myGPSTM - your Goals, Priorities, Solutions

Have you ever wondered what your financial future looks like?

Most in the field of personal finance agree that financial planning is an essential part of keeping your finances on track. For many people, though, a full financial plan can be expensive, time-consuming to prepare, and generate complicated output not appropriate in all situations. Wouldn’t it be nice if there were a simpler way to get a holistic view of your changing wealth management needs and track progress towards meeting your future financial goals?

Wondering what your future looks like? myGPS™ provides an overview of your financial picture and how you are tracking to your short-term and long-term goals.

Introducing RBC Wealth Management’s myGPS™

myGPS™ offers a prioritized view of your financial goals and recommends solutions to help achieve your wealth management needs.

- Goals: A wealth planning solution to identify and report on your goals

- Priorities: An integrated approach that pulls everything financially important into one place, enabling you to define and prioritize your milestones

- Solutions: An advice approach that helps identify opportunities and solutions on how to pursue those opportunities

myGPS™ isn’t a financial plan. Rather, it is a report on things you already know (for example, your income, the equity in your house, the current value of your investments, and your annual taxes and expenses) projected into the future based on a set of assumptions about what may happen in the future (for example, the expected average rate of inflation, your long term goals and how much you intend to spend in retirement).

Learn more about myGPS™ here.

myGPS™ Report: Six key questions you want answered

myGPS™ provides an overview of your financial picture and how you are tracking to your short-term and long-term goals. Helping to provide financial peace of mind, myGPS™ helps answer six key questions that can easily keep you awake at night.

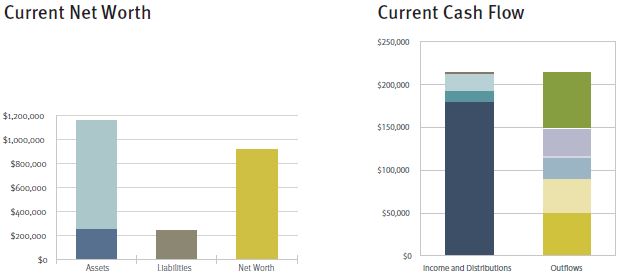

| 1. What does my current financial situation look like? Current Net Worth & Current Cash Flow – myGPS™ provides consolidated summaries showing your incomes, savings, expenses, investments, real estate and debt – your critical financial information presented in one document. |  |

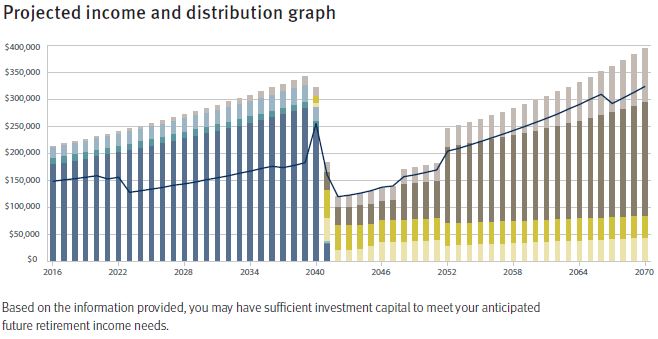

| 2. If I live to be 90, will I have sufficient funds to maintain my current and/or desired lifestyle? Projected Net Worth, Projected Income and Distribution & Projected Outflows – Based on the information provided, myGPS™ will project income, savings, taxes, expenses and the value of your assets into the future using a defined set of assumptions. |  |

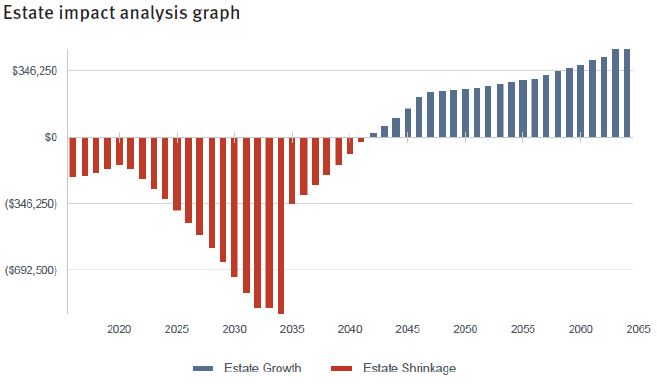

| 3. If I die tomorrow, will my family be sufficiently provided for financially? Estate Impact Analysis and Life Insurance Analysis – Anticipating your future financial needs is a difficult task. Anticipating your family’s future financial needs should you or your spouse die unexpectedly, is an even more difficult task. myGPS™ can help you identify any potential financial shortfalls should an unexpected tragedy strike you or your family. |  |

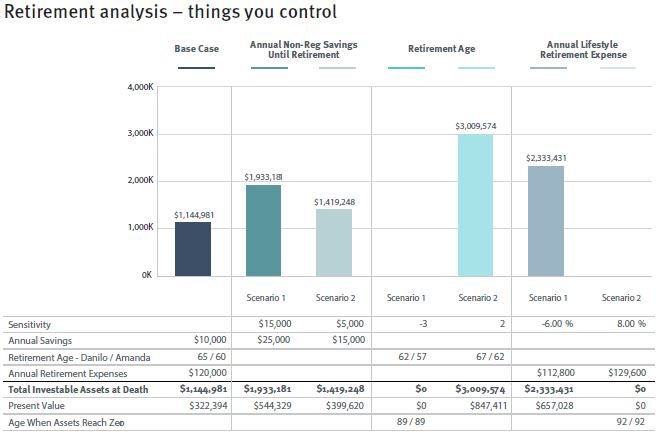

| 4. How does changing my financial assumptions impact my future financial situation? Retirement Analysis – It’s impossible to know for certain what will happen tomorrow. To provide a financial projection, however, certain assumptions about what will happen in the economy have to be made. But what if some of those assumptions prove to be wrong? What if, for example, you were forced to retire early? Or perhaps you end up spending more in retirement. The myGPS™ Retirement Analysis allows you to independently change the assumptions you have made about the future to see how that change will affect your overall finances. |  |

| 5. What can I do to ensure my financial goals and priorities become reality? Wealth Management Opportunities – myGPS™ reports the key financial products, solutions and strategies, which are tailored to your financial situation and priorities, helping you to make the most of what you have – both now and in the future. |  |

| 6. Could my business survive a major change or crisis? Business Owner Opportunities – For business owners, the line between work and life is blurred. Business Owner Opportunities, outline solutions and strategies that can be pursued from the business side or from the personal side of your finances. The opportunities are tailored to your own situation and cover only those topics which apply to you, your business and your family – strategies designed to help keep you in control of your financial future. |  |

Source: RBC Dominion Securities Inc., myGPS - Your Goals, Priorities and Solutions Factsheet

Insurance products are offered through RBC Wealth Management Financial Services Inc. (“RBC WMFS”), a subsidiary of RBC Dominion Securities Inc.* RBC WMFS is licensed as a financial services firm in the province of Quebec. RBC Dominion Securities Inc., RBC WMFS and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. and RBC WMFS are member companies of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © 2020 RBC Dominion Securities Inc. All rights reserved.