with Uber’s support, it very well could be. But the company could overextend its resources by vertically integrating the manufacturing process and an in-house ridesharing platform.

Eve’s worldwide industry connections could be an advantage. Its aircraft prioritize safety over speed, though they’re still much quicker than a street taxi would be. Archer has the weight of the US Department of Defense behind it, and the company is exploring opportunities beyond just commercial passenger travel. Plus, it has the best batteries in this space right now.

What are your thoughts on air taxis? Would you ever take an “aerial Uber?” Let me know which of these three companies appeals to you most. I’d like to see your predictions for the eVTOL market.

Thank you for reading.

| Economic news is increasingly hard to follow these days, mainly because it changes so fast and it gives so many mixed signals. Less than three months ago, we were all in shock from President Trump’s “Liberation Day” tariff announcement. While he paused the worst parts of that plan, US import taxes are still at their highest point in decades. Yet now the headlines are more about oil and geopolitics. It turns out that most of the news is just noise. The markets aren’t significantly different from where they were 90 days ago. |

The Great Slowdown

By John Mauldin | June 28, 2025

Birthdays, Anniversaries, and Travel

Economic news is increasingly hard to follow these days, mainly because it changes so fast and it gives so many mixed signals. Less than three months ago, we were all in shock from President Trump’s “Liberation Day” tariff announcement. While he paused the worst parts of that plan, US import taxes are still at their highest point in decades. Yet now the headlines are more about oil and geopolitics. It turns out that most of the news is just noise. The markets aren’t significantly different from where they were 90 days ago.

My first reaction to the Liberation Day tariffs was that we would have a hard time avoiding recession if the full plan actually went into effect. I wrote as much at the time in a letter titled The Tariff Recession?.

That headline had a question mark because I hoped to avoid the worst. Now it seems we have… though that could change. The 90-day negotiation period that Trump announced back in April ends soon. The only “deal” so far has been some small changes with the UK. Maybe others are coming. We’ll see.

But avoiding the worst doesn’t mean no problems at all. Even if Trump dials all the way back to pre-April trade policies (which I don’t expect), events over the last three months will have consequences.

I think (knocking on wood) we can avoid recession this year (assuming Trump doesn’t reinstate the high tariffs from 90 days ago). While the economy is slower for reasons I will explain below, it is still growing. Free markets are a beautiful thing, and the biggest headwinds for growth are actually caused by the government, mainly in the form of a growing mass of national debt and, to some extent, a confusing trade policy that is negatively distorting imports and exports. The outlook seems soft, but not what I would call “weak.”

I also think we can avoid significantly higher inflation than the current PCE 2.7% core rate. We’re headed toward something else—not a boom, not a recession, not severe inflation or deflation, but a period of slow, grinding growth that satisfies almost no one. Some call it stagflation, but I don’t think that’s accurate. I and some of my readers remember true stagflation from the late ‘70s and ‘80s: high inflation, high unemployment, and low growth.

Good things are happening, too. Innovation will continue in AI, biotechnology, new defense tech, and more. The next wave of the robotic revolution is still a few years away, but it will be powerful. Unemployment should stay relatively low. Hundreds of thousands of small businesses will be launched over the next few years. Existing businesses will adapt and figure out how to grow.

If this sounds like my trademark “muddle through” attitude, you’re right. But you need to understand why we’re in this position. There are a bunch of small reasons… and a really big one. Understanding it will give you a better handle on your own investments, businesses, and life.

Growth by Decade

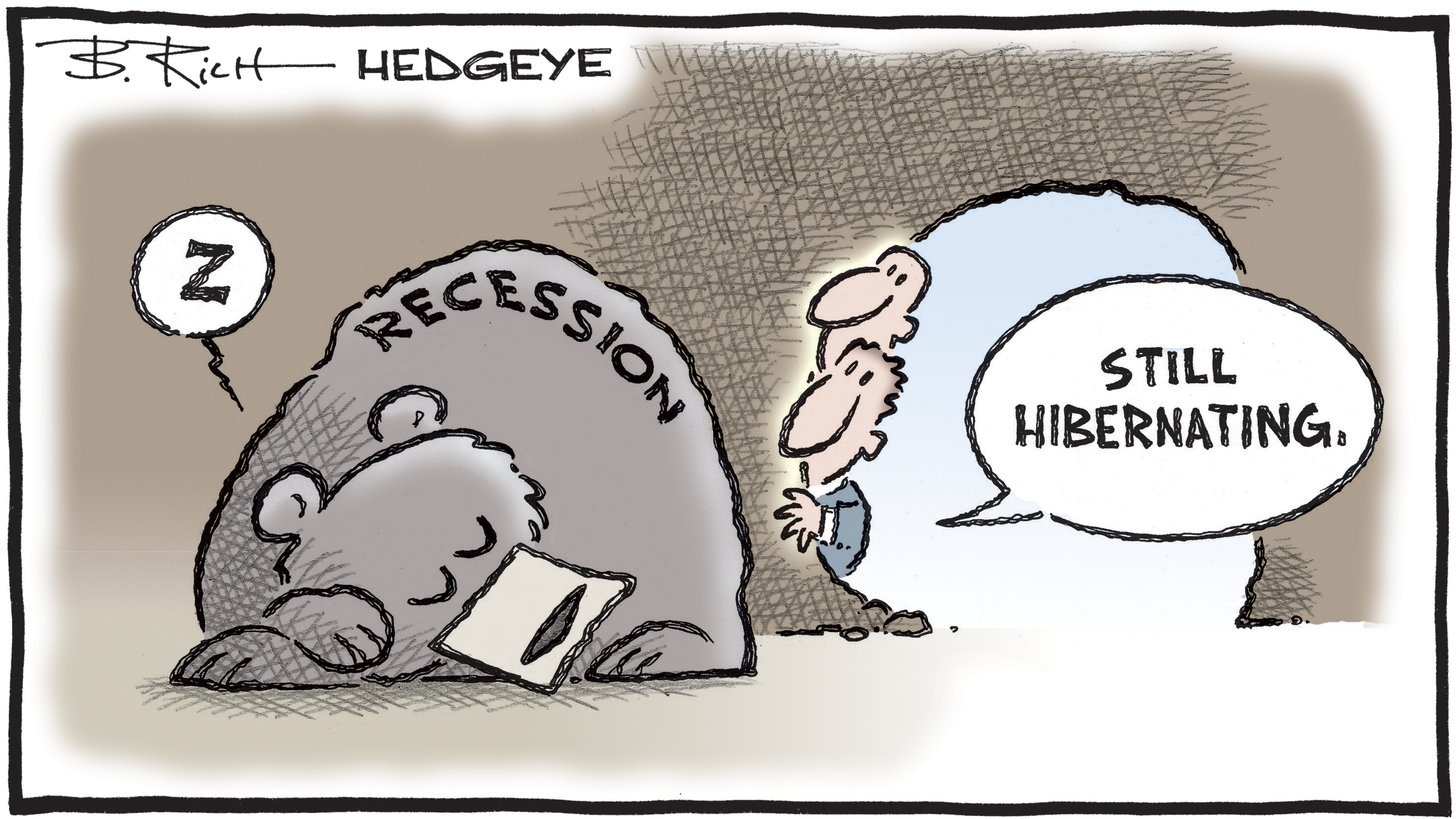

Before we consider recent events, let’s look at the long-term picture for GDP growth. I have written before about the many flaws of Gross Domestic Product as a measure of economic growth. Nevertheless, it does give us a rough measure of how much the economy is growing (or not growing).

My friend Ed Easterling of Crestmont Research made this useful chart of GDP growth by decade. For 10-year calendar decades, annualized GDP growth was as low as 1% and approached 6% in the 1940s.

Source: Crestmont Research

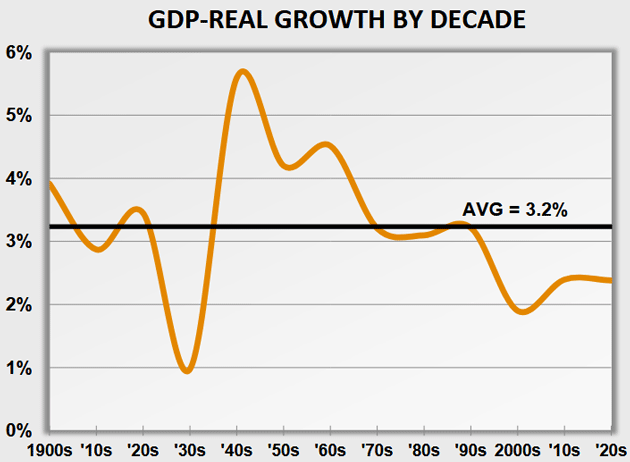

That 1940s peak was the beginning of a long slide lower. Here are the numbers.

Source: Crestmont Research

For six consecutive decades from the 1940s to the 1990s, average GDP growth was always 3.1% or higher. Sometimes better, sometimes worse, but that was the average. Key word “was.”

Those 3% years still happen—we had one in 2023—but they’ve been unusual since 2000. Average growth in this century through 2024 has been only 2.2%. That’s far below the 1950–1999 postwar pace of 3.6%. While that seems a small difference, after a little over 50 years, that is literally the difference between having an economy twice the size.

This is even more true if you look at GDP growth on a per capita basis, which is the way we as individuals actually experience it. The 1950–1999 average was 2.4%. Since then? Only 1.4%. Remember that GDP equals the number of workers times productivity. We have been adding workers, so that makes the absolute nominal number of the GDP up for the country, BUT the actual growth we feel individually is less.

This is a “your mileage may vary” type of situation. I imagine that most of my readers have seen their personal GDP go up more than 1.4%. You can look at the income statistics and find out that those in higher income brackets with more education, etc., do better than those in lower income brackets with less education. Factoring in inflation, a significant number haven’t seen much change in their economic situation. It is not a crisis per se, but it sure doesn’t feel good.

As Martin Gurri writes in his powerful book, The Revolt of the Public, there was a time when those in lower income brackets weren’t continually confronted with their relative differences from those who were prospering. With the information revolution and social media, it’s now in their faces every day.

And even an educated elite nominated a socialist candidate for mayor of New York City because he promised rent control, even though NYC’s last experiment with rent control was a disaster. They simply don’t remember how that reduced the number of apartments available.

The point is that seemingly small differences in growth make a huge difference in our personal experiences of the American economy when taken altogether over decades.

Debt Burdens

Our giant and growing federal debt isn’t just debt with the usual debt problems. It’s also a highly effective growth destruction machine. Excessive national debt suppresses national growth.

We know this from history. Carmen Reinhart and Ken Rogoff showed how it works in their very important 2009 book, This Time is Different: Eight Centuries of Financial Folly. I’ve reviewed their research many times since then, most recently about a year ago in This Time Is (Not) Different.

National debt destroys economies for the same reason personal debt drives people to bankruptcy when used unwisely. As debt grows, servicing it consumes a larger share of the debtor’s income. It can work if income grows along with debt. The problem is that loan payments are on a defined schedule. Income growth usually isn’t.

The analogy is obviously not perfect. Banks and other lenders will cut off credit. Personal adjustments have to be made, up to and including bankruptcy. Smaller countries that have no access to funding have to experience what can sometimes be very painful austerity.

The US still has the ability to attract cash at some price. We have the largest economy in the world. We have generally free markets. We have advantages that are letting us continue spending longer than anyone expects. If I had told you 15 years ago that the US national debt would be $37 trillion and was growing by over $2 trillion a year and the 10 year bond would be over 4% and Fed Funds would also be over 4%, you would’ve thought the US would be in a serious predicament.

Source: US Debt Clock

Yet here we are still Muddling Through. Why?

Governments have other advantages that households and businesses don’t. They can set their own contract terms, raise tax rates, and manipulate their currencies. They can even force people to buy their debt through bank reserve requirements, etc. They can (and it appears they will) let banks purchase US debt without having it count against their capital requirements. This is a huge change and a real bonus to banks. Of course, it means more US government debt will be bought and pushes out the day of reckoning. We can only guess how far. Probably more than we think. But then, the old Hemingway line about “How did you go bankrupt?” Answer: “Slowly and then all at once” comes into play.

We are currently in the “slowly” phase. We have no idea when the “suddenly” part starts. All this gives the government more wiggle room, but they still have limits.

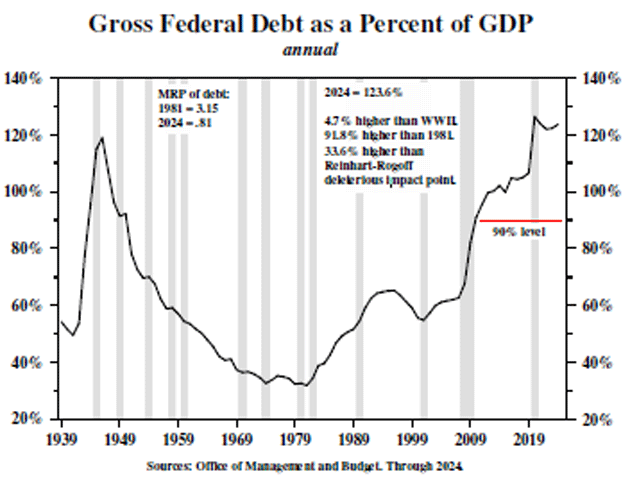

Looking at dozens of historical precedents, Reinhart and Rogoff found that countries run into trouble when accumulated debt exceeds 90% of GDP. The US blew through that line over a decade ago in the aftermath of the Great Recession. Now it’s around 123% (not including state and local debt, which has another 10%). We are firmly in the danger zone.

Source: Lacy Hunt

Dr. Lacy Hunt tracks what he called MRP, the “marginal revenue product” of debt. It shows how the economic stimulus effect of government spending declines as debt grows. In 1981, adding $1 to the national debt was associated with a $3.15 increase in GDP. By 2024, that had fallen to only $0.81. That means government debt now—today—has a negative impact on GDP. Every new dollar of debt literally slows down the economy.

This happens because growing government debt consumes more of the national income, leaving less available for more productive purposes. The government then has to borrow more money to generate the same economic impact.

Point: The government is not actually borrowing money with the thought that it is increasing growth. It is borrowing money to fund defense and other government services and entitlements. Putting money into the economy like that does have a stimulus effect. But it now comes with a negative drag, which is starting to overwhelm the stimulus. Not stopping, just slowly eroding. Never forget… slowly, and then all at once.

It becomes a vicious cycle. Here’s Lacy Hunt in his latest quarterly letter:

“Economic output declines when a factor of production (land, labor, capital, technology) is overused. Confirming this situation, the U.S. has experienced a decline in the dollar amount of GDP produced by a new dollar of government debt. In 2024, a new dollar had only 80 cents of GDP, down from about $3.15 in 1981, thus dramatically illustrating diminishing returns.

“Further evidence of the pernicious impact of government debt was illuminated when [Reinhart and Rogoff] found that when gross government debt exceeds 90% of GDP, an economy loses 1/3 of the trend rate of growth (Journal of Economic Perspectives, 2012). In 2024, the debt ratio was 35% higher than RRR's deleterious impact point (the red horizontal line in Chart 4). As they foretold, real per capita GDP (RPGDP) grew at a paltry 1.3% in the last 20 years, down slightly more than 40% below the long-term trend rate of growth of 2.3%.”

Now look again at Ed Easterling’s table, Real GDP Growth by Decade. Real GDP growth averaged 3.2% in the 1990s. In the 2010s and 2020s, it has been running at 2.4%. A little math tells me that 2.4% is only 75% of 3.2%. We lost about a quarter of our GDP growth at the same time the federal debt roughly doubled as a share of GDP. This is not a coincidence. It is cause and effect.

On a similar note, my friend Niall Ferguson at the Hoover Institution has identified the “Ferguson limit,” which is the point when a government’s interest payments exceed its defense spending. Beyond that point, great powers usually cease to be great as their debt burdens consume the resources needed to maintain geopolitical strength. The US crossed the Ferguson limit in 2024.

As I said above, excessive national debt suppresses national growth. We are watching this happen to the US in real time. We have had and will continue to have occasional good years, but the growth trend is clearly negative. The resources needed to sustain growth are instead going to service the debt.

I would like to report we are doing something to solve the problem, but it’s not happening. I thought we had a chance to at least slow the trajectory this year. That hope now seems misplaced as the House and Senate budget reconciliation bills simply nibble around the edges of our spending problem.

We have not yet reached the kind of crisis needed to motivate real change. But it’s coming.

Economic Headwinds

My confirmation bias showed last week when I saw Torsten Slok’s midyear outlook report. He and I use different terms—to me, it’s “muddle through” while he talks about “stagflation risk,” but I think we are probably 80% agreed. We both see recession as possible but unlikely, inflation rising but not to crisis levels, and some labor market weakness but not mass unemployment.

Here’s Torsten:

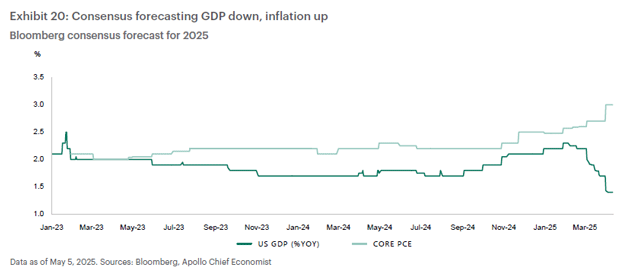

“Tariffs hikes are stagflationary—they increase the probability of an economic slowdown while putting upward pressure on prices. This time is no different. Just six months ago, we concluded that there would be no recession in 2025. We now see a 25% chance of US recession over the next 12 months.

“In June, Fed officials downgraded their estimates for economic growth this year while lifting their forecasts for unemployment and inflation. This is the consensus forecast for 2025: GDP will be lower, and inflation will be higher. That is the definition of stagflation (Exhibit 20).

“Also: Even if we don’t necessarily see two consecutive quarters of negative GDP growth (the classic definition of a recession), the overall economic impact of current policy will likely be—and feel—stagflationary. We expect just 1.2% GDP growth in 2025, and the unemployment rate to rise to 4.4%, and then to 5% or more in 2026.”

Here is the chart he references in the quote:

Source: Apollo

Consensus GDP estimates have improved a bit since he made that chart and are now closer to 2%. Shifting tariff policies make this hard to pin down, but even a mild version of Trump’s economic vision will likely reduce growth, though reduced regulation may offset some of it.

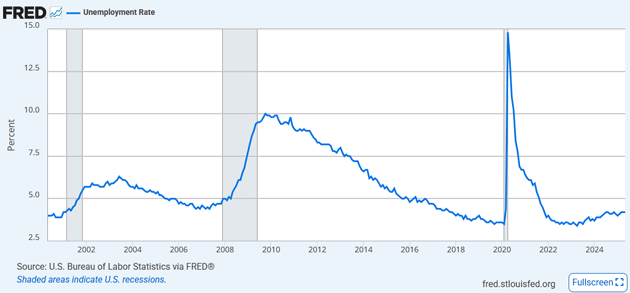

Slowing growth and persistent inflation are both clearly present. Is the unemployment rate “high” in historic terms? Not really.

Source: FRED

At 4.2% as of May, unemployment is historically quite low. It’s been rising but doesn’t tend to reach 5% until the economy is already in recession. That means we lack one of the three criteria for stagflation.

That said, the unemployment rate ignores a lot of nuances. Maybe jobs are plentiful, but they don’t match the skills or wage expectations of most workers. Unfulfilling jobs, while better than no jobs, usually leave people unsatisfied. They lose confidence in the future, which affects their spending and further reduces economic growth.

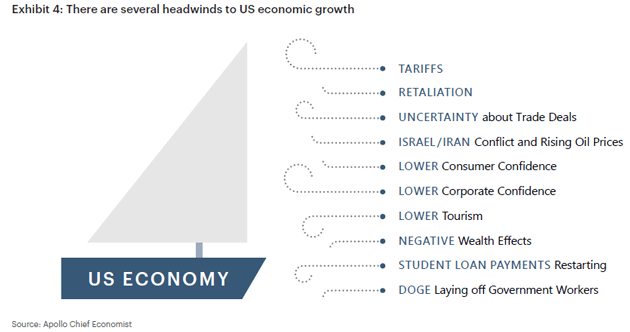

Torsten Slok has a great graphic illustrating the many economic headwinds we face.

Source: Apollo

A boat or plane moving against headwinds doesn’t necessarily sink or crash. It goes slower and the ride is a lot less comfortable, but you eventually get where you want to go. That, I think, is the best way to summarize our outlook. We’ll have a recession at some point (Congress can’t repeal the business cycle), but these headwinds, even together, probably aren’t enough to trigger one yet. A debt crisis is somewhere in our future, too, but not imminent. Meanwhile, we just kind of… slow down.

Now, slowing down is not stopping or reversing. Capital investments are being made in all sorts of industries, especially technology and defense. Tens of thousands of people are launching new small businesses as we talk. Even though I say out of one side of my mouth that the economy is slowing down, the other side sees what I and my team think of as a large opportunity. We actually plan to make significant capital expenditures over the next two years. We’re relatively small, but when added to many thousands of others, it produces growth.

The latest data doesn’t seem to give Jerome Powell comfort in cutting rates despite the pressure. But some of his fellow governors and the FOMC members are beginning to say it’s time. I would point out that even if rates are cut by 50 basis points this year, that will be minimal stimulus because it will reduce income to savers and really not have that much impact on mortgages, as the 10-year rate rules in the mortgage world.

It all means just more Muddle Through. But that is where we have mostly been since 2000. I expect that’s what will be for the next five to seven years, with the possible exception of a recession. Just that the growth rate will now be below 2% and dropping.

A slower growth, Muddle Through world over the last 25 years has still seen the US grow significantly and create massive new opportunities and whole industries, as well as hundreds of thousands of small businesses. Free markets work. When you make your investment and business plans, just factor in slower growth. Not no growth, simply slower and likely different. And certain parts of the economy and income sectors should do quite well.

Until that US government debt-crisis moment arrives, which we will get through, things will muddle along.

Birthdays, Anniversaries, and Travel

Last night was a special event for Shane and me. We celebrated our eighth wedding anniversary and her real birthday by going to the same restaurant we have been for six years in a row: Positivo at the Ritz. You literally sit on the beach watching the sunset. We have a standing booking for June 26 and February 14 at the same table. Think of it as Nobu but with less sushi and a wider menu. But the ambience is what you pay for. I cannot find the words to even express how much my life has changed for the better since Shane came into it. All of our friends say the same thing: I’m a very lucky man. (And yes, I did ask her to marry me on her birthday and married her the next year on the beach in the Virgin Islands. I have no excuse if I forget that date!)

Life is continuing to be busy, as opening clinics, writing books, and trying to figure out how to use AI, as well as writing my letter, and keeping up on details chews up time. But it is all fun and hopefully rewarding in the end. Right now, I think I would pay somebody to come over for one hour a day and tutor me on using AI. It is frustrating to try to do it on my own or by watching YouTube videos that don’t speak to my particular needs. But I’ll get there, and I can see the potential uses. I am just trying to use AI as something besides a Chatbot or search engine. And I think we all know that technology is not my forte. I can write about it all day long, but using it is another thing.

Dr. Mike Roizen is coming to Dorado Beach this weekend and will be doing a presentation on longevity to my friends and neighbors at a dinner this Monday. We “sold out” in about five days. There is a tremendous amount of interest in health and longevity everywhere I go, and it will only grow from here. That is what I mean when I say you can find large underserved markets even in a slow economy.

And with that, I will hit the send button. You have a great week. And stay healthy! I want to be writing to you for a long time!

Your needing more hours in the day analyst,

|

| John Mauldin |